Are low oil prices here to stay?

Last week, we wrote about the fundamental reasons why the price of crude oil is swiftly plunging and how its impact on countries can last for a long time (see The Game Chaner, Jan. 19, 2015). We now present the technical reasons why we think crude oil have just made a major top and why prices can stay low for years or even decades to come.

Two-year trend line broken

Crude oil indicated that a possible major top was in place back in August 2014 when prices broke below a two-year trend line, signaling a change in long-term trend. This is shown in the following chart when the price of WTIC Light Crude Oil fell below $95 / bbl.

Source: Stockcharts.co, Wealth Research

Declining moving averages

A major top in oil was confirmed when the 50-day, 100-day and 200-day moving averages of BRENT Crude Oil started trending down. In technical analysis, chartists use the 50-day, 100-day and 200-day moving averages as guides to the short-term, medium-term and long-term trends, respectively.

Source: Stockcharts.com, Wealth Research

How low can oil prices go?

In recent weeks, the decline in crude oil has entered the target zone of the four-year symmetrical triangle top completed in October which is around $44/bbl. However, we do not expect it to turn back up any time soon. Any bounce back would now face stiff resistance after several support levels were broken.

Source: Wealth Research

Broken support turns into resistance

A principle of technical analysis stipulates that support can turn into resistance. Once the price breaks below a support level, the broken support level can turn into resistance.

In the case of crude oil, the support levels at 90, 85, 80, 70, 60 and 50 that were broken on the way down will now become resistance levels.

Oil at $100 was an ‘aberration’

Respected billionaire-investor Saudi Prince Alwaleed Bin Talal said in interviews last Friday that crude at $100 was an “aberration.” In fact, he had come out publicly to say that we “will never see crude at $100 again.”

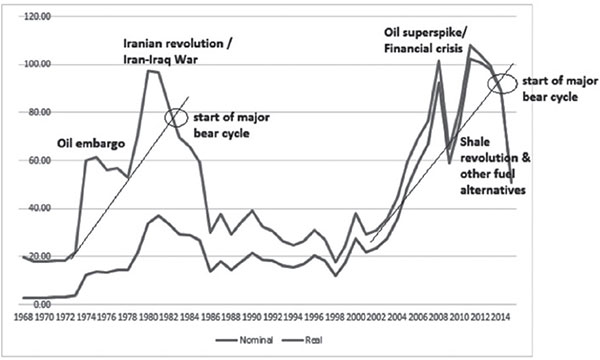

To put this into perspective, we show that from 2011 to mid-2014 and including a brief period in 2008, oil prices were at historically high levels, higher than where it was during the period 1979 to 1983 when the Iranian revolution and the Iran-Iraq war disrupted oil supplies. And that’s after adjusting for inflation.

Crude oil prices (annual)

Source: EIA, Wealth Research

How long can oil prices stay low?

Moves like this in crude oil can last for years and decades. The bull market in oil which started during the Arab oil embargo and peaked during the Iran-Iraq War lasted for eight years (1973 – 1981). It was then followed by a 17-year bear market which lasted up to 1998 when oil hit below $10 / bbl.

Oil began a new bull market from 1999 onwards and culminated with an all-time high of $147.27 on July 11, 2008. Looking at the chart above, it is clear that we are just on the cusp of another major bear cycle in oil that will last for years or even decades to come.

Quadruple blessings

Last week the Philippines received blessings from Pope Francis. In the capital market, the Philippines likewise received multiple blessings. Last Friday, the PSEi closed at an all-time high of 7,548.93. The peso surprisingly appreciated swiftly to 44.14 against the dollar even as the dollar strengthened against the euro to its strongest in 11 years. And crude oil closed at its lowest level in five years which is a blessing to Philippine consumers.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending