AyalaLand Logistics buys warehouse facility in Batangas, expands logistics footprint by 29%

AyalaLand Logistics [ALLHC 5.27 0.76%] reported that its subsidiary, Ecozone Power Management, Inc., signed a deed of absolute sale to purchase a 64,000 sqm warehouse, and the 96,980 sqm lot that it sits on, for just over P1.2 billion.

The warehouse is in Sto. Tomas, Batangas, and is ALLHC’s first and only logistics asset in the Batangas region.

ALLHC reported that the facility is PEZA-accredited, and is already leased out to companies in the manufacturing and logistics industries.

ALLHC will assume ownership and operation of the facility under its warehouse leasing brand, ALogis, and will be renamed “ALogis Sto. Tomas”. The acquisition increases the gross leasable area under ALogis management by 29%, to 288,000 square meters.

MB BOTTOM-LINE

From an industry perspective, the long-term logistics bull-run is still going strong, as evidenced by Keren Concepcion G. Valmonte’s report on the growing country-wide demand for cold storage facilities.

In it, she cites the need to store vaccines and imported food as big drivers of growth, with long-term growth supported by “demand from food and beverage companies” producing an average annual growth of 8-10% over the next 5 years.

Those are good numbers. Specifically for ALLHC, though, its stock has been taking a little vacation after a massive run-up.

From June until the end of 2021, ALLHC’s stock price rose 119% from P3.07 to P6.73.

Since New Year’s, the stock has fallen back nearly 22%, to P5.27 as of yesterday’s close, including a swift 10% drop over three days late last week.

ALLHC investors have had a lot to be pleased about, but the truth is that up to this point, actual “logistics” hasn’t been a large part of what’s made ALLHC successful.

It derives most of its income from just selling industrial lots, not from operating successful logistics businesses.

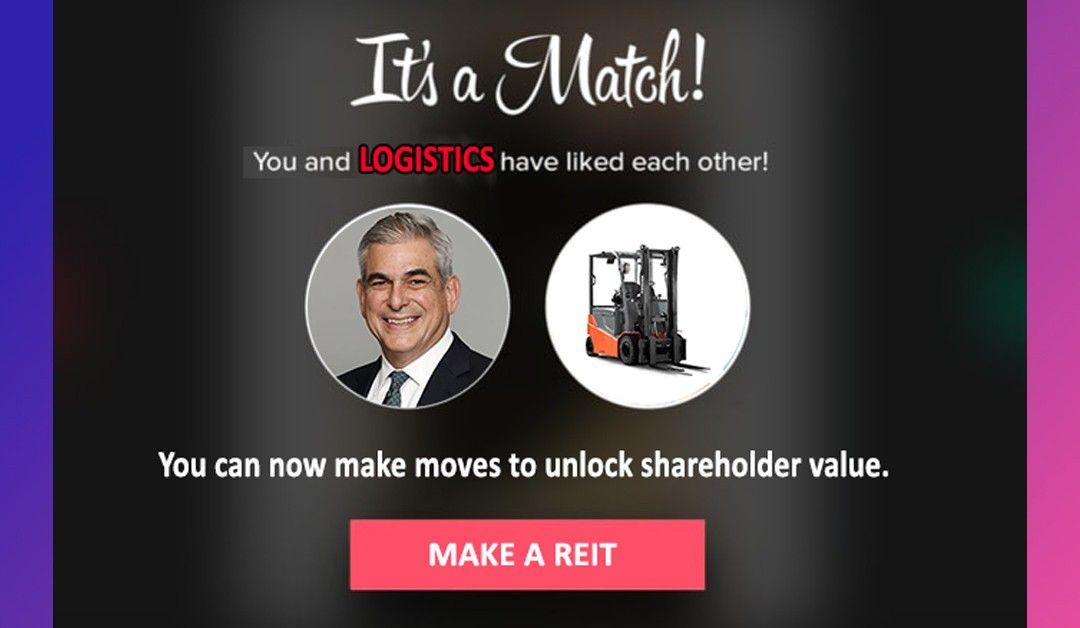

Perhaps this acquisition will rekindle speculation about a potential Ayala-owned industrial logistics REIT, filled with operating facilities like this one that ALLHC just purchased, supported by the long-term demand for the space and the service.

ALLHC investors are probably hoping that the Ayala Family feels that competitive spirit to be first to the market again, ahead of the eventual IPO of CentralHub, the Jollibee [JFC 240.00 1.69%] and DoubleDragon [DD 9.28 5.45%] logistics REIT.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest