COVID cases rising, economy worsening – why are stocks going up?

In the past weeks, we saw a slew of bad news. Several countries, such as the US, Brazil, India and South Africa, are seeing COVID-19 infections rising at a much faster pace. Major US states have also rolled back or paused their reopening programs as hospitals got filled to the brim. The IMF downgraded its 2020 global growth forecast from negative three percent to negative 3.8 percent, calling it “a crisis unlike any we have ever seen.” In the Philippines, unemployment has spiked, OFWs continue to come home and a number of POGOs have closed shop. Reopening has started, but at a slow pace as fear of catching the virus pervades society.

However, there seems to be a glaring disconnect between the real world and the stock markets. Despite all the negative headlines, stock markets roared higher in the second quarter.

US stock market strongest quarter in more than 20 years

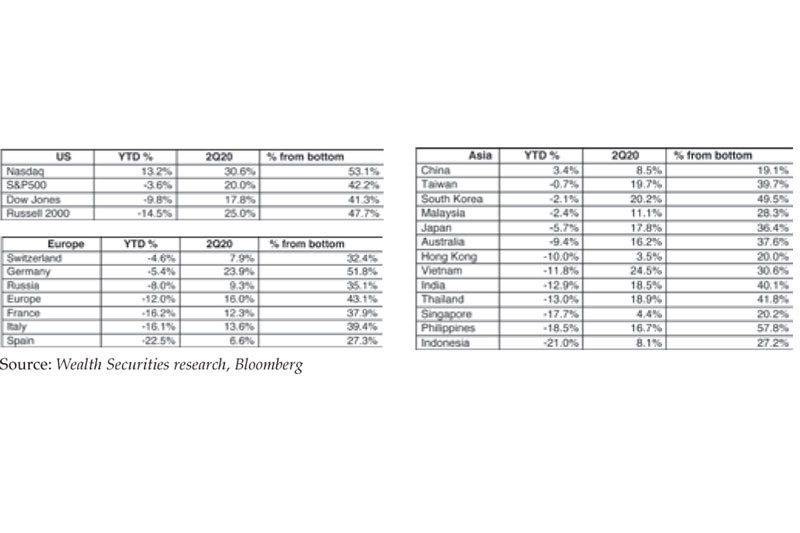

After experiencing its swiftest fall from bull to bear, US equity markets recovered surprisingly fast, as can be seen in the table below. The S&P rose 20 percent in the second quarter for its best quarterly gain since 1998. The tech-heavy Nasdaq Composite’s 30.6 percent jump over the same period was its best performance since 1999. The Dow Jones index’s 17.8 percent recovery was its best quarterly return since 1987 - 33 years ago. In fact, as of the end of this week, the Nasdaq is at a record high, while the S&P 500 and Dow Jones index are just down single digits YTD.

Phl stock market strongest quarter since 2013

As shown in the table above, the PSEi rose 16.7 percent in the second quarter, the biggest quarterly gain since 2013. Even more remarkable is that from its intraday low of 4,039 on March 19, the PSEi has gained 57.8 percent, erasing more than half its COVID-19 losses.

What’s driving the market higher?

The seeming disconnect in asset prices and the real economy can be partially attributed to the forward-looking nature of the stock market. Many investors are writing off 2020 and looking forward to 2021. They seem to be ignoring the rising number of cases in the US and elsewhere. Another important factor behind the stock market’s strength is the Fed’s aggressive monetary policy. By cutting interest rates to zero and expanding the scope of its bond-buying program, the Fed effectively prevented a credit market freeze and sparked the rally in stock prices. Governments around the world have, likewise, stepped up with decisive fiscal stimulus and record rescue packages. The rise of retail investors also created a new set of buyers and speculators (see Robinhood traders, June 22). Finally, hopes for a vaccine which will bring us back to normalcy continue to drive markets higher.

Flight to quality and market leaders

Unfortunately, despite the PSEi’s sharp bounce, it is still down 18.5 percent YTD. As seen in the table above, most stock markets are still in the red this year despite significant bounces from the low. Only the tech-heavy Nasdaq and China are in the green this year. While China was the first country hit by COVID-19, it was also the first one to recover and lift its lockdowns. Investors have flocked to the US because of its tech-heavy weighting. The top five listed US companies are the biggest technology companies in the world – Apple, Microsoft, Amazon, Facebook and Alphabet. Not only do these companies have fortress balance sheets, they also have the best secular growth trajectories and unparalleled business models.

Risks remain

On the other hand, we cannot completely ignore the rising number of cases here and abroad. An uncontrolled second wave or an uncontained first wave are risks that can trigger a major correction. US elections in November this year can also lead to higher volatility – Trump may ratchet up anti-China rhetoric to boost his election bid, while a sweep by the Democrats may lead to the partial rollback of Trump’s tax cuts.

Multi-year economic expansion after pandemic

Many experts are saying that the market may have gotten ahead of itself. With the global economy yet to exit a recession and still in the midst of a COVID-19 pandemic, valuations have become quite steep. So far, many famous fund managers and analysts are skeptical about this rally. It is important to note that the ferocity of the drop and the subsequent recovery has very little historical precedent. With this bear market caused by a life-altering pandemic, it is quite difficult to navigate the stock market. It can continue to be very volatile and news-driven. However, with global interest rates at historic lows, record fiscal programs of governments and the possible development of a vaccine, we believe that a multi-year economic expansion will materialize once we get past the COVID-19 pandemic. Thus, investors with a long term time horizon should stay invested in the equities market.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending