Lessons from a behavioral finance guru (FQwentuhan with Meir Statman)

Who is Meir Statman?

Meir Statman is one of the founding fathers of behavioral finance. He is a professor at the Leavey School of Business, Santa Clara University and a visiting professor at Tilburg University in the Netherlands. He received his Ph.D. from Columbia University and his B.A. and M.B.A. from the Hebrew University, the same school where Nobel Laureate Daniel Kahneman, the psychologist responsible for the development of behavioral economics, also studied.

His research focuses on how investors and managers make financial decisions, the cognitive errors and emotions that influence them, retirement, asset allocation, asset pricing, etc.

There must be something about Israelis and behavioral science. Many of the great behavioral scientists I follow are Israelites – Daniel Kahneman, Dan Ariely, Shlomo Benartzi and Meir Statman.

CFA event

A couple of years ago, when I saw the invite from the CFA Society Philippines for a talk to be delivered by the “father of behavioral finance,” I made sure I would not miss it. Not only did I attend it, I even interviewed the speaker after his very “brave” talk. (You’ll find out why brave later.)

His talk was attended by CFAs and fund managers. After his talk and some photo-ops, he was gracious enough to sit down with me for an FQwentuhan.

At the start of the interview, you will find him cringing at the title used by the CFA event. But he is indeed one of the founding fathers of the field.

I am very happy to share this video with you, a gem of an interview where we can all learn valuable lessons from Dr. Statman.

Among the parts that really struck me during our FQwentuhan, his talk proper and the conversation we had when Marvin and I accompanied him for lunch are the following:

1. Don’t waste your hard-earned money trying to beat the market!

This is a very good reminder to everyone who insist on getting into this “sport.” Okay, yes, it is a lot more exciting to do our own stock picking, but may I ask you to please limit the percentage to a small one? We may be better off finding thrill and excitement in other matters.

2. Be generous. No matter how hard you have worked for the success and the money that you now have, remember that you also got lucky.

Another great reminder that sharing is actually an obligation, especially if you have been blessed.

3. It is better to give with a warm hand than a cold one.

This is one of my favorite takeaways from Dr. Statman. It is Jewish saying that talks about the timing of giving, of inheritance. It so struck me that my husband and I ended up giving something substantial to our sons earlier than what we initially intended. This will be the subject of our Kumu show on Thursday at 11 a.m. I would like to know what you think about it.

4. Asset pricing and what brings you joy

We had an interesting discussion about how people perceive premium pricing when it comes to different products and services. We also discussed the importance of knowing what brings us joy so we know where to direct our spending. In our FQ workshops, we have an exercise on knowing your core values so you can use them as compass in the way you handle money.

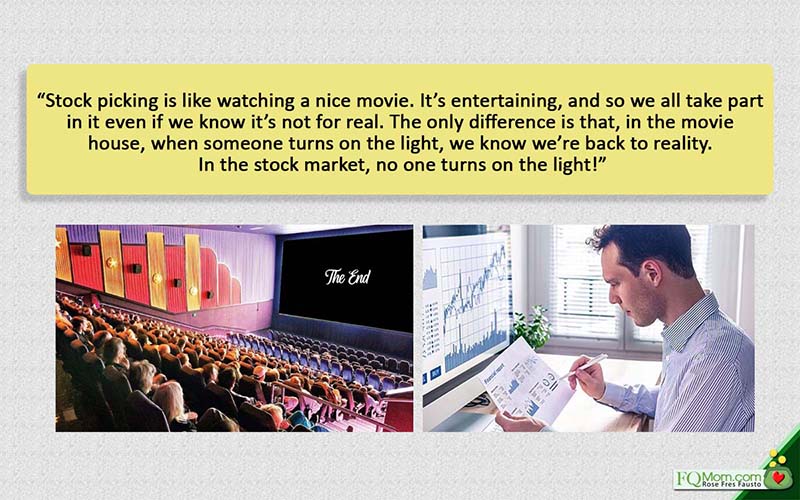

5. Audacious remark by Statman

Remember I mentioned earlier that he gave a very “brave” talk in front of fund managers during that CFA event? This is what he said, “Individuals have no business picking their individual stocks! Stock picking is like watching a nice movie. It’s entertaining, and so we all take part in it even if we know it’s not for real. The only difference is that, in the movie house, when someone turns on the light, we know we’re back to reality. In the stock market, no one turns on the light!”

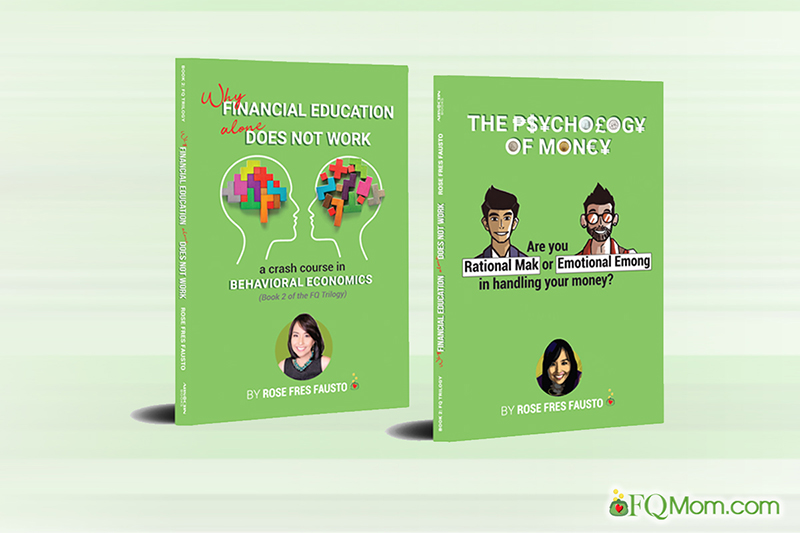

The last point finds its way to page 209 of FQ Book 2 “Why financial education alone does not work (a crash course in behavioral economics)”. It is discussed in Chapter 18 “Illusion of Control”. My lofty dream is that FQ Book 2, together with the two other installments in the FQ Trilogy, will somehow help “turn on the light.”

I hope that you will be able to apply the above lessons from one of the founding fathers of behavioral finance.

Do join us tomorrow when we further discuss “Giving with a warm hand rather than a cold one.” That’s on Thursday at 11 a.m. I’d love to hear your take on the matter. Cheers to high FQ!

ANNOUNCEMENTS

1. To learn more about your money behavior, get your copy of FQ Book 2. Get copies for your loved ones too. The principles you will learn from here are not only applicable in your financial life but all the other important aspects of your life. https://fqmom.com/bookstore/

To know more about FQ Book 2, watch this short video.

2. How good are you with money? Do you want to know your FQ score? Take the FQ test and get hold of your finances now. Scan the QR code or click the link: http://fqmom.com/dev-fqtest/app/#/questionnaire.