“Should I do my own stock-picking?” and other questions from a reader

Questions from reader:

Hi Ms. Rose! I read your FQ Book again, and recruited friends to buy your books and they did! I’m happy to report that my FQ Score has improved!

Since I watched you on Bianca Gonzales’ channel last year, I started my FQ journey – I invested in a mutual fund (money market first to be conservative) then took a risk and invested in PSEi. Then I also invested in UITF(Equity Index Fund) in two banks. I am trying to compare how they perform and to be honest, I have yet to regularly add funds to my UITFs.

Recently, I opened, funded, and invested in a mutual fund with COL Financial. My next target is to buy stocks individually. I know it’s not really the ideal way to diversify. I am 35 years old turning 36 soon. I already have a VUL that I started years ago. After all the things that I said, my question is, “Is it late for me to just have started the journey now?” I mean, I can only spare like 1K a month to put in any of the investment accounts I opened. I have this sort of panic in my mind,“Why haven’t I done this sooner?” Now I am thinking of taking a small chunk of my emergency savings to put in my investments because I feel like I’m running out of time – as what you and Ms. April Lee Tan discussed in your FQwentuhan – Time in the market is more important than timing the market (yes, I subscribed to your You tube channel too! :)).

Thank you and I hope you can reply and give me your thoughts on the above, and an update on your next FQ books!

- Kris via Facebook

My reply:

Hi Kris. First of all, thank you for being my book sales agent! :) I hope your friends have also been inspired by the book to start their FQ journey. It’s always good to have FQ Buddies for support. Congratulations for having put the lessons and inspiration into action.

You have three main questions/concerns here:

- Is it too late for me to have just started my investing journey in mymid-30s?

- Should I take out a small chunk of my emergency fund to put in equity investment?

- Should I buy individual stocks?

Let’s discuss them one by one:

Question No.1: Is it too late?

The honest answer is it would have been better if you started investing as soon as you started earning, and best if it were already a part of your childhood in the form of regularly investing from your allowance and cash gifts. But your choices were: a.) to start now in your mid-30s; or b.)start later. I’m glad youpicked option a because if you missed the two earlier buses, the next best time is always NOW!

You still have a few decades to invest, so enough with regret. :) The great news is, we just entered our demographic sweet spot in 2015 and our economy is poised to grow significantly in the next few decades. Being invested during this period will do well for your retirement nest egg.

What you have to do now is to do it regularly and automatically. You mentioned that you have yet to regularly add to your funds. This is the thing that you can control now. I suggest you make your investing automatic. Set up a system where you can just have the amount deducted from your payroll and automatically invested in your chosen retirement fund.Do not burden your will power with the monthly or bi-monthly decision-making of “Should I invest now?” If you do so, it’s hardly going to work because you will always find excuses not to. Observe the first basic law of money, “Pay yourself first.” And in these times, we can actually say, “Pay yourself first automatically!”

Question No. 2: Should I deduct from my emergency fund to transfer to my equity fund?

I understand that because you want to make up for lost time, you’re now considering taking out money from your emergency fund so you can accelerate your equity fund growth. Here are the things you have to consider. Is your emergency fund already enough to cover you in the event of emergency? Is the amount anywhere from three to six months of your expenses? If you’re fully covered on this, then you may withdraw the excess and invest in your long-term retirement equity fund. If not, increase your regular savings so you can increase your regular contribution to your equity investment.

By the way, your emergency fund may also be invested in short-term fixed income instruments so it can also earn a bit for you while it’s not being used. Just leave something like a month’s worth of salary or expenses in your ATM account and the rest in money market placements or high yielding savings account. This way, you are not easily tempted to withdraw your emergency fund during pseudo (or fake) emergency situations. Remember your emergency fund has a distinct purpose from your retirement fund.

Question No. 3: Should I buy individual stocks?

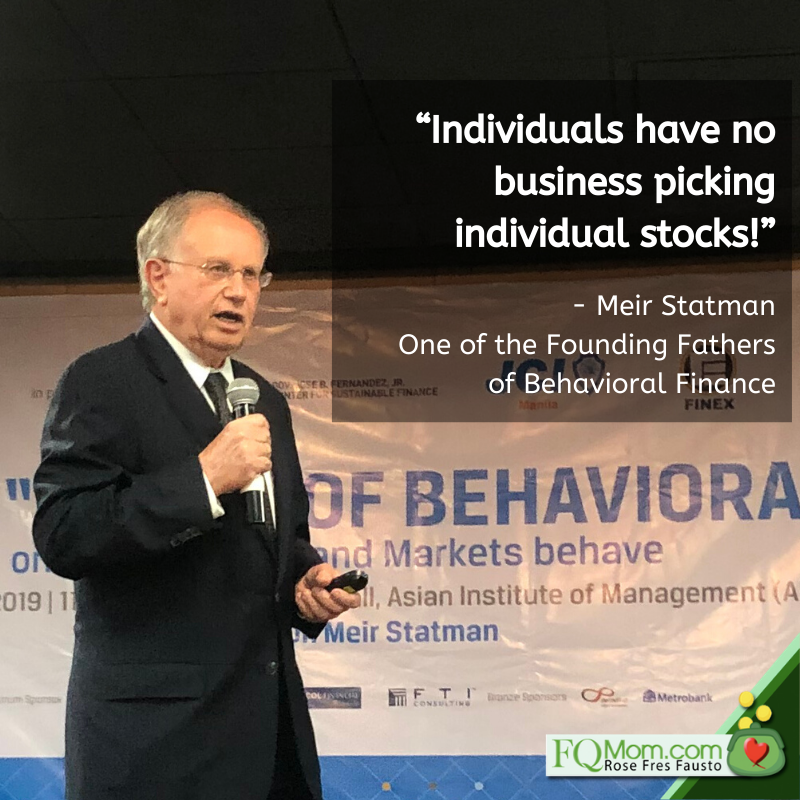

I hope you were with me when I attended the talk of Meir Statman, one of the founding fathers of Behavioral Finance, during a recent CFA event. He said this as bluntly as one could get, “Individuals have no business picking individual stocks!” And mind you, he said that in front of fund managers!

Why did he say that? Because there is more than enough empirical data that proves that we are better off just investing in equity index funds. How many Warren Buffetts and Wilson Sys can we really have in this world? And even they are having a hard time beating the market now. What more for individuals who are not trained to read financial statements, economic indicators and other market sentiments?

You mentioned about diversification. You are already automatically diversified when you buy an equity index fund because the fund owns the top 30 listed stocks in the Philippine Stock Exchange. And you can have this advantage with as little as PhP1,000, or even less in some funds.

For your purposes right now, you are better off with very simple portfolio of:

- Emergency Fund – three to six months invested in money market fund or high interest savings account, separate from your “working capital” fund which you use for your monthly expenses.

- Retirement Fund – equity index fund, choose from among the ones available in your COL platform. If you opt to continue with your existing UITF (assuming this is an equity index fund), you may just add to this.

*Note: Both investments may be done either through mutual fund (using your COL account or similar platforms) or UITF (from banks, better if the one handling your payroll account). The important thing is to automate investing by using their automatic features such as Easy Investment Program.

After you have grown your portfolio and you have become more comfortable with investing, then you may look into other investments. Admittedly, investing in index fund does not give you that thrilla in Manila. Maybe you can find thrill in the other aspects of your life, or if you really want investment thrills, just make sure to allocate a miniscule portion of your portfolio in your individual stock-picking activities. Remember, the thrill in your FQ journey is being able to see your assets grow, having the confidence that you are doing something now for your happier future, not bogged down by money problems.

And to answer your fourth question which I also received from several FQ book readers, “When will FQ Book 2 come out?” the answer is 2020! Hopefully, it will give you some thrills as we explore the workings of the human mind when it comes to dealing with money. I can’t wait to introduce you to the characters of FQ Book 2. Do say a little prayer for me so I can complete the task soon.

Thank you very much and cheers to high FQ!

Sincerely,

Rose

*********************************

ANNOUNCEMENTS

1. I am happy to again take part in the second BangkoSentral ng Pilipinas’ Financial Education Stakeholders Expo on November 25-26, 2019 (Monday-Tuesday) at the SMX Convention Center, Mall of Asia, Manila. On Day 2, November 26 (Tuesday), I’ll be moderating the Breakout Session 3: Investing in the Philippine Stock Market. I hope to see you there! :)

2. Mom and Son Podcast - Season 4 Episode 5 (MOM AND SON DATE PART 1)

Today we take you all on our Mom and Son date! Instead of the routine questions parents ask children when talking, we used a different way to achieve the goal of getting to know each other better. For this episode, the mom was the interviewer and the son, the interviewee.

Join our date and date your moms/sons as well!

#MomAndSonPodcast

Spotify

https://open.spotify.com/episode/1aKQT8jegcnbn1sOQlTfHn?si=DYAZwK7GS2CLS2X3GfHEAA

Buzzsprout

Apple iTunes

https://podcasts.apple.com/ph/podcast/mom-and-son-podcast/id1449688689?mt=2

Google Podcasts

https://podcasts.google.com/?feed=aHR0cHM6Ly9mZWVkcy5idXp6c3Byb3V0LmNvbS8yNDE0NDcucnNz

YouTube

Originally uploaded on Anton Fausto’s YouTube Channel: https://youtu.be/IzDIpEutwO0

FQ Mom Link: https://www.youtube.com/watch?v=VyrntPuUO40

3. Thanks to those who already bought the FQ Book, especially to those who took the time out to send me their feedback. Your feedback is food for my soul. To those who have not gotten their copy yet, here’s a short preview of FQ: The nth Intelligence

You may now purchase the book in major bookstores, or if you want autographed copies, please go to FQ Mom FB page (click SHOP), or FQMom.com (click BOOKS), or email us at FQMomm@gmail.com

4. Want to know where your FQ stands? Take the FQ Test Challenge now! Click link. http://rebrand.ly/FQTest

Rose FresFausto is a speaker and author of bestselling books Raising Pinoy Boys and The Retelling of The Richest Man in Babylon (English and Filipino versions). Click this link to read samples – Books of FQ Mom. She is a Behavioral Economist, Certified Gallup Strengths Coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook&YouTube as FQ Mom, and Twitter&Instagram as theFQMom. Her latest book is FQ: The nth Intelligence.

IMAGE ATTRIBUTIONS: Photos from freepik.com, modified and used to help deliver the message of the article.