Should the approach to learning about money be different between genders? (Focus: women and money)

Is gender a factor in mastering your FQ (Financial Intelligence Quotient)?

In a society where we try to “equalize” everything, we might readily answer no. The laws of money apply to all, regardless of gender. While this is true in general, a closer look at specific money situations point to the need to discuss the differences in order to come up with more effective solutions to the money concerns of women.

Do you have a female friend who is clueless about money matters because she’s used to being taken care of by her husband who just passed away? Or a co-worker who refuses to face her looming bankruptcy due to huge credit card debts? Or an old maid aunt who never worked a day in her life and expects her relatives to take care of her financial needs the way your lolo and lola did? Or a former elementary teacher who is now in Hong Kong as a domestic helper sending all her earnings to her children, and her husband who can’t seem to keep a job? Or do you have a favorite tita who still insists on staying in her big house even if she can’t afford to pay for its maintenance anymore?

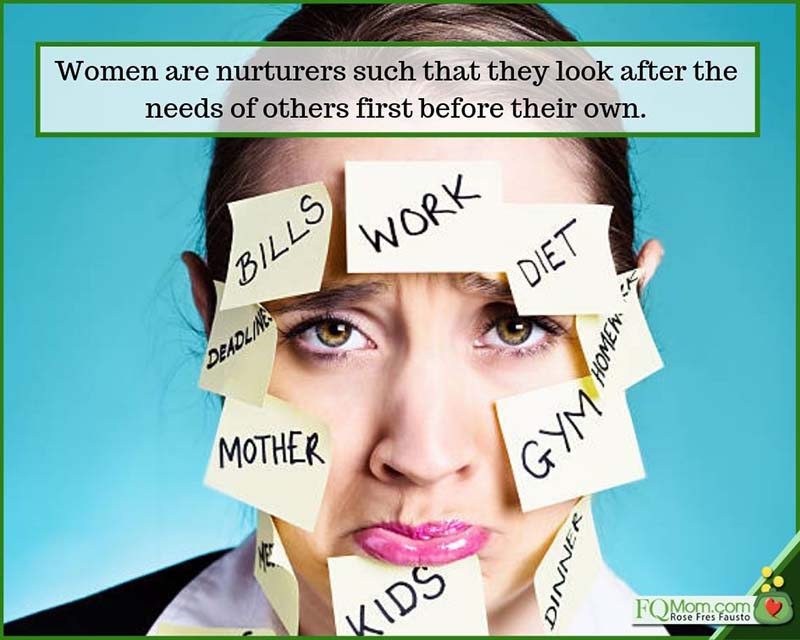

And we’re talking of smart, competent and in most cases, even accomplished women who look confident, capable and fine on the outside but are worried sick about money matters on the inside. Still, there are a lot of them in our midst that we don’t know about, simply because women are good at hiding problems. In fact, some have mastered the skill that they’ve concealed these problems even from themselves, knowingly or unknowingly. You see, they will take care of other people’s problems first, before their own.

The women situation

Below are factors that we should understand when it comes to money management for women.

1. Gender pay gap. Women are paid less than men for similar jobs held. This originates from the roles society has assigned to the genders since way, way back – the man works outside the home to earn money, while the woman works at home taking care of the household, with no remuneration attached to it. Moreover, education was not available to women before; hence, the first jobs given to them were those not requiring high skills and with lower pay. This was carried on into the modern world such that even if men and women now occupy the same jobs, the gender gap pay persists. Another reason could really be employer preference – i.e. higher pay is given to males because they will not take maternity and similar leaves. In the US where there is data, the gender pay gap is 80 cents to a dollar in favor of men. It is noteworthy that the Philippines ranks high in Global Gender Gap Report of the World Economic Forum in December 2018 – no. Eight among 149 countries based on four categories: labor force participation, educational attainment, health and survival and political empowerment.

2. Work interruptions. Because nature designed women to carry the child in pregnancy, and is better-wired to do child-rearing, she takes off from work to do this important task for society. On top of the maternity leaves (which is now 105 days in the Philippines by virtue of Republic Act 7322), who is the default parent to take a leave when the child needs someone to bring him to the hospital, or attend parent-teacher conferences and other activities? It’s the mom! Because of this, most women take off from their jobs for certain periods of time in their career, such that they are put at a disadvantage in terms of earning capacity.

3. Caring for elders. On top of taking care of their own children, women are somewhat expected to take care of their elderly parents more, as compared to their male siblings. Again, this may lead to work interruptions and also additional financial burden for the women, especially in families where money is not openly talked about. Since they’re the ones expected to take care of their elderly parents, they may end up also shouldering the related costs if they are not able to discuss this matter openly with other siblings.

4. The challenge of earning more than their husbands. If a man earns way more than her wife, everything and everyone is cool about it, but if it were the other way around, it may be a source of struggle. Spouses of such women are prone to being unfairly ridiculed as Andres (Under-the-saya) or hen-pecked husbands. Nobody wants this – not the husband, not even the wife, that I suspect, sometimes, some wives are willing to decelerate their career movement just so the husband can catch up! ![]() Moreover, in households where the wife is earning more than the husband, she is still the one expected to do the household management that could add stress to her job, something that her male counterpart will never have to worry about.

Moreover, in households where the wife is earning more than the husband, she is still the one expected to do the household management that could add stress to her job, something that her male counterpart will never have to worry about.

5. Women live longer than men. Filipino males have an average life span of 66.2 years while females average at 72.6 years, based on the World Health Organization records published in 2018 using 2016 data. That’s six years longer! As women may rejoice about having longer lives, they also have to be concerned that they have to prepare a larger retirement nest egg compared to their male counterparts, from their lower salaries and shorter work periods.

6. Women are usually left to take care of the children when the marriage ends. In a country where there are no clear-cut policies for child support easily implemented, we usually see mothers fending for their children with little or no help from the male parents. Oftentimes, I hear single mothers lament, “I don’t want to have anything to do with him anymore, so I will just take care of my children’s needs!”

7. Women are not confident about investing. Women are good with budgeting. They also have the propensity to save more in terms of percentage to their income. But when it comes to investing, they shy away from it, lacking confidence in actively getting involved in this essential element of FQ. However, let me point out that women, in general, possess the qualities that are beneficial to good investing.

8. Women are nurturers such that they look after the needs of others first before their own. This altruistic trait is good to society in general but when left unchecked, may bring about trouble to the female population.

I hope the above factors help enlighten both men and women. Cheers to high FQ! ![]()

*********************************

ANNOUNCEMENTS

1. Mom and Son Podcast - Season 2 Episode 10 (MID-YEAR SLUMP)

It's June! We're in the mid-year game now! How do you get over that mid-year slump? Today, we discuss the important mindset and steps to stay motivated to achieve those goals you set out to accomplish at the start of the year. Setting a goal and taking the first step is important but it's also very crucial to follow up the steps to achieve those goals to really reach where we want to be.

#MomAndSonPodcast

Spotify

https://open.spotify.com/episode/6DvZjI8CGNITvn33TwiiUj?si=tU-8QiqgRW24KOlw8KlmBA

Apple iTunes

https://podcasts.apple.com/ph/podcast/mom-son-podcast-episode-1-bullying/id1449688689?i=1000427744572

Buzzsprout

https://www.buzzsprout.com/241447/1227896-mom-and-son-podcast-season-2-episode-10-mid-year-slump

YouTube

https://www.youtube.com/watch?v=dx0rYRH7vEc&feature=youtu.be

2. A more detailed version of this article was published in InLifeSheroes.com

3. Thanks to those who already bought the FQ Book, especially to those who took the time out to send me their feedback. Your feedback is food for my soul. To those who have not gotten their copy yet, here’s a short preview of "FQ: The nth Intelligence."

You may now purchase the book in major bookstores, or if you want autographed copies, please go to FQ Mom FB page (click SHOP), or FQMom.com (click BOOKS), or email us at FQMomm@gmail.com

4. Want to know where your FQ stands? Take the FQ Test Challenge now! Click link. http://rebrand.ly/FQTest

Rose Fres Fausto is a speaker and author of bestselling books Raising Pinoy Boys and The Retelling of The Richest Man in Babylon (English and Filipino versions). Click this link to read samples – Books of FQ Mom. She is a behavioral economist, a certified Gallup strengths coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook&YouTube as FQ Mom, and Twitter&Instagram as theFQMom. Her latest book is "FQ: The nth Intelligence."