20 days to go and 20 FQ things you can do before Christmas

It’s only 20 days to go before Christmas. Here are 20 FQ things you can do so you will enjoy the season and still start the new year with a healthy pocket.

1. Check how much you earned this year and how much of it was set aside for saving and investing. This first step sets you in a mood that reminds you if you’ve been naughty or nice in your FQ/financial habits.

2. Check how much money you can really afford to spend for the season without getting into debt.

3. If you got yourself into debt last year just to fund your Ho! Ho! Ho! activities, check if you’ve already paid your lenders who are probably now crying Hu! Hu! Hu! because of your unpaid debts. Yes, the spirit of Christmas is giving, and that includes giving yourself and your lenders that peace of mind.

4. If you’ve already received your 13th month pay, do not spend it all. Set aside at least 20 percent of that for your saving and investing, the rest you may spend. Again, the operative word is “may.” Remember, it is always advisable to set aside a bigger percentage of your bonuses and other non regular cash inflows in order to speed up your asset accumulation.

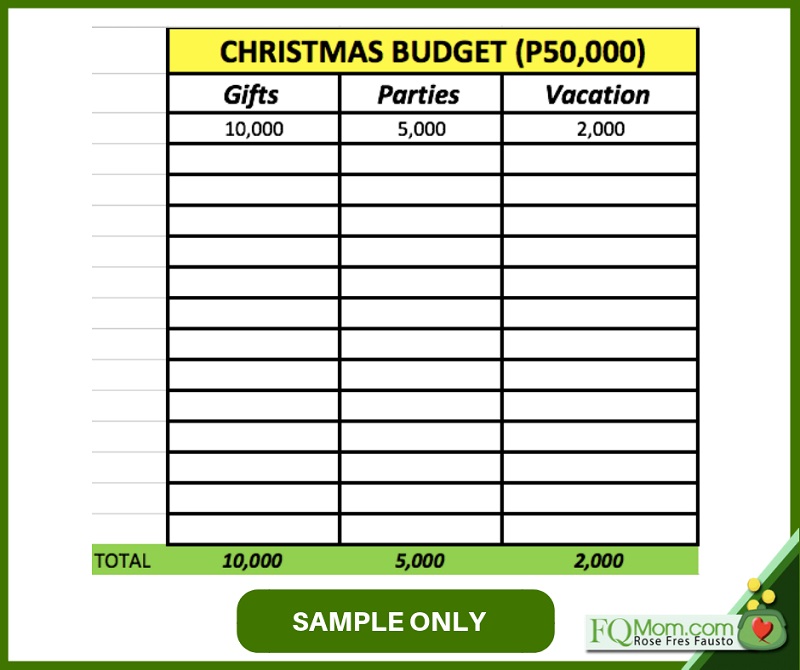

5. Now that you’ve set the amount you can really afford based on no. 2, write that out in big bold font on top of the list that you will make for your Christmas Expenses. This list will have at least three major categories - gifts, parties, and vacation. It would be good to use an excel file so that you can easily have a running balance that you can compare with your total budget written in big bold font on top of your file.

6. If your family members are also responsible in making some of the expenses in no. 5, share the list with them.

7. I’m sure by this time you’ve already done some Christmas spending. Write those actual expenses in your excel file to see how much is left in your war chest. This will help you step on the brakes if you need to.

8. For the rest of your shopping, have a plan according to your shopping behavior. If you love shopping, you can have a whole day galore but if you loathe shopping, just a few hours will do. In both cases, make it efficient. Choose your shopping venue for the items you need to buy. Given our dismal traffic situation, maybe a single stop where you can easily walk from store to store will be better. Avoid driving from one shopping place to another as time is a precious commodity.

9. Sleep well the day before a big shopping day.

10. After your restful sleep, eat your breakfast (if you’re planning to go in the morning) at the right time – not too early so as not to be hungry after only an hour of shopping. It has been established in Behavioral Economics studies that we tend to make irrational decisions when we’re in a depleted state – i.e. hungry, angry, sleepy, etc.

11. Do some self-affirmations before shopping. This might seem like totally irrelevant but studies show that when we remind ourselves of our positive traits before we go shopping, we tend to shop less. This is actually the basis of retail therapy. Someone who is feeling terrible would need more stuff to feel better about herself. The only problem with this therapy is that it actually does the opposite. Therapy is supposed to be a treatment for a disease or disorder. It may be painful while it’s being administered to you (think physical therapy of a frozen shoulder where you will need to stretch and feel the pain in order to gradually solve the problem). In the case of retail therapy, it is at best, a palliative. But of course, it’s poor marketing to use that more accurate term.

12. Dress up appropriately. Yes, come in comfortable clothes but please don’t overdo and end up in pambahay look. Sales people are only human and they have the tendency to treat well-dressed customers better than those who are not. I know of a story of someone who was not treated well because she wasn’t properly dressed. Irritated, she succumbed to her limbic brain and showed her financial capability, exaggerating her purchases. So we have two irrational behaviors at work here (the sales person’s and the customer’s); unfortunately, the cost was carried by the customer.

13. Schedule a break. Hungry stomachs and tired feet make irrational decisions.

14. Shop alone. You are affected by your companions such that when they start buying stuff, you might end up buying the same even if they are beyond your budget as stated in no. 5. Moreover, there’s also the pressure to make the purchase right away if you have people waiting for you.

15. If you have spending problems, leave the credit card at home. Shopping with cash automatically puts a stop once you use up your budget. Moreover, the pain of paying is felt more when you use cash so this might be of help.

16. However, if you want to bring your credit card, just make sure that you have designed some form of friction cost or hurdle before you use it. Again, this is for people with shopping problems. An example would be an approval you need to seek from your partner before using the card.

17. Buy less expensive items first. There is a Behavioral Economics principle called anchoring, which is the human tendency to use the number first suggested to us as a basis or anchor. So if you’ve already made a big ticket purchase at the start, chances are, it would be easier for you to purchase higher-priced goods after.

18. Be wary of sale. Red tags stating 50 percent off, etc. have a way of exciting our limbic brains especially if we see the “original” price being lowered down. It is the same B.E. principle as discussed in no. 17. Just because it is suggested that it used to be at this higher price, we are now convinced that it is our loss not to avail of the promo. An antidote to this is to ask the questions, “If this discounted price were the original price, will I buy it? Do I even want this in my crowded closet?”

19. Record purchases. Once you get home or as soon as practicable, update your excel file and input the items you purchased and tick off the items done. This will give you a sense of accomplishment.

20. Pause and ask yourself, “Are these purchases contributing to the spirit of Christmas that I believe in? Or am I just sucked into the expectations of society to give presents and spend like crazy to celebrate the holidays?”

The irony of it all is that we spend so much during the season to celebrate the birth of a baby born in a manger 2,000 years ago with no frills, no fuss. But we may rationalize our spending behavior as our way of giving importance to this most significant event in history where God became man to save us. This got me thinking, if Jesus were in front of us and we ask Him, “Hey JC, how do you want to celebrate your birthday?” I’m sure He’d say, “Nothing as extravagant as you guys always do!” Then He might throw back the question to us, “If you were to celebrate what I really came here for, what would it be like?” I’m sure we will all have to dig in to our archive of FQripot tips when it comes to celebrating.

Cheers to a meaningful Christmas celebration! ![]()

*********************************

ANNOUNCEMENTS

1. Thanks to those who already bought the FQ Book, especially to those who took the time out to send me their feedback. Your feedback is food for my soul. To those who have not gotten their copy yet, here’s a short preview of "FQ: The nth Intelligence."

You may now purchase the book in major bookstores, or if you want autographed copies, please go to FQ Mom FB page (click SHOP), or FQMom.com (click BOOKS), or email us at FQMomm@gmail.com.

2. Want to know where your FQ stands? Take the FQ Test Challenge now! Click link: http://rebrand.ly/FQTest

Rose Fres Fausto is a speaker and author of bestselling books "Raising Pinoy Boys" and "The Retelling of The Richest Man in Babylon" (English and Filipino versions). Click this link to read samples – Books of FQ Mom. She is a behavioral economist, a certified Gallup strengths coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook & YouTube as FQ Mom, and Twitter & Instagram as theFQMom. Her latest book is "FQ: The nth Intelligence."