My FQ Dad

I’m writing this during lull time of my father’s wake in Ilocos Norte. My father died on October 27, 2018, exactly one year and seven months after his love of his life died. And they both died on the 27th of the month. Oh they two were real love birds, married for over six decades who were never really away from each other for a prolonged period of time.

No matter how old you get, and even if your parent is already blessed with 90 long years to experience his grandchildren and great grandchildren, the pain of losing is still deep.

But as I reflect on my grief in between sobs and hagulgols, I realize that my tears are more about emotional gratitude of how blessed I am to have had him as my father. He was a simple man with simple dreams who cared deeply for his wife, children, grandchildren, great grandchildren, and other people. In fact, we sometimes called him “man for others” because he would always look out for the welfare of others. Incidentally, his birthday is a day before the feast of St. Ignatius, founder of the Society of Jesus where that mantra comes from.

Today I recall some FQ-related things about my Papang. He was a Central Banker for many years. As a child, I remember being thrilled receiving the earliest editions of our new coins and bills issued by the Central Bank. Our weekly allowance was also given in crisp bills with chronological serial numbers. I’m sure these childhood money memories also added to my positive relationship with money, particularly my penchant for regular saving at an early age.

“Nagngina!” (“Too expensive!”)

Another FQ memory I have of Papang shows what the Anchoring Effect is all about.

Anchoring Effect is a Behavioral Economics principle that talks about the human tendency to rely too heavily on the first piece of information offered (i.e. the anchor) when making decisions. Once an anchor is set, subsequent judgments and decisions are made in reference to it, no matter how unrelated they are to the anchor. This was shown in the experiment by Ariely, Loewenstein and Prelec wherein something as unrelated as SSS number affected the subjects’ judgment on the prices of commodities.

Here’s my father exhibiting the anchoring effect.

Two years ago, my sister accompanied Papang to buy his piña barong for their Diamond Wedding Anniversary. He happily tried on a few pieces with his usual kengkoy (funny) antics of pogi posing and dancing. They picked a nice one, which was fortunately on sale. Then he asked, “How much is it?” When he heard the net price, he exclaimed, “Nagngina!” (“Too expensive!”) and refused to buy it! My sister really wanted to buy it already because it was beautiful and reasonably priced, but it was impossible to do so because of the vehement reaction from our father who even said, “I won’t wear it!”

My sister allowed him to cool down and not force the issue even if she wanted to tell him, “Pang, it’s impossible to buy a piña barong with the price you have in mind, not even a jusi barong!”

Trying to understand Papang’s usual “Nagngina!” reactions made us realize that aside from being Ilocano, he was stuck in the price levels of his pre-retirement days, when he used to buy things for the family. His prices were anchored in the levels of three decades ago! (Click link to read more on this principle)

“Ok ngarud uray no nangina!” (It’s ok even if expensive!)

Here’s another story showing another Behavioral Economics principle at work in Papang. This time, the Pain of Paying - some purchases are more painful than others, and people try to avoid these type of purchases. Even if the actual cost is the same, there is a difference in the pain of paying depending on the mode of payment. In other words, it is not only the price that affects us.

In general, cash payment is the most painful mode, followed by debit card and then credit card. On the frequency aspect, paid one time is more painful than when done incrementally. However, in terms of enjoyment, prepayment also makes us have a higher utility/satisfaction compared to paying every step of the way as we enjoy the service. (Click link to read more on this principle.)

Remember how he vehemently refused to buy his piña barong for their Diamond Wedding because it was “nagngina!” and threatened not to wear it? But how come he loved wearing his pair of Prada shoes and Ralph Lauren jacket which were also “nagngina!” items?

It was because we took away the pain of paying from him. These were gifts from his children and the truth is, he really loved wearing high quality apparels. He was what his siblings would call “spooting” which means “porma” or “dressed to kill.” ![]()

So if you’re wondering what happened to the piña barong, my sister ended up buying it on her own. And yes, Papang wore it handsomely on his Diamond Wedding to his bride of 60 years!

Let me end this piece that the “pain of losing” my Papang is eased by the thought that he is finally reunited with the love of his life, and that they will continue their love story in heaven. Thank you Papang and Mamang for showing us that there is indeed #Forever. I love you both. ![]()

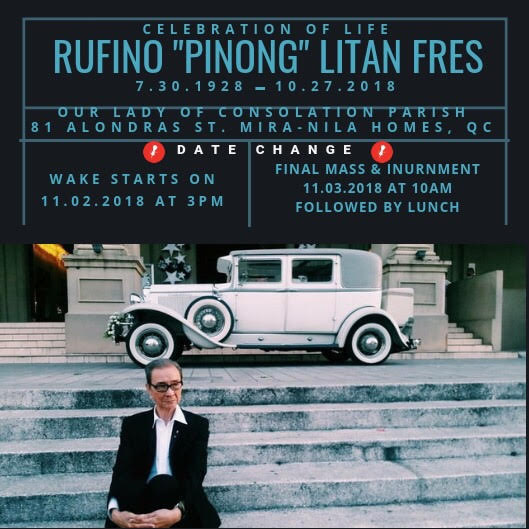

ANNOUNCEMENTS

-

For details of my Papang’s inurnment, please see image below. On behalf of our family, we thank you for your sympathy and prayers.

-

The biggest Catholic inspirational and learning event is finally here again! Kerygma Conference 2018: Limitless! Marvin and I are so excited because we will be sharing the stage with our bunso, Anton Fausto, in our talk “Parenting Challenges Made Fun”. We will be there on November 22 (Thursday) at 11:00am, SMX Convention Center, Manila. For tickets and more information, visit www.kerygmaconference.com

-

I’ll be at the Bangko Sentral ng Pilipinas’ 1st Financial Education Stakeholders’ Expo on Nov. 27-28, 2018 (Tues-Wed) at the SMX Convention Center, Manila. On Day 2, November 28 (Wed), I’ll be giving a talk on “Fin-Ed Program Design Using Behavioral Economics” and also moderating the plenary session on Innovations in Financial Education. I hope to see you there!

-

Thanks to those who already bought the FQ Book, especially to those who took the time out to send me their feedback. Your feedback is food for my soul. To those who have not gotten their copy yet, here’s a short preview of FQ: The nth Intelligence

-

Want to know where your FQ stands? Take the FQ Test Challenge now! Click link. http://rebrand.ly/FQTest

Rose Fres Fausto is a speaker and author of bestselling books Raising Pinoy Boys and The Retelling of The Richest Man in Babylon (English and Filipino versions). Click this link to read samples – Books of FQ Mom. She is a Behavioral Economist, Certified Gallup Strengths Coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook & YouTube as FQ Mom, and Twitter & Instagram as theFQMom. Her latest book is FQ: The nth Intelligence.