A book on what to do ‘when tax attacks’

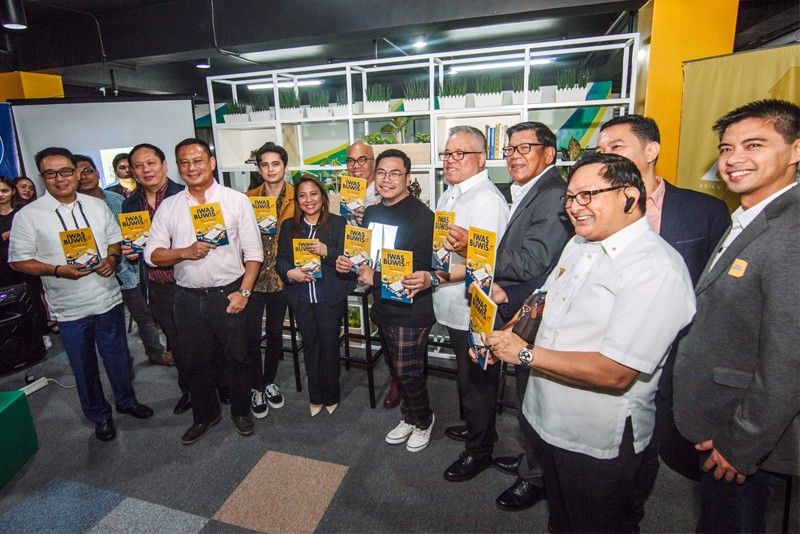

I hosted a talk segment during the book launch of my good friend Mon Abrea, popularly known as The Philippine Tax Whiz, who recently unveiled Iwas Buwis-it: What to Do When Tax Attacks. Mon is renowned for his advocacy for a genuine tax reform in the country. He established the Asian Consulting Group (ACG), the premier social enterprise on tax advisory, which launched the book.

I had a vibrant discussion about taxes with Mon, James Reid, Kean Cipriano, financial literacy advocate Salve Duplito and Potato Corner CEO Jose Magsaysay Jr.

Aside from being famous personalities, James and Kean are both entrepreneurs and therefore tax education is important to them. James has his own music label, Careless (formerly Careless Music Manila), while Kean and his wife Chynna Ortaleza co-founded Unna Cares, Inc. with two other couples. Their business provides mothers affordable and reliable products like breast pumps to help moms in their parenting duties.

(Aside from me, James, Kean and Chynna, Bea Binene is also an ACG celebrity ambassador. Bea owns Mix & Brew Coffee.)

A former BIR examiner, Mon is a sought-after tax expert and best-selling author. Ask anything about taxes and he will tell you more. He simplifies complex ideas regarding taxes. Mon was recognized as one of The Outstanding Young Men (TOYM) of the Philippines in 2015 and ranked among the Outstanding Young Persons of the World in 2017. He is a Distinguished Bedan in the field of Accounting and Taxation. He received the Metrobank Foundation’s Award for Continuing Excellence and Service (ACES).

In the relentless pursuit of his advocacy, Mon seizes every opportunity to educate people about taxes. One of them is by writing a book. “If you make taxes more accessible and easier to understand, then maybe people won’t be afraid,” he wrote in the book’s introduction.

Iwas Buwis-it is designed to be a casual read that discusses the various taxes a person must pay in his/her lifetime. It covers common experiences like career choices, starting a business, giving gifts, and many more.

It is a privilege for me to be part of this highly-informative book on taxes. The book contains my interview as a public figure and an artist manager. When asked about how I handle my taxes, I replied, “I wasn’t serious about taxes then because there was nothing to be taxed. When the problem about taxation came about, I hired experts. Today, I still have the experts. I still have the Philippine Tax Whiz, Mon Abrea, watching my back. It has not been as challenging because of ACG and the experts I consult.”

Aside from my interview, the book also features business tips from Jose Magsaysay Jr. and an interview of James.

Paying taxes, like death, is inevitable. We deal with taxes from birth to death. Computing large numbers is sometimes overwhelming and confusing. But as responsible and honest citizens, we must declare and pay our taxes correctly.

Mon shared, “The goal of the book is to help people understand taxes — not the technical knowledge, just the understanding of why we’re taxed, and what kind of taxes we pay. Iwas Buwis-it won’t be about how to file this return or pay that tax. The book is about life in general — your careers, your ideals, or even your business ideas.”

Iwas Buwis-it is part of ACG’s advocacy of assisting people through tax awareness. If taxpayers are more well-informed about taxes, they can avoid committing unnecessary violations. Mon explained, “A lot of people are afraid of taxes, but whether we like it or not, we have to pay taxes. If we make taxes more accessible and easier to understand, then maybe people won’t be afraid of it.”

ACG’s vision is to become the country’s first Tax Hub for small and medium enterprises (SMEs) in the Asia-Pacific region. To achieve it, ACG has invested in digital transformation to provide its expert tax solutions. The company opened its satellite offices in Laguna, Albay, Vigan, Bacolod and Puerto Princesa. ACG has been helping its strategic partners for almost 10 years now to save millions of pesos from the avoidance of unnecessary penalties and compromises.

ACG conducts seminars and consultations across the country. It also has the Tax Hub Talks, a regular learning session that discusses topics such as basic tax compliance, tax amnesty, starting a business, blockchain technology, among others.

Likewise, ACG continues its worthy endeavor to promote tax education and reform through the Tax Whiz Academy which offers strategic tax management program, tax seminars and certification courses to cover basic tax principles, compliance requirements and tax planning and the TaxWhizPH Mobile App, which is a software that allows taxpayers to file their taxes anytime and anywhere.

For details, call 622-7720 or visit its website at www.acg.ph.

- Latest

- Trending