All-powerful US dollar

In response to Russia’s military aggression and invasion of Ukraine, the United States and its allies imposed crippling sanctions on the Russian economy. Major Russian banks were cut off from the international payment system SWIFT. Hundreds of billions of dollars in Russia’s foreign currency reserves and sovereign wealth fund assets were frozen. Several well-known analysts like Zoltan Pozsar of Credit Suisse criticized the harsh sanctions on Russia, saying the US has weaponized the dollar, which may result in a backlash that could undermine the US currency.

Yet, nearly two months after Russia’s invasion of Ukraine on Feb. 24, the US dollar index (DXY) has strengthened 3.5 percent to 100.49. It is up 5.1 percent year-to-date. Instead of withdrawing from the dollar because of economic sanctions imposed on Russia, investors sought shelter in the mighty USA. With the Fed aggressively hiking rates and withdrawing liquidity from the markets, the all-powerful US dollar is heading higher.

Japanese Yen in a freefall

The Japanese yen, long a safe-haven, is not reacting to crisis the way it has in the past. It is down 10 percent against the US dollar year-to-date and is basically in a freefall since Russia invaded Ukraine. It is the worst-performing major currency this year. High energy prices are negative for the yen, given that Japan is a large net oil importer. Moreover, the BOJ is in full-blown yield curve control, offering to buy an unlimited amount of 10-yr JGBs to keep it below 0.25 percent. The unlimited bond purchases to keep Japanese rates low (while global interest rates are rising) have caused the yen to implode.

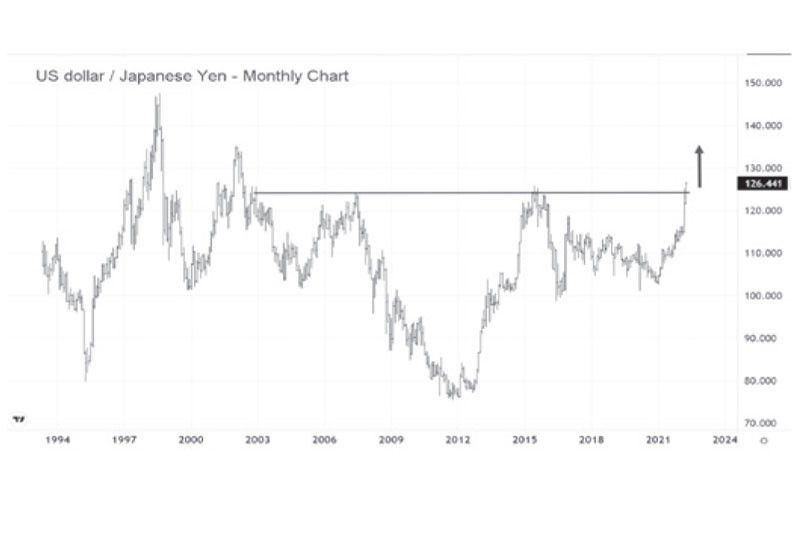

The monthly chart below shows that USD/JPY has broken out of a 20-year basing pattern. It closed at 126.41 last week as it broke above the 2015 high of 125.86.

Euro at the crossroads

The euro continued to weaken against the US dollar after the ECB signaled a gradual monetary tightening in response to rising inflation. It is currently down 5.3 percent year-to-date and 3.6 percent since the Russian invasion. The euro fell to 1.08 last week, its lowest level since May 2020, as investors anticipated a more hawkish reaction from the authorities. The ECB maintained plans to end the stimulus in the third quarter, but gave no schedule as to when it will raise interest rates. This contrasts with the Fed, which proposed a faster pace of tightening and is on track for a 50-basis point rate hike in May.

The monthly chart below shows the EUR/USD at the crossroads as it tests crucial trendline support.

Yuan under threat

According to a report by the Institute of International Finance (IIF), global investors have withdrawn money from China on an unprecedented scale. In March, more than $15 billion in Chinese bonds were sold, a record monthly outflow from the second-largest bond market. Note that US 10-year yields climbed to 2.8 percent last week, surpassing the yield for China’s benchmark 10-year government bond for the first time since 2010.

The reasons for the capital outflows are the diverging policy stance between the PBoC and the Fed, the warnings that sanctions may be imposed on China if it supports Russia either militarily or economically, the recent defaults on Chinese property bonds, and the regulatory crackdowns in China. PBoC’s foreign reserves fell by $25.8 billion as of the end of March. This may have been used to counter the capital outflows and support the Chinese yuan.

Frontier markets suffer from strong dollar

The current global macroeconomic environment and the strong US dollar have also affected the frontier markets with huge external debt, depleting foreign reserves, and balance of payments pressures, such as Sri Lanka and Pakistan. Sri Lanka is defaulting on all its foreign debt worth $51 billion. Faced with a shortage of dollars, Sri Lanka cannot import essentials such as food, fuel, and medicine, resulting in food shortages, power cuts, and soaring prices. As a result, the Sri Lankan rupee has plunged 36 percent year-to-date and is now the world’s worst-performing currency.

Meanwhile, the Pakistani rupee plummeted to a historic low of 191 last week as default risk soared to its highest since 2013. Amid a financial and political crisis, the Pakistan central bank had to raise benchmark rates by 250 basis points to 12.25 percent to stabilize its currency and prevent further erosion of its currency reserves.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.netto learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending