Peso – Asia’s best performer last week

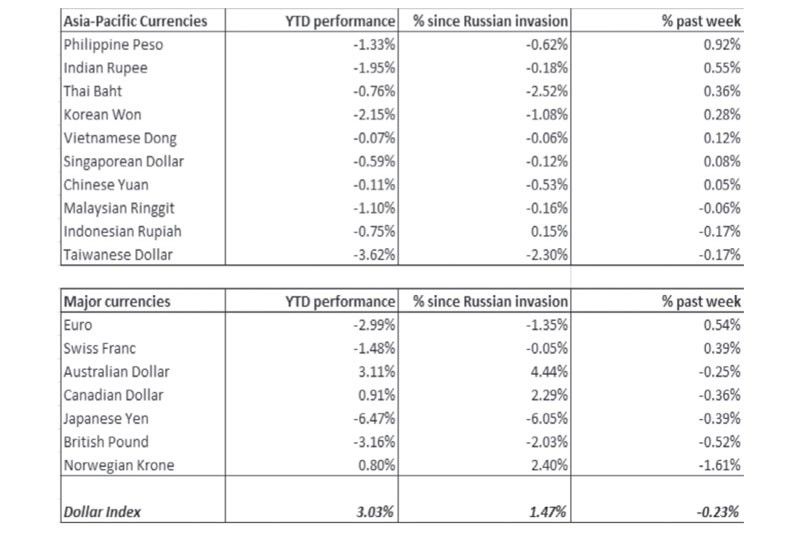

The table below shows that last week, the Philippine peso was Asia’s best-performing currency. It closed at 51.67 last Friday, gaining 0.92 percent against the US dollar. The peso strengthened after the BSP signaled it would begin raising monetary policy rates in the second half of this year. It also appreciated as oil prices eased following the US announcement of an unprecedented oil reserve release.

Before the outstanding performance last week, the peso was the worst performer in Asia. Last week’s advance pared down the peso’s losses to just -1.33 percent year-to-date and -0.62 percent since Russia invaded Ukraine on Feb. 24. So far, the worst-performing currency is the Japanese yen, which has declined by 6.05 percent since the Russian invasion. On the other hand, the best performers are the commodity currencies – the Australian dollar and the Canadian dollar, up 4.44 percent and 2.29 percent over the same period.

Source: Bloomberg, Wealth Securities Research

BSP hiking rates in H2

Bangko Sentral ng Pilipinas (BSP) Governor Benjamin Diokno said that monetary policy normalization could begin in the second half of this year as it prepares to unwind the stimulus placed during the COVID-19 pandemic. In 2020, BSP’s key interest rates were lowered from four percent to a record low of two percent as part of its pandemic measures to support the Philippine economy. Diokno now sees policy rates rising by 50 to 75 basis points in the second half of this year as the economic recovery continues, and as the BSP addresses escalating prices and elevated inflation.

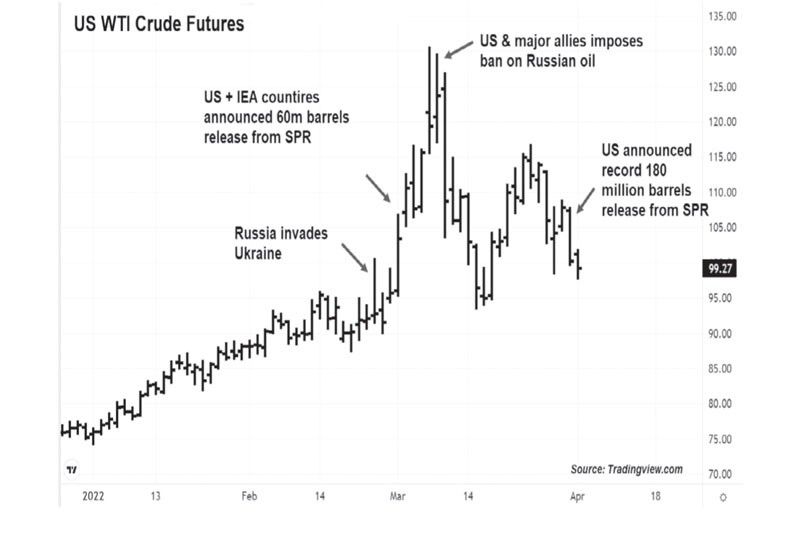

Biden announces record SPR release

To calm the spiking oil and gas prices, US President Biden announced a release of up to 180 million barrels of oil from the Strategic Petroleum Reserve (SPR). “The scale of this release is unprecedented,” according to the White House statement. This is the largest such release in history, equivalent to one million barrels of oil per day for the next six months. Other member states of the International Energy Agency (IEA) also agreed to go ahead with their second coordinated oil release in a month. The details will be published this week. Both Brent and US WTI crude benchmarks settled 13 percent lower for their biggest weekly declines in two years.

Peso strengthens below 52-level

The drop in oil prices and prospects of a hike in BSP policy rates are giving the Philippine peso a respite. Oil prices have pulled back 25 percent from their March highs, easing inflation fears, which led EM currencies to rally. The peso has now strengthened back below the 52-level. Near-term, technical analysis now points to the peso consolidating between 51 and 52.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending