Oil hits highest since 2008

Escalating military conflict in Ukraine and the crippling Western sanctions, including a US ban on Russian oil exports, sent oil prices soaring to their highest level since 2008. In a bid to freeze the world’s second-largest energy exporter out of the global markets and isolate Russia economically, the US is also in active discussion with its European allies for a total embargo of Russian oil. This sent the global benchmark Brent crude to an intraday high of $138 per barrel last week. Likewise, US West Texas Intermediate (WTI), the gauge which tracks US crude, hit an intraday high of $130.50.

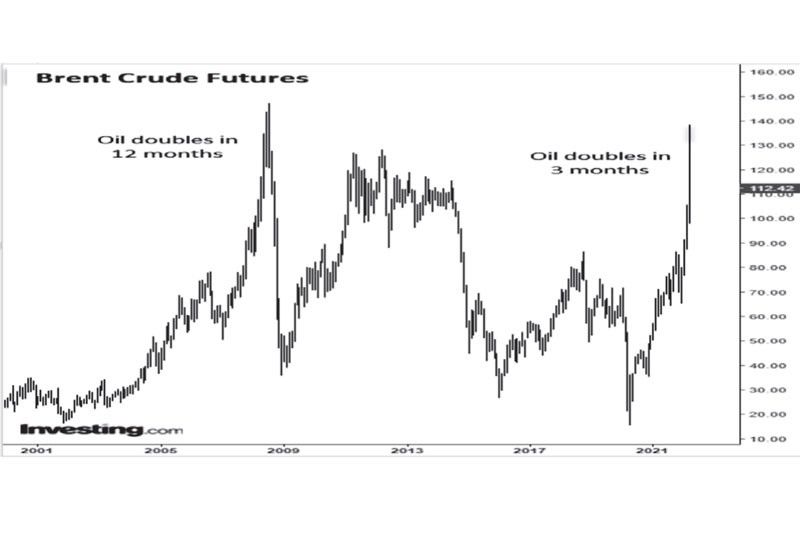

Oil doubles in 3 months

To put this current move in perspective, refer to the monthly chart of Brent crude below. Note that one barrel of Brent crude oil was priced at less than $70 per barrel back in December. But by March 9, the price has almost doubled. During the oil spike in 2008, it took a year for prices to double from $70 in July 2007 to $147 in July 2008.

Russia unfazed

Putin said the Western sanctions are akin to a “declaration of war.” Putin is unfazed by the threat of crippling sanctions. Russia is willing to sacrifice and suffer the consequences. But it is also ready to inflict pain on its perceived enemy, even if it must endure pain in the process.

In retaliation to Western sanctions, Putin signed an order banning and restricting more than 200 exports, including tech, telecoms, medical, auto, agricultural products, and electrical equipment. In addition, Russia has issued a list of 43 “unfriendly countries” in the wake of severe Western sanctions. The decree stipulates that Russian citizens and companies with foreign currency debt owed to creditors from the list of “unfriendly countries” will be allowed to pay only in rubles.

Weaponizing energy and food

Further complicating the situation is the threat of Russia to weaponize its energy, food, and commodity exports. Russia is a key exporter of oil and natural gas. It is also a top producer of wheat, barley, sunflower oil, and a major exporter of coal, iron, steel, nickel, copper, aluminum, and palladium.

Russia threatens energy Armageddon

Russia’s deputy prime minister, Alexander Novak, warns of catastrophic consequences if the EU follows the US to ban Russian oil. He threatened Russia would cut natural gas supplies to the EU. “The surge in price would be unpredictable. It would be $300 per barrel, if not more.” This is also seen as a possible retaliation against Germany for withdrawing support for Nord Stream 2. Russia supplies 40 percent of the natural gas imported by the EU via the Nord Stream 1 pipeline.

Collateral damage for Phl

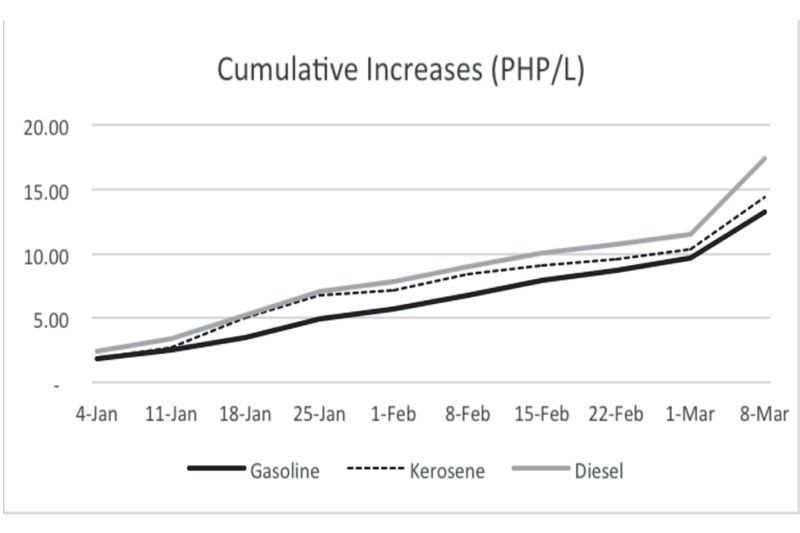

Even if the Philippines is not directly involved in the war, it suffers collateral damage from the conflict between the West and Russia. With the Philippines importing most of its oil needs, it will now pay more for fuel. As oil prices spike to historic proportions, Filipino consumers are also feeling the pain. The price of fuel products was already steadily rising before Russia invaded Ukraine on Feb. 24. The pace of the rise has increased since then. Last week, the average price of gasoline increased by P3.60/liter. Diesel was P5.85/liter higher, while kerosene was up by P4.10/liter.

Economic war

Rising oil and gas prices have a significant impact on food costs, and if they continue to increase, so will the cost of groceries. Russia and Ukraine are among the top global exporters of grains and oilseeds, including wheat, barley, corn, sunflower seeds, and sunflower oil. Russia is also the world’s leading exporter of fertilizers. Higher fertilizer prices, which have doubled the past year, means that farmers will need to charge higher for their crops and produce.

Higher oil, commodity, and food prices are major determinants of inflation. As a result, central banks are raising interest rates at the expense of slowing down the economy. The confluence of all these factors – soaring energy and commodity prices, rising food costs, elevated inflation, fast climb in interest rates, and slowing economic growth – raises the risk of recession and/or stagflation. The looming economic war is now a major risk for the whole world.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending