A timely move

In a timely move, the Philippines lifted the nationwide ban on open-pit mining which had been in effect since 2017. Finance Secretary Carlos Dominguez III who pushed for the “revival of the mining industry” last year, said lifting the ban would raise government tax revenues, attract private investments, and generate jobs among locals in rural areas. This development comes at an opportune time when prices of nickel, copper, and other industrial metals are surging to fresh highs amid dwindling supplies, increased demand from economies reopening, and the aggressive global pivot towards clean energy.

Generating jobs, exports

According to Secretary Dominguez, lifting the ban will help bolster the economy. He cited DENR estimates that 11 pending projects could start immediately, generating P11 billion of yearly government revenue and creating 22,800 jobs. Those projects will also expand the country’s mining exports by 20 percent to P36 billion.

EVs and the clean energy revolution

The long-term prospects of metals like nickel, copper, and lithium are bright. The rapid worldwide transition to electric vehicles (EVs) and clean energy are very reliant on mining and critical minerals. Our top mineral export, nickel, is vital in lithium-ion batteries used in EVs. Our third largest mineral export, copper, is used in renewable energy systems to generate solar, hydro, thermal, and wind energy.

Nickel, copper hit fresh highs

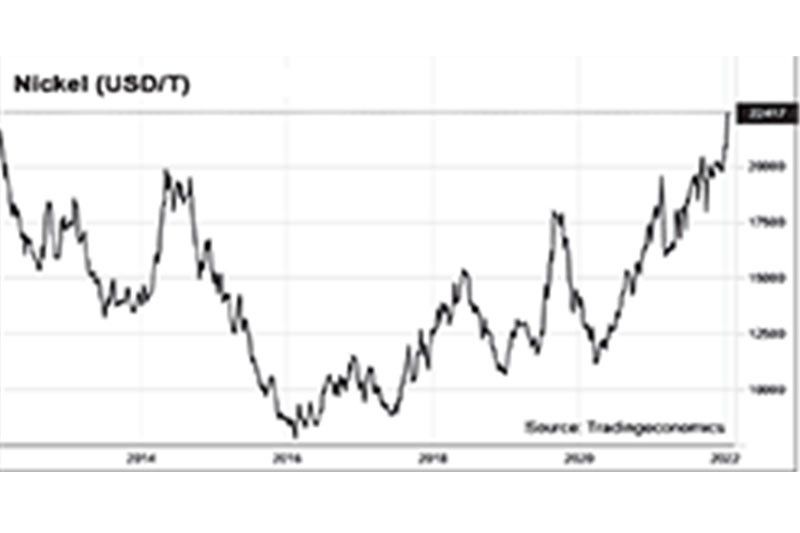

Last week, nickel settled 7.5 percent higher at $22,417 per metric ton, the highest since 2011 amid record low inventories and expansions of steel capacity in China and Indonesia.

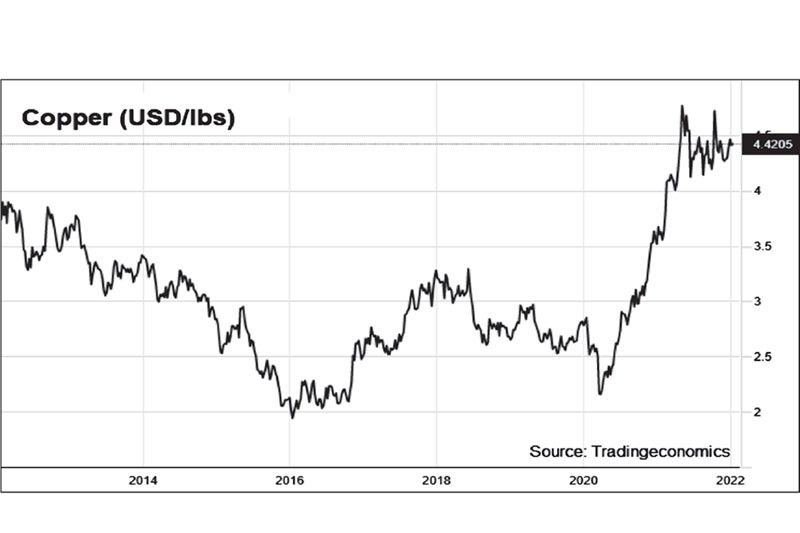

Copper surged above $4.50 per lb in intraday trading last week and closed at $4.42 on easing concerns over the property slowdown in top metals consumer China.

Untapped mining potential

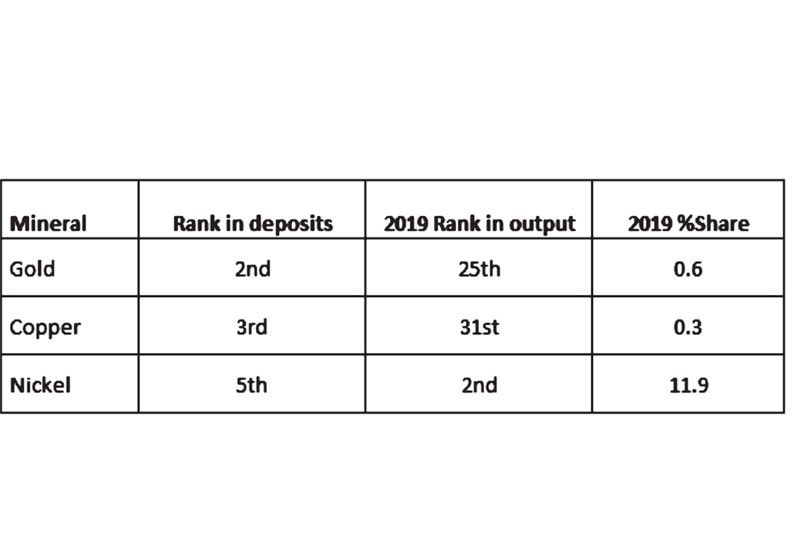

While the Philippines is considered the fifth most mineralized country globally, its resources are largely untapped. The country has nine million hectares of mineralized land and established reserves of 13 known metallic and 29 non-metallic minerals. According to the MGB, the Philippines ranks among the world’s biggest in terms of gold, copper, nickel, and chromite mineral deposits. Unfortunately, there is a large gap between the ranking of our mineral deposits and actual output. While the country’s gold and copper deposits are ranked second and third biggest globally, our gold and copper output are ranked 25th and 31st, respectively.

Source: Worldminingdata.info

A booster for the Philippines

The lifting of the ban is a shot in the arm for the Philippines, especially at this time when fuel and energy prices are soaring. It will also pave the way for the much-needed investments to boost the Philippine mining industry, create jobs, generate revenues for the government, increase exports, reduce the budget deficit, and unlock economic opportunities for the country’s communities.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending