Hawkish Fed fuels US dollar strength

Last week, we showed the stellar performance of the US dollar for the year 2021. Gaining against almost all currencies., the US dollar Index (DXY) strengthened 6.4%. Investors expect the strong dollar to continue this year due to the Fed’s monetary tightening. To start 2022, a hawkish stance in the December Fed minutes released mid-week fueled a spike in US bond yields. The fact that the Fed is tapering, reducing balance sheets, and raising rates soon underpins the strong US dollar.

Fed minutes reveal earlier hikes

According to CME Fed Futures, the odds of a rate hike in March rose to 71 percent following the release of the December Fed minutes last Wednesday. Note that most Fed members are now hawkish, in contrast to their position a couple of months ago when Powell said inflation is transitory. The Fed continued to view mid-March as the end of its pandemic bond-buying program. The minutes also revealed that the Fed might start to shrink its balance sheet “relatively soon” after the initial rate hike. Many analysts expect the Fed to hike three times this year and the balance sheet reduction to begin in Q3 2022.

Bond yields surge to 2-year highs

Treasury yields climbed across the board. Last week, the two-year yield pushed above 0.90 percent, the highest level since March 2020, before closing at 0.86 percent. The 10-year yield surpassed last year’s high of 1.8 percent before pulling back to close at 1.76 percent for the week. The 25-basis point move in the 10-year yield was the biggest weekly spike since September 2019. The 10-yr is now targeting 2.25 percent based on technical analysis.

US dollar vs. Major & Asian currencies

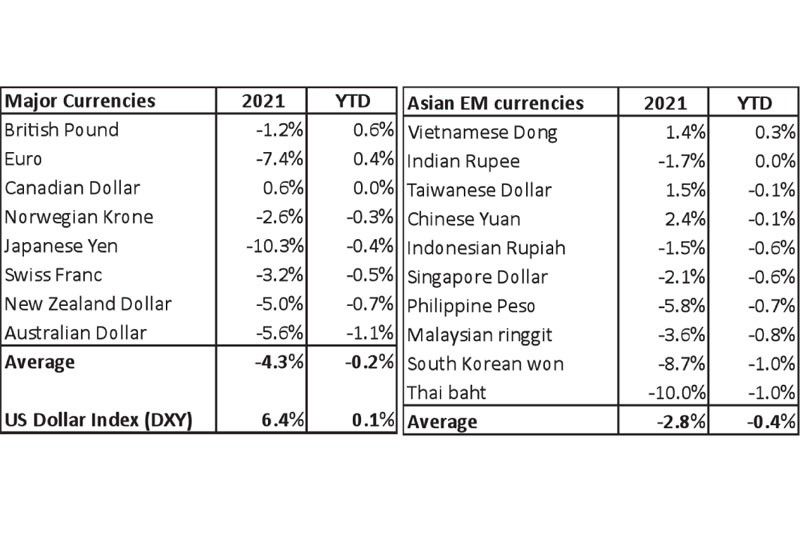

On average, major currencies were down slightly by -0.2 percent against the dollar last week. However, the US dollar’s performance was mixed. The British pound and the euro strengthened, gaining 0.6 percent and 0.4 percent, respectively. On the other hand, the Aussie and Kiwi dollars lost -1.1 percent and -0.7 percent, respectively. The Japanese yen sank to a 5-year low against the dollar after declining -0.4 percent.

Among Asian EM currencies, the Thai baht performed worst with a negative one percent drop in one week. Meanwhile, the Philippine peso lost -0.7 percent over the same period. On average, Asian EM currencies declined -0.4 percent last week.

Peso breaks 51

After consolidating between 49.50 and 51 the past six months, the peso-dollar rate closed at 51.35 last week. This is the weakest level the peso has hit since the height of the pandemic in March 2020. Based on technical analysis, the peso is likely to range between 50 and 52 for its next consolidation phase.

World’s Best Central Bank Governor

We congratulate BSP Governor Benjamin Diokno for being awarded by The Banker magazine as the best central banker of 2022, not only in the Asia-Pacific region, but also in the world. The Banker commended Diokno’s efforts to modernize the country’s banking system. It also cited BSP’s timely and decisive response to contain the economic fallout from the Covid-19 pandemic.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending