Race against time

One year after the first lockdown, the Philippines is once again facing a surge in COVID-19 cases. With daily cases now at record highs since the pandemic started, both quarantine facility and hospital capacity have hit critical levels. Thus, the government was left with no choice but to re-impose enhanced community quarantine (ECQ) on NCR+.

Phl not alone in lockdowns

While everyone wishes to avoid a situation that will merit the imposition of ECQ, the Philippines is not alone in reinstating lockdowns. Whether it is called a 3rd wave, 4th wave or simply a new surge, many countries have also been forced to close down their economies except for the most essential of industries. This policy spans the different continents, such as Europe (ex. France, Germany and Italy), North America (Canada), South America (Chile) and Africa (Kenya).

Delicate balancing act

With daily cases breaching 10,000 per day, ECQ was the policy of last resort. Hearing of people that we know succumbing to this disease is a sign of the accelerating spread of COVID-19. Lines of people waiting outside hospitals because there were no rooms available is evidence that the healthcare system is approaching its breaking point.

Unfortunately, the stricter a lockdown, the more significant its economic impact. According to NEDA director general Karl Kendrick Chua, NCR and adjacent areas will be losing P 1.2 billion a day in terms of income. Thus, the government is faced with an exceedingly delicate balancing act with severe consequences on either side.

Buying time

With ECQ, the government is in effect buying time for the hospital system before it reaches a point of total breakdown. Currently, there are simply not enough rooms nor staff for COVID-19 patients. A “circuit breaker” is needed to give hospitals more breathing space than they currently have. The ECQ will not only prevent more people from catching COVID-19, but also ensure that sick people are able to get the appropriate level of care.

The imposition of ECQ on NCR+ also has another purpose – buying time for the arrival of vaccines. As we wrote last year, the development of vaccines with high efficacy against COVID-19 are a game changer (see A great day for science and humanity, Nov. 16th 2020). Real world evidence also shows that vaccinations significantly reduce the number of cases and deaths from COVID-19. In the US, the 7-day rolling average of cases dropped by 75 percent from their peak as vaccinations exceeded the total number of reported cases. In Israel, the model for a swift and successful mass vaccination program, cases are down 96 percent from their peak.

Mass vaccination to begin in 3Q21

As of this writing, the Philippines has vaccinated more than 700,000 people, mostly in the A1 group which is composed of frontline health workers. With more vaccines arriving in the coming months, inoculations for vulnerable groups A2 (senior citizens) and A3 (persons with comorbidities) have also commenced alongside the A1 group. For the vast majority of the population though, mass vaccination is expected to begin in 3Q21. This is when tens of millions of vaccine doses will be arriving. If all goes according to plan, the government is targeting herd immunity by the middle of 2022.

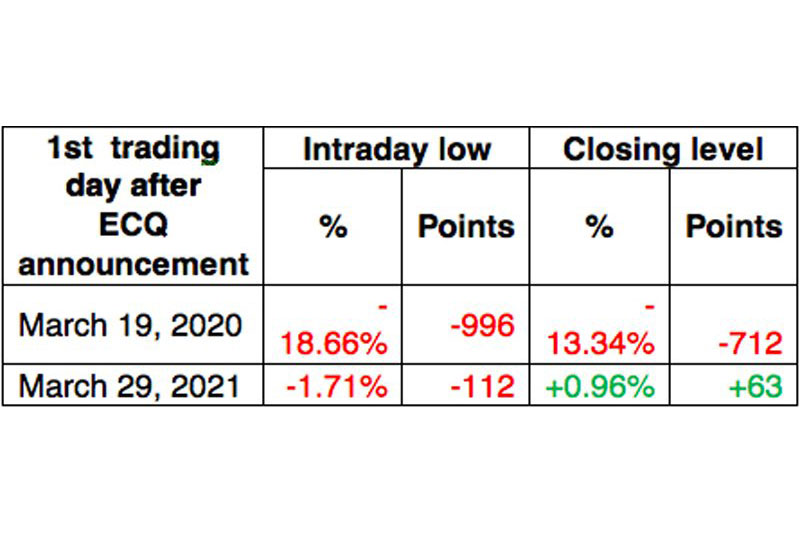

PSEi drop not as deep as last year

After the government’s announcement imposing ECQ on NCR+, investors and fund managers braced for a sharp drop when trading resumes. Recall that on March 19 last year, the day the stock market reopened after the first lockdown, the PSEi fell as much as 18.7 percent before closing at 4623. As can be seen in the table below, the PSEi had a 1000-point intraday drop before recovering part of its losses. This time though, the PSEi only dropped 112 points at its intraday low and even ended the day up 0.96 percent on net foreign buying.

Peso/$ also stable during ECQ 2021

Last year, the peso was not immune from the volatility brought about by the ECQ announcement. Initially, the peso depreciated by three percent against the US dollar, going from 50.51 to 51.96 in less than a week. However, by the end of March 2020, the peso had returned to its pre-ECQ level. This time around, the peso did not experience any gyrations and remained relatively stable, trading between a narrow band of 48.40 to 48.60.

A bitter pill to swallow

ECQ is a bitter pill that Filipinos needed to swallow. The government was compelled to impose ECQ to limit the surge in daily cases and buy time for the overburdened hospital system. While trying to contain the virus and its more transmissible variants, the government is exerting all efforts to procure vaccines for Filipinos. It is imperative that vaccines are rolled out quickly and herd immunity is reached. Indeed, this is a race against time.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending