Peso hits turning point at 48

Three weeks ago, we wrote about the peso’s volatility dropping to 20-year lows. We said that “if there is one thing that is predictable in markets, it is the fact that price volatility goes through cycles of highs and lows. A volatility expansion phase follows every volatility contraction, and vice versa (see Peso volatility slumps to 20-year lows, Feb. 1).” True enough, volatility expanded last week, with USD/PHP resolving higher to close at 48.45.

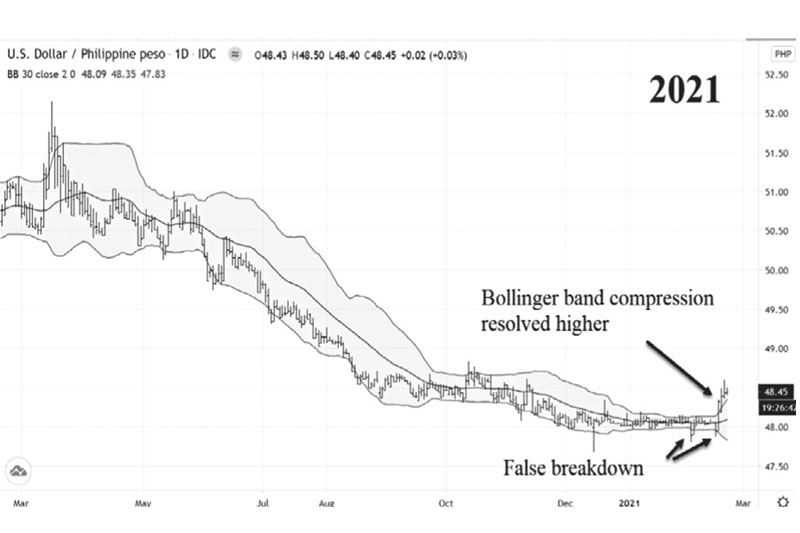

False breakdown

USD/PHP has been trading in a tight range for the past three months. As mentioned in our previous article, the 30-day standard deviation of price fell to just 0.035, the lowest in 20 years. The chart below shows a Bollinger band plotted two standard deviations above and below the 30-day moving average – which should capture 95 percent of the price movement.

But after two false breakdowns below 48, USD/PHP surged higher and broke the upper Bollinger band decisively last week. It closed four consecutive days above the Bollinger band. This indicates a character change and signals an intermediate bottom for USD/PHP.

Source: Tradingview, Wealth Securities Research

Rising US interest rates

Global central banks have cut interest rates to historic lows and injected massive amounts of liquidity since the start of the pandemic. But the recent rise in US interest rates suggests that bond investors are now pricing in a possible tightening of policy to address rising inflation expectations. US interest rates have rapidly increased since bottoming out in August 2020. The yield on the benchmark 10 year Treasury note has exploded 180 percent from 0.5 percent in August to 1.34 percent as of Friday. Over the same period, the yield on the 30 year Treasury bond surged 80 percent to 2.14 percent.

Historically, the US dollar was generally stronger during periods of rising US interest rates. Note that as US yields rise, the US dollar becomes more attractive. This puts pressure on higher-yielding emerging market (EM) currencies like the Philippine peso and the Indonesian rupiah, which tend to depreciate.

Source: Stockcharts.com, Wealth Securities Research

2013 analog

In technical analysis, price pattern “analogs” are used to study the resemblance of the current market price action to that which occurred in the past. In the case of USD/PHP, the current movement correlates highly to 2013. Back then, the volatility as measured by the Bollinger bands also shrank to multi-year lows. Many investors and analysts were forecasting the peso to break below 40. But after a false breakdown and a slight dip below 40.50, USD/PHP reversed higher. Volatility expanded as prices resolved to the upside.

Source: Tradingview, Wealth Securities Research

48 – intermediate bottom for USD/PHP

Similar to 2013 when the US Fed announced it was tapering its QE program, US Treasury yields are also rising today. Back then, the US dollar firmed while the Philippine peso weakened. Like the 2013 price analog, USD/PHP today resolved higher following a volatility squeeze. The key support level at 48 is likely an intermediate bottom for USD/PHP.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending