The weak US dollar

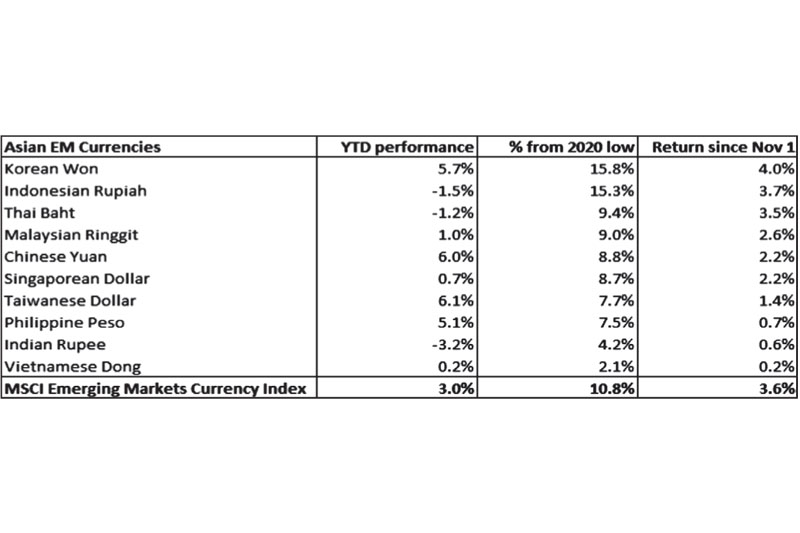

Investors and readers have been asking us: Why is the peso is so strong? Indeed, it closed at 48.07 last week, its strongest level in five years. But in actuality, it is the weak US dollar that is driving the peso stronger. While the peso has gained 5.1 percent against the dollar this year, this is just in line with the US dollar’s general trend.

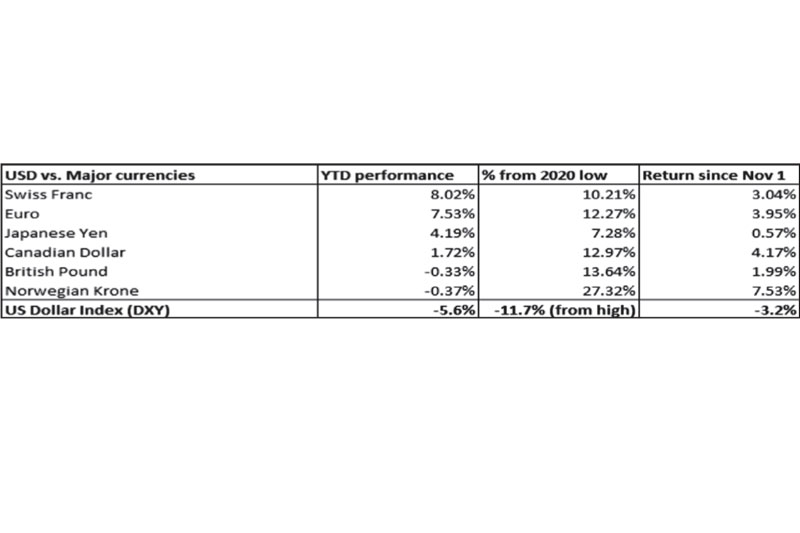

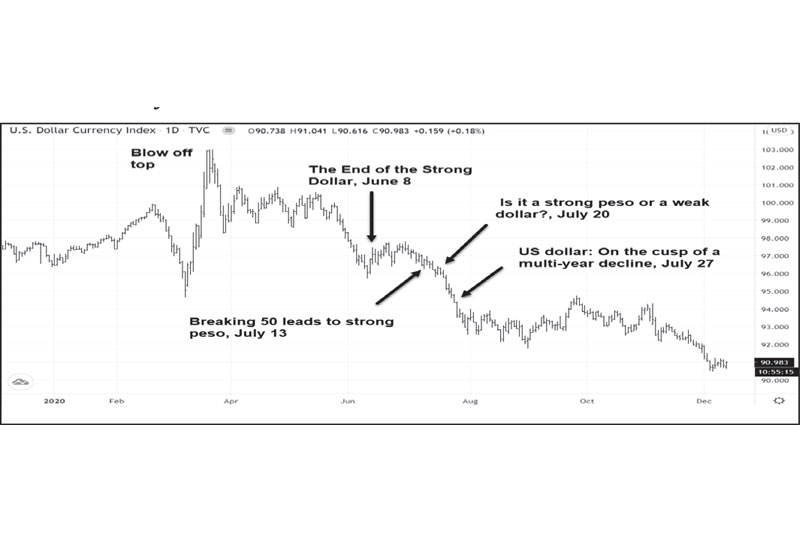

The US dollar index, a measure of the dollar relative to a basket of foreign currencies, has lost 11.7 percent since hitting a year-high of 102.99 in March and is down 5.6 percent year-to-date.

Dollar on a long-term decline

In a series of articles back in June and July, we wrote about the possible reversal of the US dollar’s long-term trend. We noted the dollar’s blow-off top in March during the height of the COVID-19 panic as the culmination of its safe-haven appeal. We also discussed the fundamental and technical reasons why the dollar would continue to be weak.

“Blow-off top may be the turning point in the dollar.” - (The End of the Strong Dollar, June 8)

“A substantial break in the yuan (USD/CNY) below 7.00 would confirm further dollar weakness.” - Breaking 50 leads to strong peso, July 13)

“Dollar weakness to accelerate as the global economy recovers.” - (Is it a strong peso or a weak dollar?, July 20)

“A global rush away from the dollar is on the horizon, as shown by the rising euro.” - (US dollar: On the cusp of a multi-year decline, July 27

Capital flows back into EM

According to the Institute of International Finance, portfolio inflows into emerging markets, which reached a record $76.5 billion in November, are on track to hit their highest quarterly level in eight years. Biden’s win in the US presidential elections renewed confidence in emerging markets with investors looking at a more predictable and less antagonistic US policy towards global trade. More importantly, hopes for a smooth COVID-19 vaccine rollout in 2021 have boosted capital flows into emerging markets, lifting oil prices, commodities, EM equities, and EM currencies.

Bullish bet on EM currencies

The financial market’s euphoric reaction to the COVID vaccine breakthroughs and the US elections pushed emerging market currencies to their best levels in two years. The MSCI EM Currency Index, which tracks the performance of 26 emerging market currencies against the dollar, has risen 3.6 percent since Nov. 1 and is on track for its seventh consecutive monthly rise. EM currencies are up three percent year-to-date and 10.8 percent since the March lows.

Since Nov. 1, the Korean won and the Indonesian rupiah outperformed their regional peers, posting gains of four percent and 3.7, respectively. The Korean won surged on the back of a positive growth outlook and robust November trade data. Like most commodity-related currencies, the Indonesian rupiah rallied strongly alongside copper, nickel, and tin, which comprise some of its major resource exports.

Steady peso better than strong peso

Given the US dollar’s weakness, the strong recovery of EM currencies, and improved investor sentiment, upward pressure on the Philippine peso remains. Despite the strong surge in EM currencies since Nov. 1, the peso has been relatively steady. So far, the 48 support-level is holding because we believe that businessmen, especially exporters, and government officials view that too strong a peso is net negative for the economy. While a strong peso has its benefits, any sharp appreciation in the peso is deemed counterproductive. This is disadvantageous to the export sector, BPO, tourism and mining industries. OFW beneficiaries will also be receiving less in peso terms. A steady peso is better than a strong peso.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending