Philippines, less vulnerable to Middle East conflicts

Markets were rattled when US President Donald Trump ordered a drone strike which killed Qasem Soleimani, Iran’s top general. News of the assassination caused oil prices to spike and triggered a flight to safety – gold prices jumped, US Treasuries moved higher, stocks dropped, and emerging market currencies weakened.

Double whammy for the Phl

The vulnerability of the Philippines comes to mind whenever conflicts arise in the Middle East. Our country imports almost all of our fuel requirements. Inflation spikes, transport and food prices climb, and the peso depreciates whenever oil moves up. Moreover, the country has more than two million OFWs who are employed in the Middle East. These OFWs remit money back to their families in the Philippines, thereby anchoring the spending of many Filipino households. Prolonged tensions in the Middle East displace OFWs in the region and result in slower remittances which can dent domestic consumption.

The world depends less on ME oil

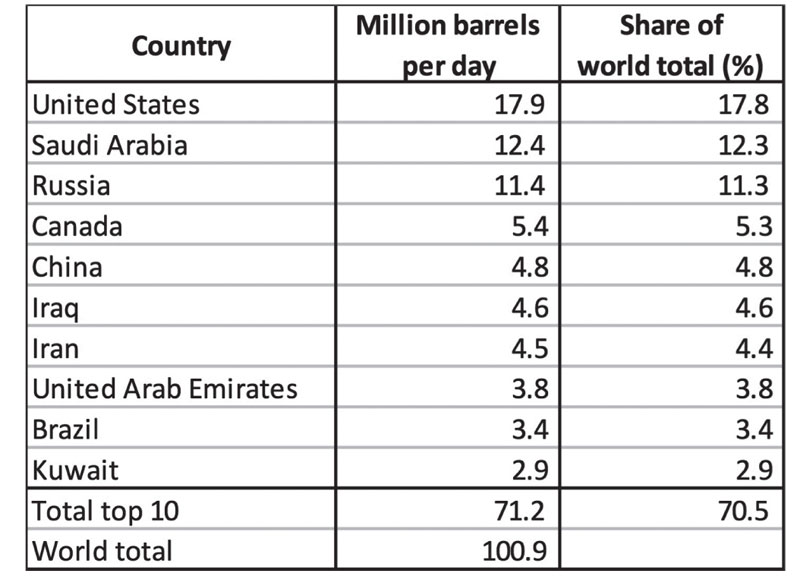

In the past, oil production was dominated by the Organization of the Petroleum Exporting Countries (OPEC). However, the shale oil revolution in the US and the oil sands in Canada have drastically altered the supply dynamics of oil. The rise of shale oil and the development of fracking technology has propelled the US to become the top oil-producing country in the world. The table below shows that the US accounts for 17.8 percent of global oil production, while Iran only accounts for 4.4 percent

Top 10 oil producers in 2018

Source: US Energy Information Administration

In recent years, the world has become less dependent on crude oil due to the development of renewable energy sources (hydro, geothermal, solar, wind) and advancements in electric/hybrid cars.

Phl remittances become more diversified

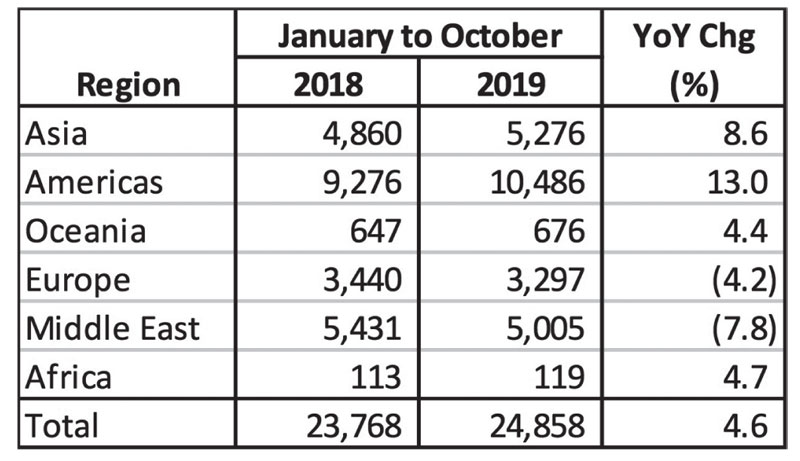

Remittances from the Middle East account for 20 percent of total OFW remittances, a major driver of our domestic economy. But as seen in the table below, OFW remittances from January to October 2019 still grew by 4.6 percent despite the 7.8 percent drop in Middle East remittances. Total remittances continued growing on the back of stronger inflows from the Americas and Asia. The US, Canada, Malaysia, Singapore, Hong Kong, Japan, and other countries are compensating for the decline in Mid-East remittances.

OFW Remittances – January to November 2019

Amounts in million US dollars

Source: Bangko Sentral ng Pilipinas

Phl economy has more growth engines

In the past, the primary driver of the Philippine economy was OFW remittances. Hence, the country was more vulnerable to developments in the Middle East. However, the Philippine economy has become more diversified and now relies on multiple growth drivers such as BPOs, exports, tourism, and POGOs. Though declining remittances from the Middle East may impact domestic consumption, our diversified economy can rely on other emergent sectors to shore up growth.

Structural reforms in the oil industry benefit the country

The deregulation of the oil industry implemented by the Ramos and Arroyo administrations was an important structural reform which strengthened the Philippine economy (see Secular Bull Market, Jan. 18, 2013). Oil subsidies were abolished, prices were dictated by global markets, and new players emerged. Unlike in the past when government finances were saddled by oil subsidies, the current government benefits from a stronger fiscal position brought by excise taxes on fuel. This was a result of the implementation of TRAIN, a recent overhaul of our country’s tax system.

De-escalation triggers quick market recovery

Despite turmoil in the Middle East, markets recovered quickly when the de-escalation of the US-Iran conflict became apparent. Oil prices dropped sharply, while gold and US Treasuries also came down. Stocks consequently recovered and the US market notched fresh record highs. Meanwhile, the peso has appreciated and the PSEi has staged a recovery in light of the positive news. Indeed, the recent price action of oil and other asset classes illustrates that the world and the Philippines are now less vulnerable to Middle East conflicts.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending