Second wind

Global markets continued to rally last week, supported by notable progress on the US-China trade talks and central bank action. A crucial development which altered market direction was the Fed’s drastic U-turn from hawkish to dovish (see U-turn, April 1, 2019). These catalysts have given the market a second wind after it dropped last year on concerns regarding slowing global growth and the US-China trade war.

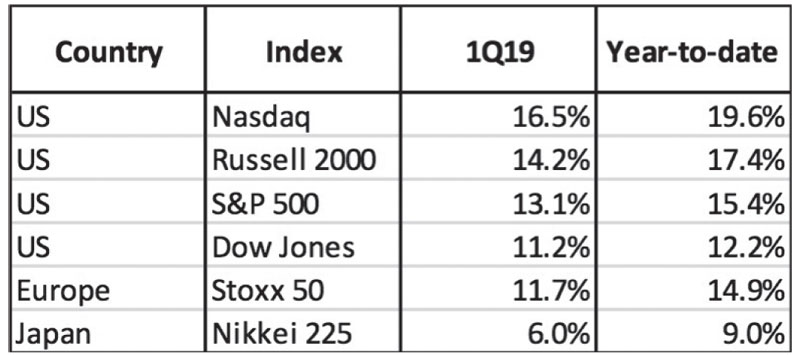

US stocks post best first quarter since 1998

The S&P 500 posted a return of 13.1 percent in the first quarter of 2019. This was the benchmark’s biggest first quarter gain since 1998 and best quarterly return since the third quarter. The Dow, Nasdaq, and Russell 2000 also posted double-digit returns in the first quarter. Meanwhile, Euro Stoxx 50 rose 11.7 percent in the first three months.

Source: Bloomberg

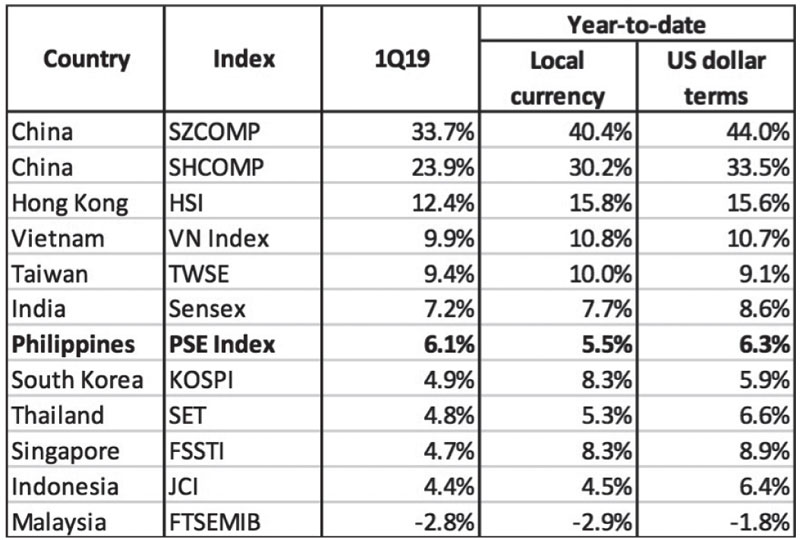

Bull run in China

Although US indices delivered record returns in early 2019, China is still the best performing market for the year. The Shanghai Composite posted a return of 23.9 percent in the first quarter and is up 30.2 percent year-to-date. The Shenzen Composite rose 33.7 percent for the quarter and 40.4 percent year-to-date. The PSE Index is in the middle of the pack among Asian indices, gaining 6.1 percent in the first quarter and 5.5 percent year-to-date.

Source: Bloomberg

China’s double barrel stimulus

China has implemented fiscal and monetary stimulus to spur its slowing economy and counter the negative impact of the trade war. A positive reading from China’s manufacturing PMI last week shows that the government’s double barrel stimulus is gaining traction, further adding to investor optimism.

Central banks act against global slowdown

Last week, IMF managing director Christine Lagarde announced that the IMF has lowered its projection for global growth this year. Lagarde explained that the world economy is in a precarious and delicate position, and global growth has decelerated since the start of the year. Central banks around the globe have responded decisively after growth targets for their respective countries have been slashed. Consequently, the Fed has announced a pause in its rate hiking cycle and pledged to end its balance sheet normalization in September. Meanwhile, the European Central Bank (ECB), the People’s Bank of China (PBOC), and other central banks have started to ease monetary conditions and implement stimulus programs to counter the effects of the global economic slowdown.

Trade war, Brexit pose risks to growth outlook

Though major markets have performed well in the first quarter of the year, there are still key risks that bear watching. Last week, Moody’s warned that a global recession is highly likely if there is no US-China trade deal within months. In addition, a hard Brexit will slow the British economy and potentially drag the whole Europe into a recession. These will weigh heavily on global growth and aggravate the slowdown that many major economies are already experiencing.

Significant headway in trade talks

Last week, key government officials from both the US and China have touted the significant progress of negotiations after another round of trade talks. The final trade deal is reportedly 90 percent done but the remaining issues would be the trickiest part. The US insists on establishing enforcement mechanisms to ensure that China abides by the deal terms. For its part, China is asking for the removal of tariffs that the US imposed on Chinese goods.

Trade talks enter high-stakes, endgame stage

The final outcome of trade talks will determine the fate of the global economy and direction of the stock market. Anticipation of an amicable trade deal, along with central bank easing, have already provided a second wind for the stock market. However, failure to finalize a trade agreement and an escalation of the trade war will be disastrous for both the stock market and the global economy. The stakes are high for both the US and China to finally secure a trade resolution given the advanced stage of negotiations.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 250-8700 or email [email protected].

- Latest

- Trending