In charts: The Philippine economy 100 days into Marcos presidency

MANILA, Philippines — When he took over a hundred days ago, President Ferdinand “Bongbong” Marcos Jr. said he has “ambitious” economic goals for the country.

For this year, Marcos wants to achieve a gross domestic product of 6.5-7.5%, lower than 7-8% set by his predecessor, Rodrigo Duterte, before leaving office. But from 2023 until the end of Marcos' term in 2028, the government hopes that annual GDP growth would hit between 6.5-8%, higher than Duterte’s goal of 6-7% growth.

But from rising inflation to worrying levels of public debt and a bruised peso, the Philippine economy has yet to find an impasse. While 100 days are not enough to make great strides toward a stronger economy, any short-term measures by the nascent Marcos administration could make a big difference in easing the economic hardships of many Filipinos.

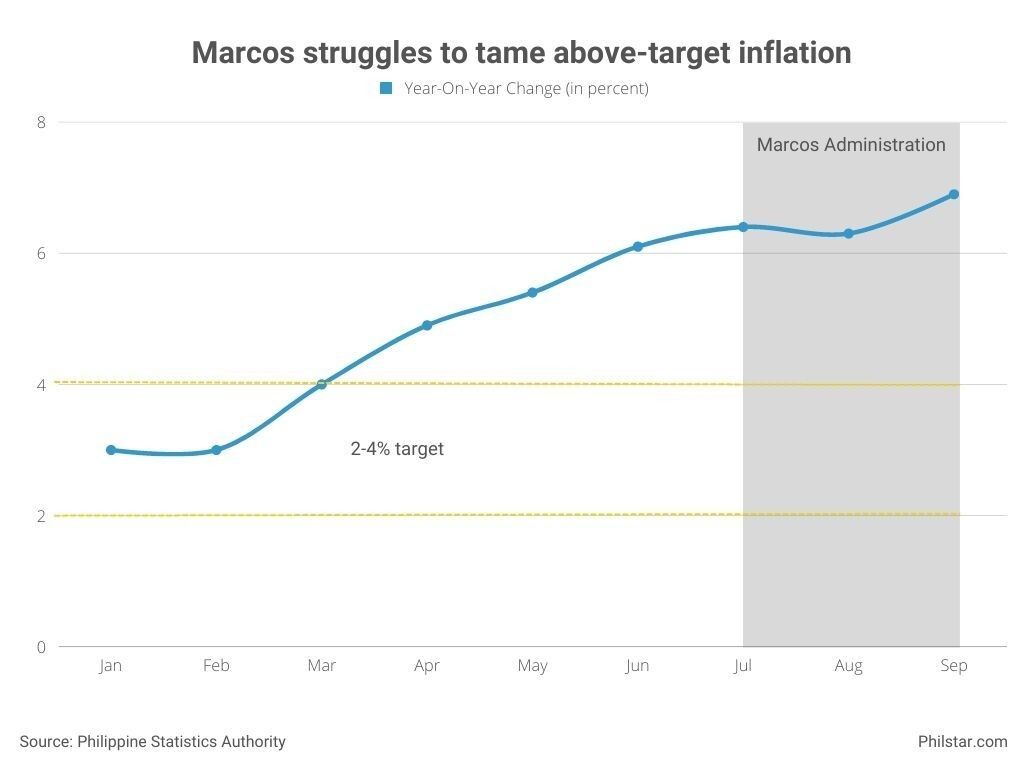

Boiling inflation

Inflation, as measured by changes in the consumer price index, sizzled 6.9% year-on-year in September, the hottest in 4 years. State statisticians expect the cost of consumer goods and services to grow even faster as expensive food prices could stick by year-end.

For his part, Marcos appointed himself as secretary of agriculture.

The Bangko Sentral ng Pilipinas earlier projected that inflation could peak in October and start easing from there, but stubborn supply-side issues have convinced some analysts that the peak might be further from what the government had predicted.

READ: Painful battle against inflation continues as BSP hikes rates anew

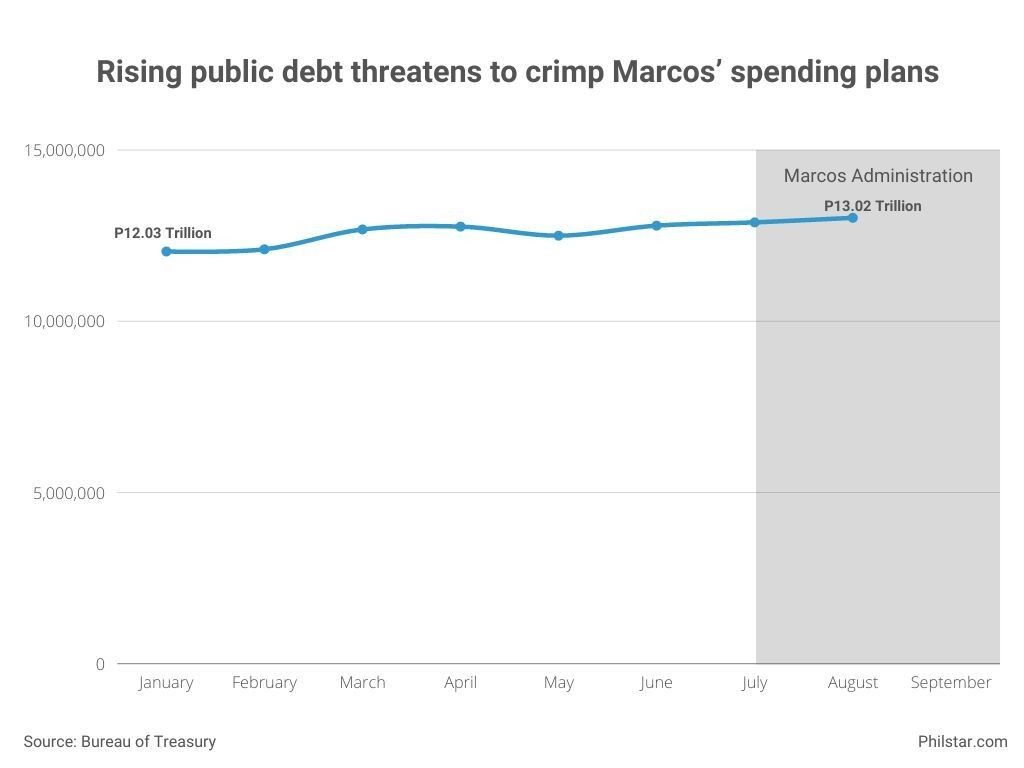

Worrying debt

The Marcos Jr. administration inherited worrying levels of public debt, which ballooned to its current size after the Duterte administration went on a borrowing spree to fund its pandemic response.

While economic managers insist the levels are still manageable, the levels still leave the state in a precarious fiscal position. For one, a fattening debt stock would mean that more taxpayers’ money would be used for debt-servicing, leaving little cash for spending on Marcos’ planned reforms and programs.

READ: Sustaining its ascent, government debt tips over P13-T in August

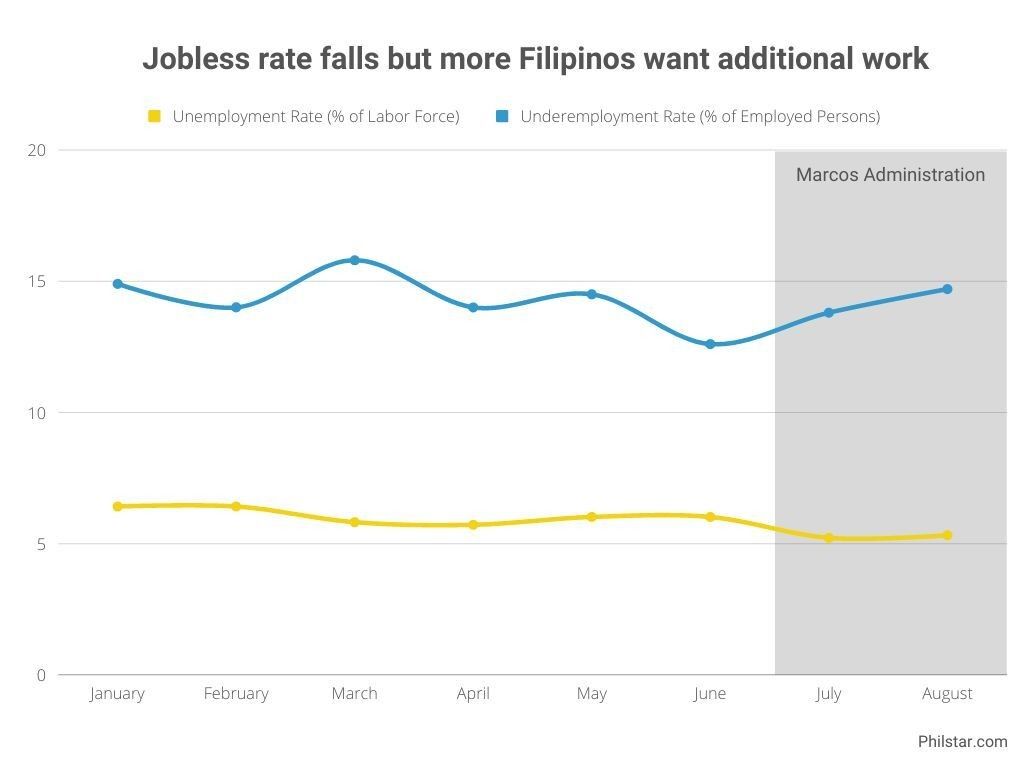

Joblessness

The unemployment rate has gone down significantly and is now at its lowest level since the onset of the pandemic.

While there’s a case to be made that the labor market is adjusting to this “new normal” since the economy has reopened, more Filipinos are getting low-paying jobs that make it hard to keep up with rising cost of living, prompting workers to look for additional jobs to augment their income.

READ: Jobless rate worsens in August, adding pressure on inflation-hit workers

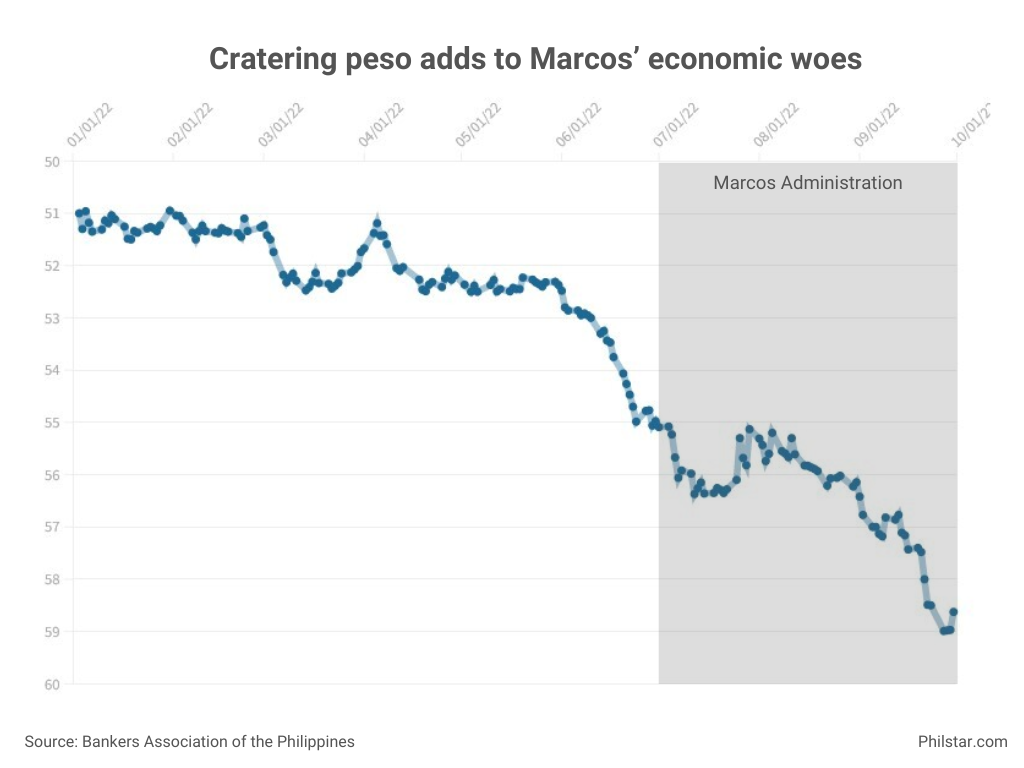

Bruised and battered peso

The peso faced significant struggles in the past months as the surging dollar sent the local unit to new lows. As it is, a weak peso bodes ill for the domestic economy’s recovery from the pandemic, especially since the country uses the greenback to pay for imports such as oil and various raw materials. Businesses and firms pass on this additional burden to consumers to recoup their expenses.

The BSP has been wary of speculative attacks on the peso, urging calm in the markets and noted that the dollar spot market remains open.

READ: Stubbornly high Philippine inflation dilutes benefits of a weak peso

Great expectations?

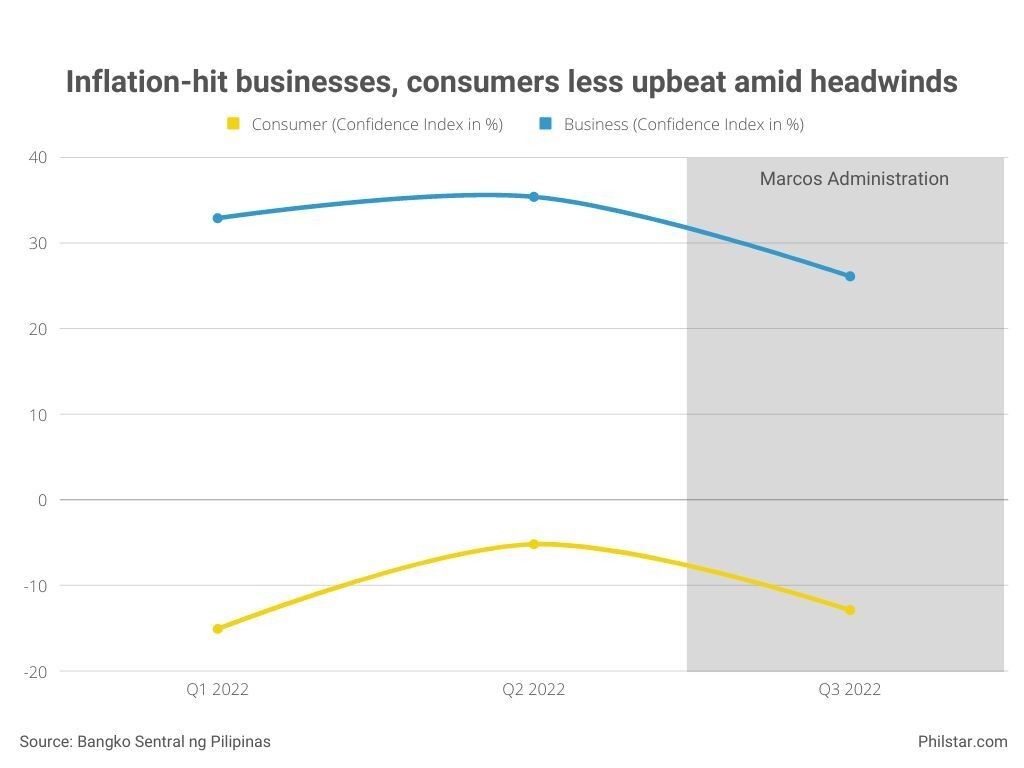

Consumers and businesses were increasingly wary of their economic fate in the coming months, as the BSP’s quarterly surveys showed gloom stayed top of mind as inflation proved persistently high.

READ: Consumer, business confidence turn gloomy as high inflation stubbornly persists

While this is not a barometer of the Marcos Jr. administration’s style of governance, this waning confidence augurs a not-so-cheery holiday season.

— Charts by Philstar.com/Anjilica Andaya

Read other explainers on Marcos' first 100 days:

- Latest

- Trending