How do you make your financial decisions? (Meet Makatwirang Mak and Emotional Emong)

The Bangko Sentral Ng Pilipinas will be holding its annual Financial Education Stakeholders Expo. It will be a weeklong online event packed with various talks and other activities that you can join for free! (Click https://facebook.com/PisoLit or https://facebook.com/BangkoSentralngPilipinas to know more about it.)

This annual event is dear to me because I have been taking part in it since its inception in 2018. (Click 2018 BSP Financial Education Stakeholders Expo to watch our session on Innovations on Financial Education.) This year I will be giving a talk and moderating the session on Behavioral Insights on How We Make Personal Financial Decisions.

So, the question is,” How do you really make your personal financial decisions?” More importantly, what do you actually do with and for money? What are your actual money behaviors?

Chances are, if you try to answer the first question, you may come up with these steps:

- I will set my goals.

- I will evaluate my financial condition.

- I will assess my available options in reaching my goals.

- I will pick the best plan and execute.

- I will evaluate my implementation periodically, and revise if necessary.

And to that, you will get a response of “Very good!” But giving honest replies to the next two questions might be tricky, not as neat as your five steps anymore. Why? Because this is how our brain works.

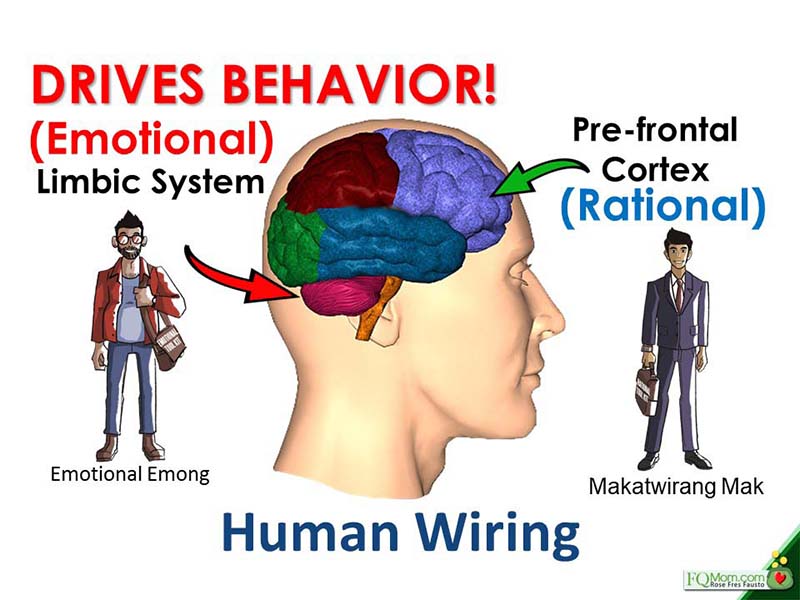

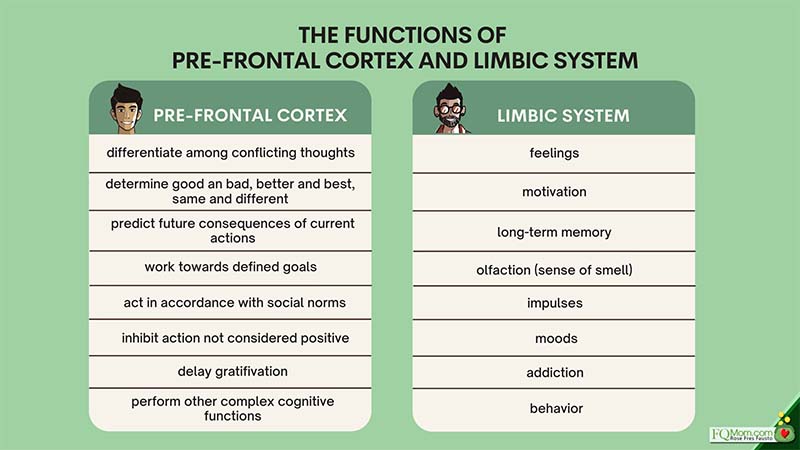

Our brain has two distinct but intergrated systems: the prefrontal cortex and the limbic system. The former is responsible for the executive or analytical functions. The latter is responsible for all our emotions.

When we try to solve a Math problem or any problem for that matter, we use our rational brain. But as you can see in the image above, it is our emotional brain that drives our behavior. In “FQ Book 2 Why Financial Education Alone Does Not Work”, this concept is explained in a fun and no-nosebleed manner by introducing two characters, Rational of Makatwirang Mak and Emotional Emong.

Makatwirang Mak is a healthy, smart, good-looking guy who makes sound and sensible decisions in life. He eats the right food in the right quantity at the right time and exercises regularly, no miss! He doesn’t make hasty decisions because he weighs everything that matters first before taking action. He is able to make the right decisions in his spending and investing. He is the perfect model for Traditional Economics theories.

Our other character is Emotional Emong. He is not bad looking at all. It’s just that he has put on some unwanted pounds from his good old days as a school jock! You know, one drink too many, coupled with the decline in his physical activities, has started to show in his physique. He’s an adventurous dude, the life of the party! He is with you when you want to plunge into something you’re not sure of. He’d say, “Go for it man. You only live once! YOLO!” He’s emo all the way! He is the subject matter of Behavioral Economics principles.

So, who are you? Are you Mak or Emong?

We are both Mak and Emong. Yes, we are just like that singer in the barrios with two personas – male costume and singing voice on one side, and female costume and singing voice on the other side. If you don’t know this, ask your parents or grandparents. ![]()

No matter how smart and calm we are, let us remember that we are all complicated human beings experiencing the tugging of our Mak and Emong sides all the time. An awareness of this ever-present tension will help us navigate our daily life so we can make the best choices and actions in our spending, saving and investing, and balance what is good for our present self and our future self.

Cheers to High FQ!

ANNOUNCEMENTS

1. If you want to examine how Mak or how Emong you are on different Behavioral Economics principles, you can rate yourself on all 16 principles in the book “The Psychology of Money”, it’s the flipside of the two in one second installment of the FQ Trilogy. Click this link to get your copy. https://fqmom.com/product/fq-why-financial-education-alone-does-not-work/

To know more about "FQ Book 2", watch this short video .

2. We will have a special guest on our Kumu show Money Lessons with FQ Mom and Sons on Thursday at 11 a.m. It will be Fitz Villafuerte of Ready to be Rich.

3. I will be one of the judges of Condura Negosyo Plus on Nov. 20, 2021

4. I’ll be part of the 2021 BSP Stakeholders Summit on Nov. 25, 2021.

5. If you want to have a free exploratory consultation on our Financial Architecture service, please click this link https://tinyurl.com/IFEFinancialArchitecture.

6. How good are you with money? Do you want to know your FQ Score? Take the FQ Test and get hold of your finances now. Scan the QR code or click the link http://fqmom.com/dev-fqtest/app/#/questionnaire

This article is also published in FQMom.com.