What do you own and why?

David “Sandy” Gottesman, the founder First Manhattan Co., an investment advisory firm, considers this question the most important thing to ask when hiring an employee.

Come to think of it, one’s honest answer to this question is very telling. It reveals what a person values.

Now here’s something unsettling. According to Morningstar, a major investment research firm, half of US fund managers do not invest in their own funds! Isn’t that troubling? It’s like relying on your cook to serve you the best meals that are delicious and healthy, and then you find out that she does not eat what she cooks. You’d get suspicious, right? Or a doctor who prescribes you all these procedures and medicines, and then you find out that he wouldn’t take them when he suffers from the same ailment as yours. Very disturbing.

When my mother was diagnosed with cancer at the age of 84, my siblings and I had meetings with her doctors together with her. I remember always asking that question, “Doc, if you were as old as my mom and had the same condition, would you do that procedure?” There would always be a pause before the reply. The truth is, even if a good number of doctors prescribe procedures on the aggressive side for their patients, they normally wouldn’t opt for the same procedures when it comes to their own condition. No matter what their reasons are, there is a wide difference in what they choose for their patients and what they choose for themselves.

It’s not only the doctors that I ask that kind of question to. I often ask that question when I seek counsel or advice.

In some of the finance events I attend or moderate, I love asking a question similar to Gottesman.

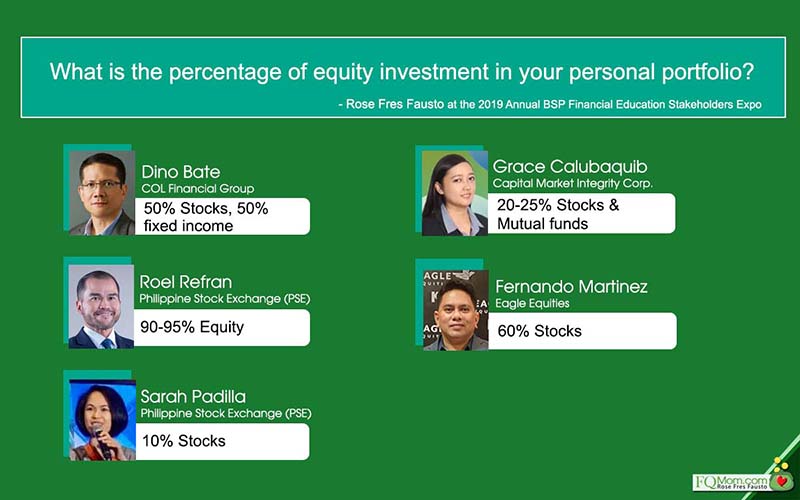

Here’s an example of such event. This was held pre-COVID days during the 2019 annual BSP Financial Education Stakeholders Expo. I was the moderator at the session on Investing in the Stock Market. So my question at the end of the panel discussion was, “What is the percentage of equity investment in your personal portfolio?”

The panel included the following speakers:

- Dino Bate, President and CEO of COL Financial Group

- Roel Refran, COO of the Philippine Stock Exchange (PSE)

- Sarah Padilla, Assistant Manager at the Market Education group of PSE

- Grace Calubaquib, AVP and Head of PSE’s CMIC (Capital Market Integrity Corp.)

- Fernando Martinez, stock broker at Eagle Equities

Let me share with you a clip of that event. Please listen to how they will answer my question.

An excerpt from the breakout session on Stock Investing I moderated at the BSP Financial Education Stakeholders Expo 2019. You may go to minute 10:18 to watch them reply to the question, “What is the percentage of equity investment in your personal portfolio?”

So, how did you find their answers? Did their personal portfolios convince you to invest in the stock market? Here’s a summary of their answers.

Here’s another event I attended in 2017. It was co-hosted by the CFA Society of the Philippines and the Fund Managers Association of the Philippines (FMAP). It was moderated by my husband Marvin, the founding president of FMAP.

The panelists included the country’s top fund managers:

- Wilson Sy, founder and fund manager of Philequity Management Inc.

- Fritz Ocampo, SVP & CIO of BDO

- Phillip Hagedorn, Investment Director of ATRAM Asset Management

- Smith Chua, CIO of BPI Asset Management

- Mary Leung, Head of Standards and Advocacy of CFA Asia Pacific

In the Q&A portion, I asked them these two questions.

- Can you share with us your personal asset allocation?

- How often do you evaluate your portfolio?

These were their answers:

- Mary Leung – majority in real estate. I evaluate every quarter.

- Phillip Hagedorn – 60% in real estate, the rest in stocks. No fixed income.

- Smith Chua – 70% fixed income, 30% stocks because my wife is conservative.

- Fritz Ocampo – 60% real estate, 30% stocks, 5% art, 5% cash. Evaluates every month.

- Wilson Sy – 100% stocks, but it depends on the interest rates. In 1983 with the Jobo bills at 40%-53%, it was all fixed income, then again in 2000. But right now, why will I put money in fixed income when the rates are at 1%-2%? I don’t look at my asset allocation than much now because it’s all in equity.

Here’s the summary of their answers in a single image.

How about you? What is your answer to the question, “What do you own and why?”

Whatever your answer is, I hope you are observing this FQ Rule:

ANNOUNCEMENTS

1. Let’s continue the conversation on Thursday on our Kumu show (Episode 18: What do you own and why? Bonus: Investing in Real Estate with guest Edric Maguan.)

2. To read more about the CFA/FMAP event, please click Why doesn't 99% invest in the stock market? Answer: Myopic Loss Aversion.

3. Please subscribe to my new FQ Mom Podcast. If you’d rather consume this article in audio and listen to additional comments and insights, please listen to my podcast on the platform of your choice.

4. To learn more about your money behavior, get your copy of FQ Book 2. Get copies for your loved ones too. The principles you will learn from here are not only applicable in your financial life but all the other important aspects of your life. https://fqmom.com/bookstore/

To know more about FQ Book 2, watch this short video .

5. How good are you with money? Do you want to know your FQ Score? Take the FQ Test and get hold of your finances now. Scan the QR code or click the link http://fqmom.com/dev-fqtest/app/#/questionnaire