How to manage money for fresh grads (and not so fresh grads)

I see a lot of graduation photos being shared on social media again. To the graduates and parents, congratulations! This article is dedicated to you. It’s also dedicated to the not-so-fresh grads, especially those who want to get a hold of their money management.

Here are the things that you may do to put your finances in order.

1. Prepare an inventory of your skill sets. Yup, this is the time to really think about and write down the things that you are good at and fond of doing. These are your most important assets that will set you off for life. If you need help, ask the people around you.

2. Figure out what the world needs from you. Given your skill sets, what world need can you fill up? If this seems like a daunting task to figure out at this stage in your life, check which companies may have good use of your skill sets enumerated in number one and see what openings they have.

*For numbers 1 and 2, the Japanese philosophy of Ikigai might be of help because it’s easy to remember.

3. In looking for a job, put more weight on the training that you will get. Recently, there was an interesting online discussion regarding a tweet about the P37,000 starting salary that was declined by a fresh graduate. This topic deserves a separate article because inasmuch as the amount is higher than most of the starting salaries, the graduate had all the right to decline if she felt that her value deserved more. But let me just remind fresh graduates what we have advised our own children when they were looking for their first jobs, “The most important factor in your first job is the training that you will get. A good boss will serve as your mentor who will leave a significant mark while you are being molded.” Aside from having a good boss, good co-workers are also important because they usually end up being your life-long friends, as what happened to me and my husband. Then again, there is also a level of compensation that will make you feel valued so that you can concentrate on your work instead of always being on the lookout for a higher salary.

4. Create your balance sheet. If your parents have somehow encountered my FQ lessons, maybe you already have a simple balance sheet that shows your assets (e.g. cash, bank deposits, investments, other assets, liabilities). If you still don’t have one, this is a great time to create your very first. Then update it every quarter.

5. Note to parents: Cut your children’s financial umbilical cord. If your children have no savings that could last them until they find a job, agree on an allowance that is finite, say one to three months. Make it finite so you don’t encourage your young graduates to over-extend their “rest period” before they start working.

6. Even before you get your first salary, set in place your automatic saving and investing. Commit to a savings rate already. If you are new to regular saving, you can start ideally at 20% then work your way up. There are options such as an automatic saving/investing that can already be provided by the bank handling your salary. Or you may check out other online platforms that will make it easy for you. Take advantage of the power of default bias. Set it up and you can let it work its magic with no more effort from you.

Components

If you noticed, I didn’t ask you to list down your expenses first. Here’s why, I wanted to you start with the 20% savings rate, then later on figure out what expenses should go into your monthly budget that will not go beyond the remaining 80%. This makes you live out the first basic law of money, “Pay yourself first.”

When you already know your monthly expenses, set your emergency fund (EF). In your automatic saving and investing, this can go to money market fund so that it can still earn you a little interest while still allowing you to withdraw when emergency comes. Fill up this fund until such time as it is equivalent to six months up to one year.

If you are still living with your parents and still getting free board and lodging without threat of being kicked out and you’re raring to start your investing journey, it may be okay to start your long-term investment fund (IF) even before you complete one year EF. Put your long-term IF in equity index funds using the same platform as your EF.

7. Track your expenses. This will be very useful for you as you develop your spending habits. Having a record will make you aware where your hard-earned money goes and also helps you control unnecessary spending. I have been using my excel file but there are some online apps that might be more appealing to you.

You may want to come up with your income and cashflow statement using your expense tracker. This is also a powerful tool for you. While you may update your balance sheet on a quarterly basis, you are better off updating your income and cashflow statement on a monthly basis.

8. Use loans prudently. Debt is a double-edged sword as discussed in FQ Book 1 Chapter 7. So don’t get into it if you don’t need to. And if you need to, make sure you know what you are getting into. Study the terms and conditions including the fine print. Always remember that debts can be a drag to fulfilling your desired financial condition. Read these articles on debt to know more about it – "Good debt vs bad debt" and "The basics of borrowing".

9. Are your parents/other relatives expecting you to help? Have an open and healthy discussion with your family members about this. If your family is counting on you to help out in some of the family expenses, be very clear on the matter. What expenses are these? Are you comfortable shouldering these expenses? Until when? What are the expectations with regard to this arrangement? Although some families may feel uncomfortable discussing matters like this, bring it up and talk about the elephant in the room now to avoid misunderstanding in the future.

10. If you’re a freelancer, you have a bigger challenge of managing your money. You have to be more religious with your balance sheet, income & cashflow statement if your source of income is not steady. You may want to take the advice of our guest during our Kumu show last week, Mr. Jim Paredes, who shared that he did the reverse – instead of our suggested 20% savings, he did 80% savings because he knew his income was not stable. It was a good thing that my son Anton, also a creative with no regular cashflow, was the one co-hosting that episode with me. (Click How to earn as a creative to watch the episode.)

There are so many more tips I’d like to tell you, but I guess let’s just have these 10 items first. Sometimes it can be daunting but developing your FQ is really an important part of adulting. I am quite optimistic about your generation. I see a lot of you who want to take control of your life – both financially and career-wise. If you want one-on-one guidance for this, you may wish to check out financial architecture and career clarity and design, respectively.

It’s going to be a fun ride. Join us on Thursday as we discuss more about this topic.

ANNOUNCEMENTS

1. On May 27, 2021, I will give a talk to SLAMCI employees and clients to tackle why financial education is not the solution to our money problems. If you want to hold a similar event, please contact FQTeam@FQMom.com.

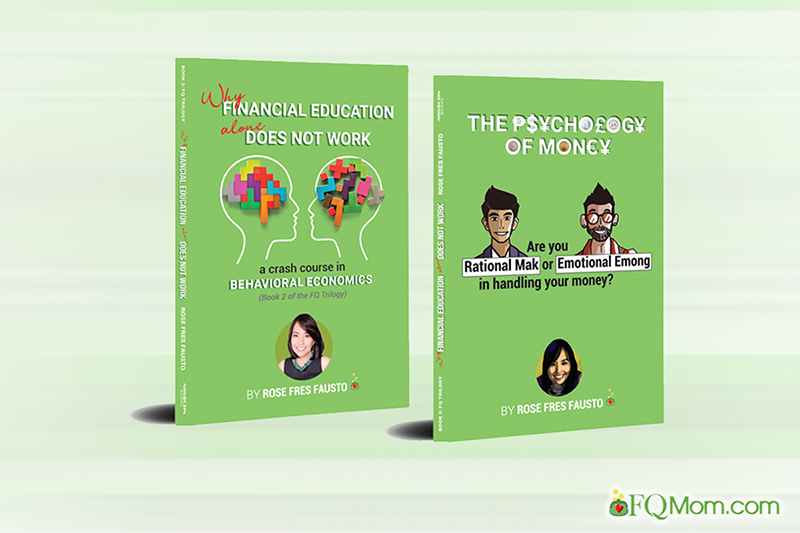

2. To learn more about your money behavior, get your copy of FQ Book 2. Get copies for your loved ones too. The principles you will learn from here are not only applicable in your financial life but all the other important aspects of your life. https://fqmom.com/bookstore/

To know more about FQ Book 2, watch this short video.

3. How good are you with money? Do you want to know your FQ score? Take the FQ test and get hold of your finances now. Scan the QR code or click the link http://fqmom.com/dev-fqtest/app/#/questionnaire.