Financial education is not the solution to our poor money behavior!

I am sorry to burst your bubble but financial education is not the solution to our money problems. This is the main message of my “author’s speech” during the launch of my latest book “Why Financial Education Alone Does Not Work” (a crash course in Behavioral Economics) held last Friday March 19, 2021.

I wish to share it with you. You’d be surprised that even if the title may sound combative, you will see a very excited, giddy me delivering this message. It’s because I am not here to just oppose this popular belief. I am here to provide enlightenment to my partners in this move to improve the financial well-being of Filipinos all over the world. I hope the insights from the book will bring us all together to help solve the money problems of the regular Juan and Juana.

If you prefer to read rather than watch, here is the full text of my speech.

Magandang araw po sa inyong lahat. Thank you to everyone who spoke earlier. Thank you for your kind and encouraging words – Gov.Say Tetangco, Deputy Gov. Diwa Guinigundo, Wick Veloso, Nandy Aldaba, Robi Domingo, Hans Sicat, Cesar Purisima, Riza Mantaring, Bo Sanchez, Bianca Gonzales, John Beshears and Dan Ariely.

And of course thank you to everyone here right now. Thank you for carving out one hour in your very hectic and tiring zoom schedule these days. Thank you also to everyone who’s joining us live on Facebook, on the pages of ABS-CBN Books, FQ Mom, BDJ, and Crazy About Paper. And of course, my special thanks to GCash, particularly the GInvest group, for being our sponsor in this event. Maraming salamat.

Today is March 19, 2021. It would have been the 91st birthday of my Mamang, and in a few days, it will be her fourth anniversary in heaven. I remember her dearly on this occasion, not only because it’s her birthday today, but also because she was my greatest influence in making me believe that being frugal is cool and in fact, spending more than what you can afford is so uncool. She’s the FQ Lola! Aside from being frugal, she also taught me another important life lesson: that sometimes we need to tell the truth even if it’s not popular to do so.

In FQ Book 2, I take that risk of being unpopular. I call out the most popular answer to our money problems which is financial education and say that it doesn’t work! Financial education does not work in the way we all want and hope for it to work! It is not the answer to our money problems.

Honestly, I really really hope it were. We teach you personal finance and you’re all set! Unfortunately, there’s no empirical evidence that shows financial education works to solve our money problems. In fact, studies show that the positive effect of financial education in our financial behavior is a minuscule 0.1%! Papayag ka bang magpabakuna kung ganyan kababa yong efficacy?

The first time I read about the meta-analysis on the effect of financial education on our financial behavior, I was really shocked, then skeptical. I thought it was a typographical error. Pero hindi e. And when I studied things further, I realized, “Tama nga ito. Kadalasan alam naman na natin kung anong dapat gawin, ‘di ba?”

When it comes to handling money, I always talk about the three basic laws of money.1. Pay yourself first.

2. Get only into a business that you understand, and seek advice only from competent people.

3. Make your gold work for you. Make an army of golden slaves before you buy luxury.Simple right? Yes, but simple is not always easy. And this goes for the other important aspects of life.

Let’s talk about health. We also have three basic laws of being healthy:

1. Eat well.

2. Sleep well.

3. Exercise regularly.Is there any adult who doesn’t know these three basic laws of health? I guess none. But look what’s happening to our general health condition?

Is there any adult who cannot understand the three basic laws of money enumerated earlier? I guess none. But even if they master these laws or ace their finance classes as mandated by the government, they still end up saddled in money problems - no difference from those who didn’t take up the finance classes. This is so sad if we are going to put finite resources in financial literacy programs that will not work.

So bakit ganito? Bakit alam na alam na nga natin, tinuro na sa atin, naiintindihan naman natin, pero hindi pa rin natin magawa? To lighten my speech, let me share the meme of FQ Book 2: Bakit gets ko na pero ‘di ko magawa. Parang rap ano? Sige nga, subukan natin. Let’s just imagine we’re all together in a nice hotel ballroom and I’m going to ask you to rap with me. Gawin natin ng sabay-sabay, “Five-six-seven-eight, Bakit gets ko na, pero ‘di ko magawa, bakit gets ko na, pero ‘di ko magawa!

Ok, I’ll just assume na sinabayan nyo ako, and you even laughed at me, but please, let’s just give me a big hand for my rap performance! Hahaha!

So bakit nga ba? Bakit gets ko na, pero ‘di ko magawa?

It’s because of our human wiring.

At the start of the book, I give you a short lesson in biology. We have our pre-frontal cortex or our rational brain. When I give you a Math problem, that’s the part of your brain that you use. Then there’s our limbic system, our emotional brain. This is the seat of all our emotions. This is responsible for switching on our fight or flight reaction.

Now here’s the question: Guess which part of the brain financial education targets? It’s our rational pre-frontal cortex!

And guess which part of the brain drives our behavior? It’s our emotional limbic system!

And this is the reason for our meme Bakit gets ko na pero ‘di ko magawa! Financial education targets the wrong side of the brain! That’s why there is a huge gap between knowledge and behavior.

This is the reason why we should all use Behavioral Economics (BE) in dealing with the important matters of our life such as money, health, relationships, etc. Behavioral Economics, simply speaking, it the fusion of Traditional Economics (which assumes that consumers act rationally) and Psychology (which studies our actual behavior).

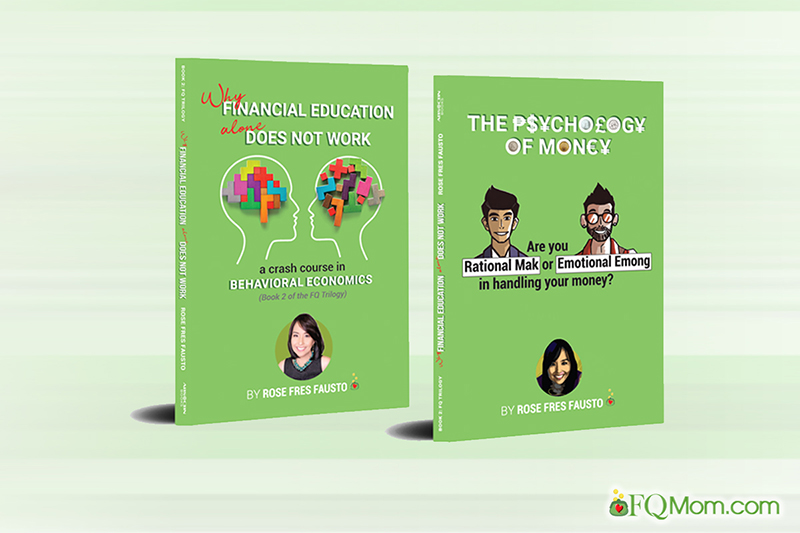

BE sounds quite intimidating and that’s the reason why I created makatwirang Mak and emotional Emong - so that we can understand all these principles without nose bleed. FQ Book 2 aims to bring down the highfalutin Ivy league-ish terms such as loss aversion, sunk cost fallacy, hyperbolic discounting and many more to become mainstream language. Dream ko sana ‘yong mga regular Juans nag-uusap ng ganito, “Pare, o ibenta mo na yang basura stocks mo. Bakit ayaw mo pang bitawan? Na-Sunk Cost fallacy ka lang!” or “Naku girl, tigilan mo na yong pag YOLO YOLO mo. E ano ngayon kung may seat sale, wala ka pa ngang ipon, na-Hyperbolic Discounting ka na naman! Huwag puro YOLO You Only Live Once, isipin mo rin YAGO – You Also Grow Old!”Ganon talaga ‘yong dream ko - to make all these ivy league-ish terms mainstream talk.

As you go from one behavioral bias to the next, you will give yourself a ME (MakEmong) score. This way, you know where to protect yourself. Some have asked me, “Rose, what’s a good ME Score?” To that I always answer, “It’s the honest ME Score. You should answer the question how are you affected by these biases? And not how you understand these biases.” Honestly, even after studying Behavioral Economics for a decade now, my ME Score is 41/59. I’m leaning towards Emong. I guess the regular rational person is around 40/60.

But does that mean that if your Emong is stronger than your Mak, you won’t have a high FQ? Fortunately, the answer is no. Your ME Score is just your rational/emotional temperament, your natural tendency. And the more you know and are honest about it, the more you can safeguard your decision making and behavior. Like in my case I’m 30/70 in ego depletion, I know that it’s hard for me to make sound decisions or to even be nice if I’m hungry. I’m just like the judges in the study I discuss in FQ Book 2. Do you know that when the judges are hungry (close to lunch or end of day), your chances of you getting a parole goes down to as low as zero? But when your case is discussed early in the morning or after lunch (when the judges are not hungry), you get higher chances of getting a parole.

So, after you assess your own ME Scores in all these 16 behavioral biases discussed in the book, you can now protect yourself from your weaknesses. And that’s what we should all do. Let’s determine our respective ME Scores so that we can protect ourselves from ourselves.

And this is my call to those who may not like the thought that our favorite solution, financial education, to our money problems doesn’t work. Please read the book. Understand why sometimes you might feel that those whom you gave financial education to actually improved their financial behavior. Understand that there are so many factors involved, Correlation is not causation.

Yes, financial education is still needed but we should not count on it as the solution to our money problems. You see, it appears to be the most intuitive and intellectually attractive solution to the problem. It is very enticing, seductive, even profitable to some, including myself and convenient to the institutions responsible for solving the problem. If we really put all these elements together, it’s so easy to agree and convince ourselves that it’s the win-win solution to money problems, except that we won’t be able to help the guy whose problem we are trying to solve.

The problem is if we continue to count on financial education as the solution to money problems, we will just waste limited resources, bring false hopes and undue confidence, make us put the blame on the wrong things and distract us from addressing the real problem more effectively. Like what has been happening to our public school teachers who are buried in debt. No wonder they once had a rally where they had this big banner saying “Financial literacy is not the solution to our problem!”

It is bothersome to think how Financial literacy programs are expected to result in educated consumers who can handle their own credit, insurance, investment, retirement planning, etc. just because they are given numerous options to choose from in the free market.

Can we really expect the regular Juan to understand all these hybrid products offered to him with varying complexities and no standardized way of showing interest rates, actual investment components, commission rates, forfeiture clauses, etc.?

If we don’t expect our regular Juan to be his own medical doctor and lawyer or legal adviser, why should we expect a lot from him when it comes to handling his money?

Think about that.

So ladies and gentlemen, I’m offering FQ Book 2 as my gift to the Filipino community and the world. I hope that by trying to come up with this fun way of understanding complex matters about our money behavior, I’ll be able help you understand and focus on the right things in solving your money behavior.

I promise you, it is an easy read. After reading this book and giving yourselves your honest ME scores, you will never be the same again. You will be able to catch yourselves and your loved ones and label those behavioral biases that make it harder for you to do the right thing. Sasabihin na ninyo, “Uy, Loss Aversion yan; Uy, Confirmation Bias o Illusion of Control yan, etc.” You’ll be able to incorporate pauses so that you can make the right decisions that are good for you - not just for your present self but also your future self. Knowing your biases will help you design the correct default choices making it easier for you to do the right thing more effortlessly. Why waste precious your will power, when you can automate things?

And the good news is all these BE principles are not just applicable in money matters. They’re also applicable in our love life, health, relationships, career and all the other important aspects of our life.

So, I invite everyone to read FQ Book 2 to have all these benefits. Let’s all embrace our duality, our Mak & Emongness, our ME Scores with pride and live more meaningful lives!

Maraming maraming salamat po sa inyong lahat!

If you missed attending this live FQ Book 2 launch and the chance to win prizes, there’s another chance. I’m inviting you once again to another launch, whether you missed it or not. You will have another chance to win investments packs. Join my launch on Kumu, where we will have another style of celebration. Please see announcement below for details.

ANNOUNCEMENTS

1. Game! Let’s have another get-together to celebrate FQ Book 2. We will do it Kumu style. Joining me will be my favorite person in the world Marvin Fausto, and the muse of the Philippine investment world, April Tan who is the chief equity strategist of COL Financial. COL is our sponsor for this launch, so come live to win prizes!

2. To get your copy of FQ Book 2 click: https://fqmom.com/bookstore/.

To know more about FQ Book 2, watch this short video .

3. How good are you with money? Do you want to know your FQ score? Take the FQ test and map out your 2021 FQ [lan. Scan the QR code or click the link: http://fqmom.com/dev-fqtest/app/#/questionnaire.