6 ways to protect your investment from dangers of confirmation bias

In my previous article, we discussed how we tend to stick to our political bets, no matter how terribly they turn out as leaders. The decades of Martial Rule in the Philippines, complete with data that show how poorly we did economically and morally, still manage to get the best rating from some Filipinos. When you talk to them, they are ready with their “facts” that support their claim for the golden years of Martial Rule. They are exhibiting confirmation bias big time! (Click link to read article.)

Confirmation (or confirmatory) bias is a human tendency to search for, interpret, favor and recall information in a way that confirms or supports our prior beliefs. We are all prone to this. We cherry-pick empirical data that support our beliefs, ignoring the other data that say otherwise.

Succumbing to this bias makes us feel good in the short-term because we hang out with people who share our beliefs and opinions. We read books and articles, watch videos that confirm our initial beliefs. We feel validated. It feels great to feel right, it’s a cozy and proud feeling.

Unfortunately, this bias is a major cause for investment mistakes.

Let’s say you attend the presentation of Company X. You listen to the owner articulate the promise of his company – an exciting growth that has never been seen before. Earlier, you have been thinking of this promising new industry and have been wanting to invest in it. You buy Stock X and immediately enjoy a 5% increase in the price.

Later on, someone points out that the company is highly leveraged, something that was not mentioned during the presentation. Instead of going through their financial statements, you look for news of their new big projects and just convince yourself that they need to borrow in order to fund those projects. You watch the owner guest on various business shows deliver his rhetoric on his high-growth company. You read the technical analysis of your stock market “guru” on Facebook who has already loaded up on the stock. You choose to focus on these and didn’t bother to look more closely at the company’s increasing debts.

Confirmation bias makes you overconfident because you just gather data that appear to confirm your investment decision. This overconfidence gives you that false sense that nothing will go wrong, increasing your risk of being blindsided when something goes wrong.

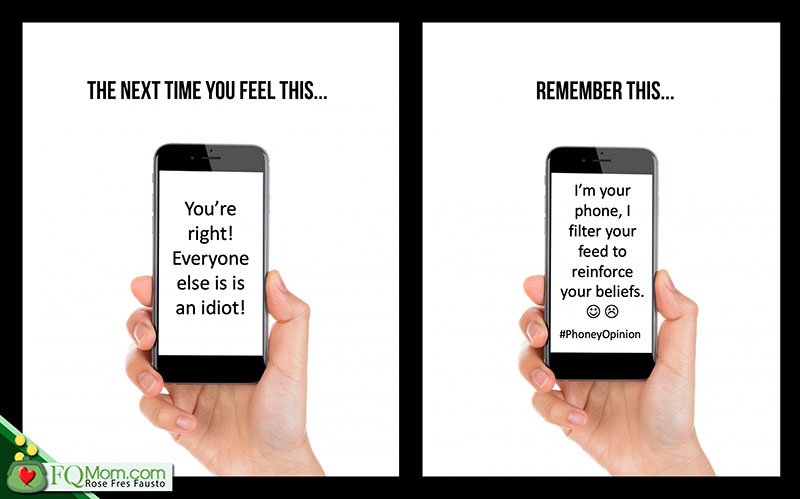

In this age of internet, this confirmation bias has been exacerbated. The mighty algorithms of Google, Facebook, etc. make sure that you get the content that you want. For example, if you search for the topic “climate change,” what appears on your feed is very different from the one who googled that in another country, or your friend who doesn’t share your beliefs on this topic. The algorithm feeds you what you want to consume, making you stay longer online, making you even more confident and probably stubborn with your initial belief.

What to do?

It is easier to see confirmation bias in others than in ourselves. This reminds me of the biblical passage that goes, “Why do you see the speck in your friend’s eye when you have a log in your own?” With this in mind, let’s start with the premise that we are all prone to confirmation bias, and discuss some things we can do in order to protect ourselves from its negative effects in our investing, and life in general.

1. The next time you feel arrogantly correct about your position based on your quick Google research, remember that the mighty algorithm feeds you what you want to see.

2. Humility is a virtue that is a good antidote for the confirmation bias. Please remember that no one has a monopoly of stupidity. Not even __________ (fill in the blank), whom you already unfriended on Facebook! You, me and even some really brilliant people also have their moments of idiocy.

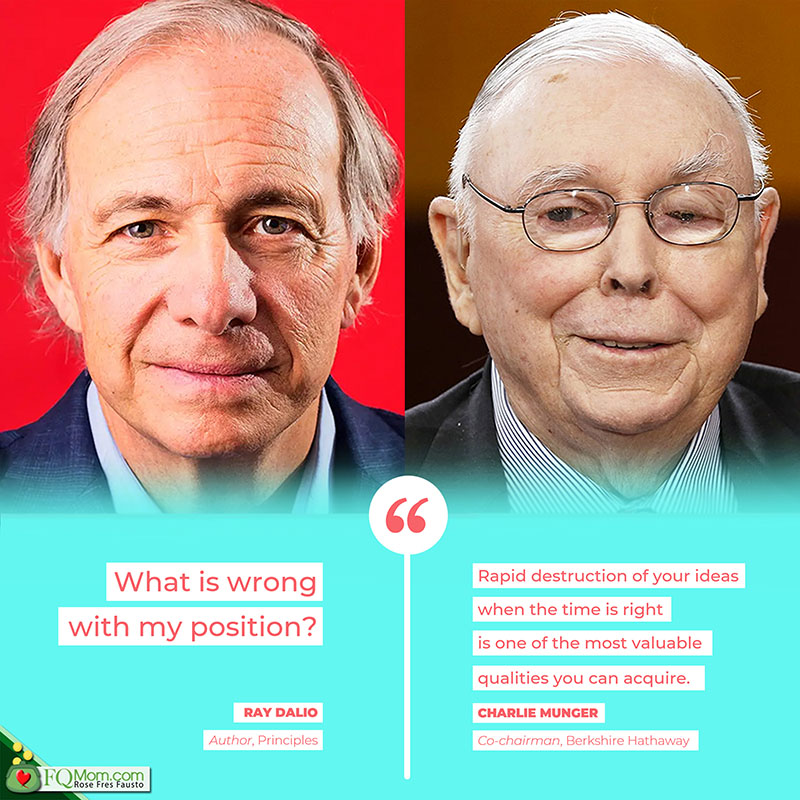

3. Question yourself the way the world’s best investors do. Ray Dalio, the owner of Bridgewater, the world’s largest hedge fund, always asks the question, “What is wrong with my position?” as a standard step in his decades of successful investing. His philosophy in investing and life in general is found in his important book entitled “Principles.” Charlie Munger, Berkshire Hathaway co-chairman and partner of the world’s greatest investor Warren Buffett says it is more important to ask the question why one is wrong than why one is right. He said, “Rapid destruction of your ideas when the time is right is one of the most valuable qualities you can acquire.”

4. Empathy is another virtue that helps us against confirmatory bias. When talking to someone with an opposite view, try to be in his shoes in order see another perspective.

5. Remember and reflect on what Anaïs Nin, French-Cuban American writer, said best, “We don’t see the things as they are, we see them as we are.”

6. Respect facts. Now that you’re aware of various lenses from which different people can interpret information, gather facts and evaluate them using universal standards. For example, a country’s growth in economy is universally measured by its GDP (gross domestic product). Other good economic indicators are inflation rate, interest rates, foreign exchange, stock exchange index, international investment ratings, etc. These are generally cold facts that you can use to evaluate a leader’s performance.

I hope the above can help all of us address our tendency for confirmation bias. If we all do, we will not only have better investment decisions, we will also create a more peaceful world.

Cheers to high FQ!

********************

ANNOUNCEMENTS

1. I will be giving a webinar for the Philippine Stock Exchange (PSE) this Friday Oct. 9, 2020 in celebration of Financial Literacy Week, an activity in tandem with the World Investor Week of the International Organization of Securities Commissions (IOSC). It's free so I hope you and your friends can come join us live. Click the link to register: http://bit.ly/PSEWebinarS2_Oct2020.

2. How do you rate yourself when it comes to FQ? If you want to find out, take the FQ test and see where you stand right now. Scan the QR code or click the link http://fqmom.com/dev-fqtest/app/#/questionnaire

3. Have you visited our new home recently? Please do, click http://fqmom.com and let’s continue the conversation.

4. If you want to enhance your FQ through stories, check out FQ Mom books, available in print (with autograph) and ebook versions.

5. If you haven’t watched it yet, join me in this important conversation about differing views of Filipinos on Martial Law, confirmation bias, and other matters, hopefully to help you see your role in our divided country.