Delicate recovery prompts BSP to keep ultra-low interest rates

MANILA, Philippines — The fragility of the economy’s recovery from a pandemic-led crash convinced the Bangko Sentral ng Pilipinas to keep rates at record-low on Thursday.

As widely expected, the Monetary Board left the central bank’s overnight reverse repurchase facility at 2.0% at their meeting. The BSP's benchmark rate, which banks typically use when charging loans to borrowers, has been unchanged since November when the central bank culminated a massive easing streak to blunt the economic pain from the health crisis.

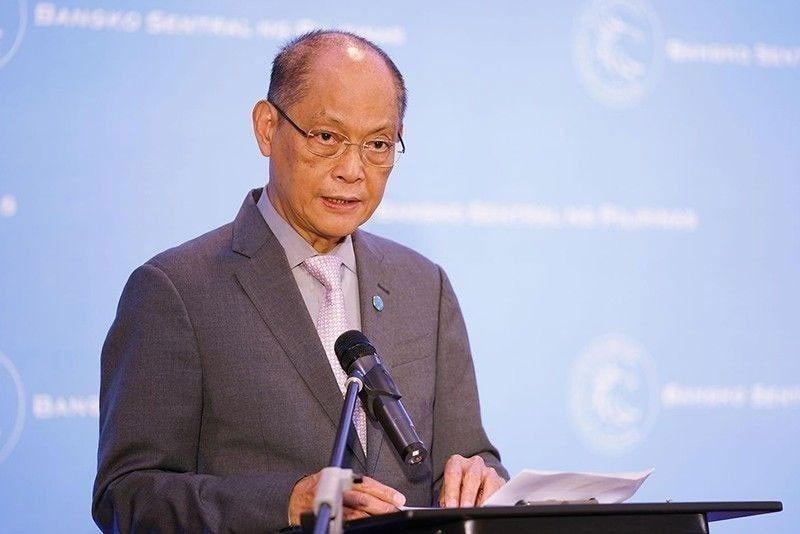

For Governor Benjamin Diokno, there are signs that the economy is starting to heal, but he stressed that the recovery has been delicate as the pandemic drags on. “The Monetary Board also observed that economic activity has improved in recent weeks, but the overall momentum of the economic recovery remains tentative as the threat of COVID-19 infections continues,” Diokno said in a statement.

“The Monetary Board believes that sustained monetary policy support for domestic demand should help the economic recovery gain more traction, especially as risk aversion continues to temper credit activity despite ample liquidity in the financial system,” he added.

The BSP said it has room to maintain a relaxed monetary policy, thanks to manageable inflation. For this year, higher world oil prices and better global economic outlook are seen pushing up consumer price growth to 4%, up from the previous forecast of 3.9% but still within the government’s 2-4% annual target. Inflation steadied for the third straight month in May to 4.5%, but pork prices continued to drive overall costs and the BSP said it is something that can only be solved with “non-monetary measures.”

Inflation would be less of a problem in 2022, with price uptick seen easing to 3%, albeit higher than the earlier projection of 2.9%. Inflation is forecast to stay in that level until 2023.

With inflation fears receding, more rate cuts to support the beleaguered economy are only a few months away, Alex Holmes, Asia economist at Capital Economics, said in a commentary.

“Provided inflation falls back as we expect, then rate cuts are likely in the second half of the year. We are sticking with our view that the BSP will cut rates by a further 50bps in the second half of the year, with the first in September,” Holmes said.

But there’s a possibility that another cut to the policy rate would be futile. Despite the ultra-low rates, bank lending still crashed 5% on-year in April, the worst level in 22 years, mainly because of two reasons: pandemic-stricken borrowers are afraid of incurring more debts and banks have gone risk-averse.

This dangerous combo, in turn, is delaying the economy’s absorption of the BSP’s cumulative 200-basis point rate cut, BSP Deputy Governor Francisco Dakila Jr. said, and therefore blocking central bank efforts to speed up recovery.

“As can be seen the lag in the transmission of monetary policy is variable and it can be longer in an environment of uncertainty,” Dakila said in a press conference.

“There’s longer lag that we are experiencing, but this should help loan growth moving forward. Of course, the main driver is the pick-up in demand coming from our vaccination efforts,” he added.

- Latest

- Trending