Breaking 50 leads to stronger peso

People are perplexed why the Philippine peso is the strongest currency in Asia year-to-date while COVID-19 cases are still rising, OFWs are returning, and foreign selling continues at the PSE. However, in previous articles we pointed out the fundamental reasons behind the peso’s strength (see Philippine peso, the strongest currency in EM, May 11, and Is the strong US dollar ending?, June 8). These include the attractive yield difference between the peso and the US dollar, crude oil prices dropping, recent major bond offerings of Philippine corporates, Philippine gross international reserves (GIR) at record highs, sharp reduction of Philippine imports because of the economic slowdown, and the general weakness of the US dollar. Finally, technical analysis indicators also point to further peso strength.

The importance of big round numbers like 50

Last Friday, the peso closed at a 37-month high of 49.485 against the US dollar. More importantly, it traded below the critical psychological level of 50 for the second straight week.

In technical analysis, big round numbers typically define key psychological price levels where traders make major buy and sell decisions such as Dow 10,000 or Nasdaq 5,000.

In the case of the Philippine currency, it is the 50-peso level. Looking at the USD/PHP monthly chart, notice how 50 acted as critical support and resistance during the past 20 years. The longer the peso trades below 50, the more significant this number becomes. Also note how 40, another round number, marked major support for USD/PHP in 2008 and 2013.

Chinese yuan – the barometer for EM currencies

The Chinese yuan is considered the gauge for emerging market (EM) currencies. Previously, we wrote about the sensitivity of EM currencies to the yuan. We discussed the significance of the seven-level in the USD/CNY as technical and psychological support (see seven is significant, Nov. 11, 2019). Instances when the USD/CNY sharply increased above this level have caused undue strain on EM currencies, including the peso. The spike in USD/CNY in August 2019, due to the escalation of the US-China trade war, caused the peso to depreciate from 50.80 to 53. And recently, at the peak of the pandemic scare last March, when USD/CNY moved sharply above seven, the peso weakened from 50.50 to 52.

Yuan strengthens, testing the critical 7.00 level

Last week, the Chinese yuan appreciated one percent against the US dollar to close at 6.9994. This move resulted from a surge in China stocks and growing optimism that China will lead the world out of the economic slump. In June, China’s factory activity rose to a three-month high as economic recovery appeared on track. Recently, the yuan and the euro are tracking each other closely. A substantial break below 7.00 in USD/CNY would confirm a reversal in the yuan and further weakness in the US dollar.

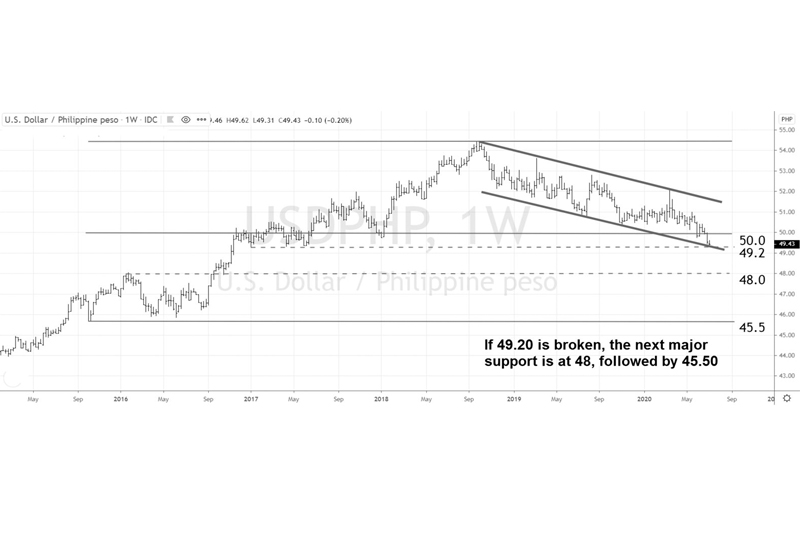

49.20 is crucial for the peso

From the weekly chart below, we see the peso-dollar rate currently at the lower boundary of its downward trending channel. It is also right on top of the next critical support at 49.20. Based on the peso trend, the overall US dollar direction, the recent strength in the yuan and the euro, a break below this level would cause the peso to appreciate further. From a technical analysis standpoint, if the peso breaks below 49.20, the next support is 48, followed by 45.50.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending