EDITORIAL - Back on the gray list

Apart from travel restrictions, overseas Filipino workers may soon have to contend with stricter rules in sending home their hard-earned money. Tighter monitoring of OFW remittances is one of the expected consequences if ever sanctions are applied over the Philippines’ failure to address deficiencies in fighting money laundering as well as terrorist and proliferation financing.

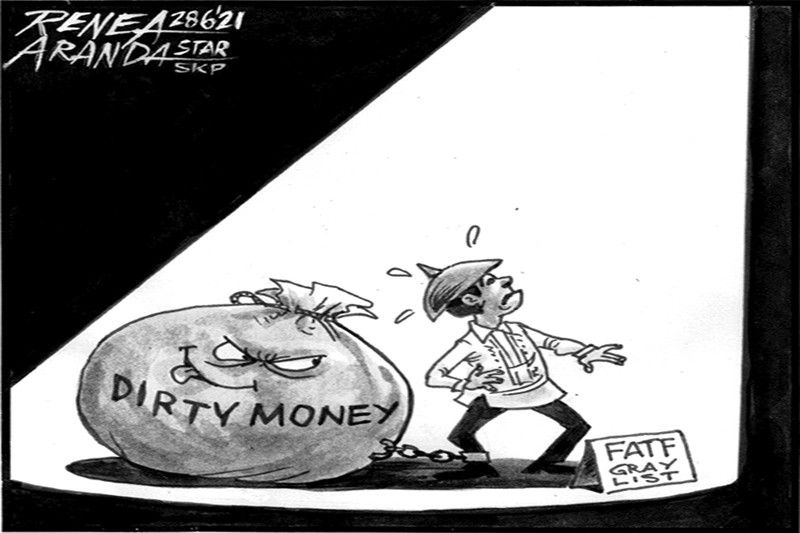

Apart from OFWs, many enterprises will feel the impact of tighter financial monitoring, as sanctions would make it more expensive to do business in the Philippines. Last week the Paris-based Financial Action Task Force returned the Philippines to the so-called gray list of countries under tighter FATF monitoring. The country shares the dubious honor with Haiti, Malta, Pakistan and South Sudan.

The FATF-International Cooperation Review Group was not satisfied with the measures implemented to address concerns raised in 2019 by the Asia Pacific Group on money laundering. The measures include enactment of the Anti-Terrorist Act last year as well as amendments to the Anti-Money Laundering Act or AMLA.

Last April, the International Monetary Fund emphasized the importance of easing bank secrecy laws to avoid inclusion in the FATF gray list. Another reform being pushed is the inclusion of tax offenses among the predicate crimes that can be investigated by the Anti-Money Laundering Council. The IMF also noted the conflict of interest in the twin roles of the Philippine Amusement and Gaming Corp. as casino operator and regulator.

Resistance to financial transparency has always been strong in Congress, for reasons one can only speculate about. The country was blacklisted by the FATF as a money laundering haven in 2000. It took years before the AMLA was finally signed into law and the country was removed from the blacklist in February 2005.

It took more years before corruption was included among the predicate crimes under AMLA. This time, the FATF wants, among other measures, tighter supervision of casino junkets as well as designated non-financial businesses and professions. Sanctions are also being pushed on unregistered or illegal remittance operations. The FATF wants greater use of financial intelligence as well as heightened identification, investigation and prosecution of terrorist financing cases.

The pandemic has already triggered an economic conflagration that has rendered millions jobless and forced the shutdown of many enterprises. The last thing the country needs in this difficult time is to face sanctions for failure to sufficiently address money laundering.

- Latest

- Trending