How to help yourself deal with inflation: Learnings from IFE's investment briefing

Last Saturday was the 2023 investment briefing of our company, IFE Management Advisers Inc. held at the Discovery Suites in Ortigas Center. IFE stands for Investing For Everyone. I gave the welcome remarks and since the briefing title is The (R)eal Estate of the Markets, I included this short story in the opening.

Person A lives in a house he does not own. He likes flexibility so much that even if he already likes the property and can afford to purchase it, he opts to rent it on a monthly basis. Every month, he decides, “Will I extend my rent for another month?”

Person B lives a similar house but he owns it. Every month, he doesn’t have to decide whether he would stay in this house or move to another one.”

Fast forward to three years. Let’s see what happens?

Person A is still in the same house. You know, we are creatures of habit and more than we usually think, our Emotional Emong side prevails that we are affected by inertia or default bias. (To know more about this, read FQ Book 2). Person A’s house still looks the same - bare, no improvements.

On the other hand, Person B’s house is now a home – complete with plants, furniture, and other improvements.

I shared this story in my welcome remarks because usually, we overvalue having many options. But too many options can also stifle us and prevent us from moving forward. The case of Persons A and B is also a good analogy for romantic relationships. It’s the same thing for finding the right property and the right person. Sometimes we have to ask ourselves, “Ano pang hinihintay ko? Baka mawala pa.”

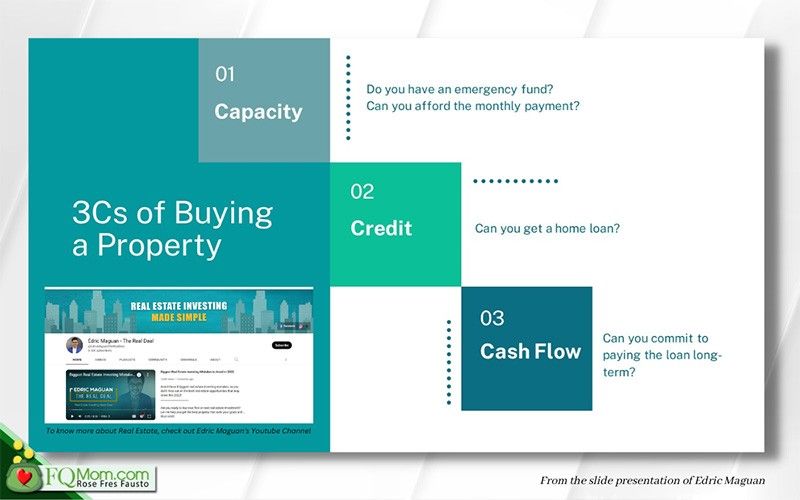

Our guest speaker was Edric Maguan, CPA, REB who talked about investing in the real estate, with emphasis on tips for the young first-time home owners. He shared the 3Cs for investing in real estate.

Last year, we had Edric as our guest on Money Lessons with FQ Mom. If you want to know more on real estate investing, click What do you own and why?

For the state of the markets, Enrique Fausto, C.F.A. gave a 2022 recap both on the domestic and international scenes, what to expect for this year, and what to do with your investments. If you’re a client of IFE, you may request for their summary of the report by email invest@ifemanagement.com.

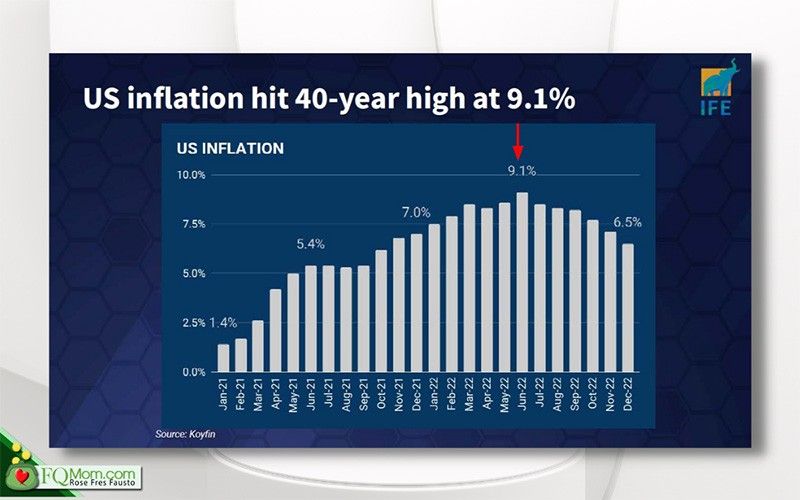

For today’s discussion, let me share the matter on inflation. The US hit a 40-year high of 9.1% in June 2022. Back home, it was 8.1% in December, but of course, for some individual commodities, the inflation rate was way more than that as can be seen in our ridiculous sibuyas runaway inflation reaching as high as 750 per kilo from 150 per kilo, to the point that a bride even used it as her bouquet. She probably wanted to remember what was happening in her country when she got married. Literally and figuratively, Filipinos can really say,”Nakakaiyak talaga ang sibuyas!”

So how do we deal with inflation on a personal basis?

There are three steps you can do on your own to help yourself deal with inflation.

1. Pay down debt. If you are carrying credit card and other high interest rate debts, please pay them all off. The BSP already announced the increase in the credit card interest rate limit from 2% per month to 3% per month. Recall that during the height of the pandemic, BSP reduced the interest rates to 2% per month as a way to help citizens cope with pandemic. The new limit means a whopping 36% p.a.! Before you start investing, please zero out your credit card and other high interest bearing debts first as it is unlikely to find a legitimate investment with this high return. (To watch a discussion, I had on this subject matter on Net 25’s A.S.P.N., click How to be prudent in using credit card.

2. Cut unnecessary expenses. Go back to your budget. Because each item in your expense list might have already increased considerably, it is time to cut down. For example, if you have a budget to eat out once a week but found that the actual peso cost of one eat out has significantly increased, reduce eat out to two times a week. Go down through your list and take out other expenses that you can live without. Avoid going to shopping places – both the brick and mortar, and the online stores. I know it’s so nice to join the bandwagon on revenge travel but if your earnings cannot comfortably fund them yet, you are better off observing the third basic law of money – i.e. “Make your gold work for you. Make an army of golden slaves before you buy luxury.” Or to use the FQ Mom Guideline: Buy luxury only if you can afford to buy 10 pieces of it.

3. Add value to customers and employers. It is crunch time. And you could be in a position that compels you to increase the price of your goods and services because your production cost has significantly increased. If this is the case, give a bit more to your customers. This way, the impact in the increase of your price is softened. On the other hand, if you’re an employee, be aware that a lot of people are losing their jobs. You are lucky to still have one, especially if you continue to receive pay hikes. Give more in terms of your output. Level up by learning new skills that can contribute to your company. This way, your employer is happy with you.

I hope you find the above inflation coping mechanisms helpful. Cheers to high FQ!

ANNOUNCEMENTS:

1. Before you start investing in the real estate market, check where you are in your high FQ journey. Take the FQ test now. Share the link with your loved ones.

2. To have in-depth understanding of FQ and improve your life in general, grab your copy of the FQ books.

This article is also published in FQMom.com.