Is GInvest a G? This new GCash feature can make money for you for a change

The following does not constitute investment advice.

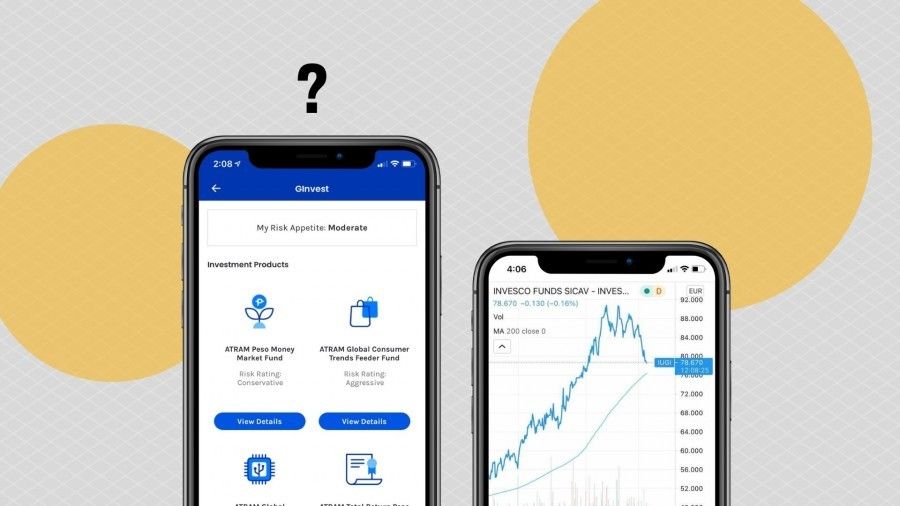

GCash now allows everyone who has the app to invest in the local and international stock markets for as low as P50. But is there a downside to this kind of accessibility?

A new product within the e-wallet, GInvest, rolled out earlier this year aims to make investing easy and affordable. No longer does one need to have hundreds of thousands to millions of pesos to place in the financial markets, be it bonds or stocks.

As with every proper investment platform, GInvest provides a questionnaire to identify each potential investor’s risk rating or risk appetite before presenting available investment products on the platform by the ATRAM Group., an asset management and financial advising company.

ATRAM is also the company behind Seedbox PH where more details about the GInvest funds can be found.

This risk rating—or the amount of risk an investor is comfortable in taking and can afford to take—is central to anybody’s investment plan.

Risk tolerance "often varies with age, income and financial goals," according to Investopedia. So take that survey to know your risk rating. Best to stick to investment products aligned with this rating and your investment strategy.

Conservative investors

These are generally risk-averse individuals who are unwilling to expose their money to potential loss. Potential gains are lower as a result. They usually opt to place their principal in money markets or fixed income funds.

ATRAM Peso Money Market Fund

- Philippine-based fixed-income fund

- Invests in: Time deposit placements in BPO and RCBC and in treasury bonds.

- One-year return: 0.48% as of May 26 (still higher than savings banks' interest rate!)

- Best to keep invested for: Short term or around 1-3 years

- Minimum initial investment: P50

Moderate investors

Those who are willing to accept some risk for a potentially higher gain via a balanced approach: 50% of their principal is placed in a stock or equity fund while the other 50% in large-company or corporate bond funds.

ATRAM Total Return Peso Bond Fund

- Invests in: Philippine government and corporate bonds

- One-year return: 2.27% as of May 26 (not bad!)

- Best to keep invested for: Medium-term or at least 3 years

- Minimum initial investment: P50

Aggressive investors

These are generally market-savvy individuals who can take large swings in their investment portfolio, risking much for much larger returns. They usually invest a large part of their portfolio in local or international stocks (or both).

ATRAM Philippine Equity Smart Index Fund

- Invests in: 30 large or "blue-chip" companies in the Philippine Stock Exchange such as SM Investments Corp. and Ayala Land Inc.

- One-year return: 15.60% as of May 26

- Best to keep invested for: Long term or more than 5 years

- Minimum initial investment: P1,000

ATRAM Global Technology Feeder Fund

- Invests in: U.S. stocks of global technology companies such as Microsoft, Apple, Alphabet (Google) and Samsung

- One-year return: 52.22% as of May 26

- Best to keep invested for: Long term or more than 5 years

- Minimum initial investment: P1,000

ATRAM Global Consumer Trends Feeder Fund

- Invests in: U.S. stocks of global companies catering to indvidual consumer needs such as Amazon, Alibaba, SEA Corp. (Shopee) and Sony.

- One-year return: 47.59% as of May 26

- Best to keep invested for: Long term or more than 5 years

- Minimum initial investment: P1,000

Take note!

No easy, get-rich-quick assurance here: Investing in stocks and bonds involves a required time horizon. If you pull out your funds before they are mature, chances are you won't see a good return.

Allocate your investment: If placing your money in just one type of fund on GInvest is not enough for you or you are concerned about the risk involved, then balance it out by also placing in another, less risky product.

An important reminder, as noted by investment experts: Only invest money you don’t need because investments are not emergency funds or savings that can be pulled out at a moment’s notice whenever someone needs them.

Research, research: Before making investments to further your financial goals, always conduct due diligence and look up the fund you're about to commit to.

--

ALSO ON THE BUDGETARIAN