What’s your first money lesson? (Let’s continue discussing on Kumu!)

Last week, I asked the help of my social media family, “What’s your first money lesson that you still remember until now?”

I received a lot of replies and reading through them was an enriching experience. Some are happy, some are sad, but for sure all of them are a big part of how they are today with money. In our FQ workshops, we have this exercise that’s always a hit among participants. We call it the Childhood Money Memory (CMM). We give them guide questions to help them recall how it was for them in their early years. Then we give them a chance to recall one vivid money memory.

Sharing one’s CMM oftentimes comes with tears. Some come with laughters. In both cases, the exercise always brings about a cathartic experience. It is quite powerful, giving the participant a deeper understanding of his or her relationship with money.

Here are some examples:

1. “I started in Grade 1 in 1990 and got my first 50 centavos allowance. Sabi ni Mama, piso yan pero kunuha ko na ang savings.” – from Rfa DA

My comment: Wow! This observes the first basic law of money big time – i.e. Pay yourself first! It is automating your savings and with a 50% savings rate at that! Thumbs up to Mama!

2. “Laging sinasabi sa amin dati, kaysa bilhin mo ang maliit na laruan ngayon gamit ang maliit mong ipon, mas magandang itago mo muna ang pera at mag-ipon pa ng konti para mas magandang laruan ang mabibili mo.” – from Shankar Advani

My comment: A great lesson in delaying gratification! It observes the third basic law of money – i.e. Make your gold work for you. Make an army of golden slaves before you buy luxury ![]()

3. “If you can afford to buy five cars, buy two.” - from Lulu Seville Asis

My comment: This is another implementation of the third basic law of money. It’s another take similar to FQ Mom Guideline on Luxury – i.e. “Buy luxury only if you can afford to buy 10 pieces of it.” ![]()

4. “You earn your own money – aka tweezing lolo’s white hair and earning x pesos per strand!” – from Betsy Esguerra

5. “We sold snacks when school is in session and ice candy during summer. Yong tubo pambili namin ng gusto namin.” – from Ge Gatma

My comment on 4 and 5: To a certain extent, it’s an early practice for the second basic law of money - i.e. Get only into a business that you understand. Seek advice only from competent people. Because it is in encouraging our children to earn their own money early on even in fun ways like plucking out lolo’s white hair! I wonder, “Uso pa bai to?” Kidding aside, these lessons gave them a preview of the things they can do, enjoy and be good at, while earning money.

6. “I remember my mom kapag gusto ko bumili ng something, she would say, ‘Ano akala mo sa akin, tumatae ng pera? Kapag may gusto ka, paghirapan mo! Huwag puro luho, para alam mo kung gaano kahirap kitain ang pera!’ Kaya yong first cellphone ko na 3310, ilang araw na overtime ginawa ko para lang mabili yon. That’s the time na na-gets ko, tama ang mom ko. Simula noon, pag may gusto ako, iisipin ko, ‘Is it a need or a want?’” – from Zhel Enriquez

7. “Haan kayo nga gastador. Haan kami agtakki ti kwarta! My mom circa 1993, hahaha!”

My comment on 6 and 7: They mean the same. It’s the old Filipino style of saying “Money does not grow on trees!” but with a much stronger Pinoy punch, like Manny Pacquiao’s left hook! Hahaha! And I think the lessons worked well on them. ![]()

8. “When you borrow money, pay it.” – from Jolly Ringo Lapar

9. “Huwag patagalin ang pagbayad ng utang.” – from Cherry Ann Banan

10. “If you can’t buy it in cash, you can’t afford it!” – from Fair Rupal

My comment on 8 – 10: These are wise words they learned about borrowing. As I discussed in FQ Book 1 and in a previous article, debt is a double-edged sword. It can bring both benefit and damage. When abused, it will no longer empower you, but oppress you, for you have become its slave.

There are so many more interesting first money lessons, and we will discuss them tomorrow during our first episode on Kumu!

What is Kumu?

Kumu is a fast-growing Pinoy community platform for livestreaming. It was founded by Roland Navarro de Ros (together with Rexy Dorado, Andrew Pineda, Clare Ros) in 2017 and launched in 2018. In October 2020, the app topped the download charts of both the Apple App Store and Google Play in the free apps category. Kumu (short for kumusta) aims to become a super app that combines functionalities of other apps like YouTube, Tiktok, Shopee, Instagram and FB Messenger into one. Isn’t that amazing? A Filipino app on top of the charts? If you’re interested to check it out, please do so and join me tomorrow March 4, 2021 at 11 am.

Yup, this tita is joining the Kumu bandwagon! After having been in talks with the people at ABS-CBN since last year, FQ Mom is turning FQumo Mom! ![]()

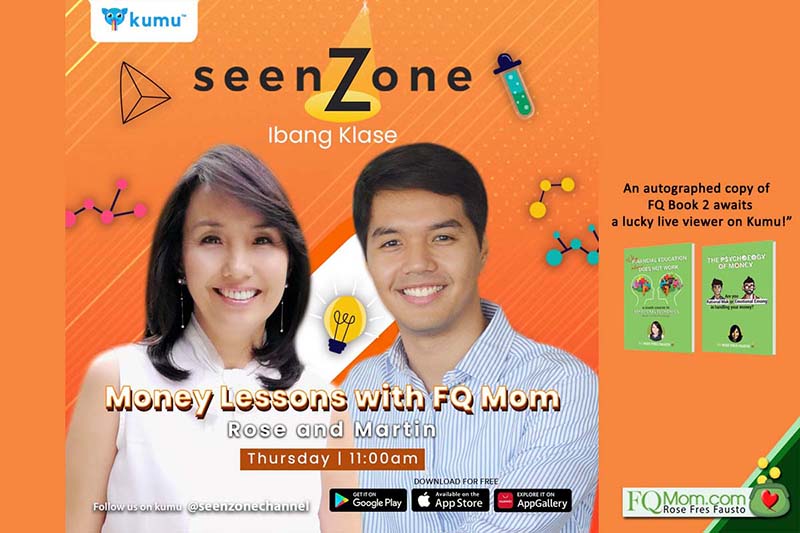

There’s a bonus: one FQ son joins me for each episode. Kumu caters to a young market, and I think my hijos will be of great help to me. Well, just on the tech side alone, I’m really better off with them around. When it comes to presenting, this middle-aged woman is so not a multi-tasker.” Even if I multitask in other things, I find it difficult to check what’s happening on different devices at the same time while I talk to the audience. But I guess, I just have to learn in order to reach out to more people.

So, please mark your calendar: March 4, 2021 at 11 a.m. For the first episode, my first son, Martin will join me. We will be thrilled and grateful to have you on Thursday. We will continue this conversation about first money lessons plus a lot more. We will give away a free FQ Book 2 to a winner to be chosen from among the live viewers who will share their first money lessons.

See you on Thursday. For the meantime, you may download the app on your mobile device now here and calendar our date! Cheers to High FQ!

ANNOUNCEMENT

1. Starting tomorrow and every Thursday at 11 a.m., you can join me live on Kumu for an hour of Money Lessons with FQ Mom (and Son). See you tomorrow!

2. Use the principles in Behavioral Economics to your advantage! Apply them not just in money matters but also in matters of the heart, career and other important aspects of life. My latest book is a product of my years of studying, writing, rewriting, some more writing and rewriting. To get your copy click https://fqmom.com/bookstore/ Insert FQ Book 2 Poster.

To know more about FQ Book 2, watch this short video.

3. On Monday, I will be giving an FQ workshop to the employees of Insular Life. This is in celebration of the Women’s Month. If you’re interested to have your own FQ Workshop for your company, family, civic or other kind of group, please contact us at FQTeam@FQMom.com.

4. How good are you with money? Do you want to know your FQ score? Take the FQ test and map out your 2021 FQ plan. Scan the QR code or click the link: http://fqmom.com/dev-fqtest/app/#/questionnaire