What is Financial Wellness to you?

What does financial wellness mean to you?

I asked this question to some millennials, retirees, and the people in between, and here are their answers:

1. “Financial wellness for me is a personal state of my financial health wherein, just like physical health, it’s a continuous journey of adapting, modifying lifestyle, developing resiliency to withstand whatever financial drawbacks that may come my way. It’s a constant goal setting to maintain a financial equilibrium to enjoy a stable and financial crisis-free life.” – Peach (married)

2. “Financial wellness for me is basically having the comfort of knowing that I’ll always have supply for my demand. :)” – Joey (married, father of 2)

3. “Financial wellness is having the security to have more than enough for daily and long-term expenses, plus having a safety net for emergencies and spare funds for things and experiences that make living and working much more meaningful.” - Anne (married, brand new mom)

4. “It’s being financially independent and being able to afford making memorable moments that will result to happy state of mind and feeling. :)” – Bebet (married with four children)

5. “Financial wellness to me is the term used to describe the state of my financial status in comparison to my relative average spending across three years. It also takes into account having fiscal diligence practices like emergency funds, funds for leisure, self, etc. In the same way doctors define your wellness relative to your body concerns, financial wellness defines the health of your wallet relative to your needs and some wants.” – Noel (married, with two children)

6. “Financial wellness is being able to live within your means, at the same time, have the freedom to reward yourself by buying things you want without feeling guilty because you have enough savings for yourself. Lastly, it is being able to provide and support monetarily the people in need.” – Monchi (single millennial)

7. “I do not have a technical explanation for this, but for me, it is an overall good feeling that the financial matters in my life are in order. There is enough for every basic need and for achieving the quality of life I desire for me and my family. Financial wellness adds to the level of security and peace of mind as we live. To be able to achieve it requires that I know how to properly use money and am able to make sound financial decisions. It’s knowing that you can use money well to benefit as many areas of your life, that you know what to do when it becomes scarce, that you can adjust depending on your financial circumstances – overall, just being able to incorporate handling finances as an integral part of living a happy and fulfilled life, without necessarily being super rich!” – Wosh At Work (working mom)

8. “Financial wellness for me is simple. If I die tomorrow, I won’t be a burden to my family. If I live today, I’m a blessing to people around me especially my family or loved ones. It also means that I have the freedom to say ‘No’ if it compromises my values, integrity, and reputation.” – Keiven (single millennial)

9. “I agree with google search definition :) There are many facets to financial wellness, to name a few: a.) Ability to live within one’s means; b.) Being financially prepared for emergencies; c.) Having the knowhow needed to save and make good financial investments/decisions; d.) Having a plan for the future.” – Alfonso (single)

10. “As a seafarer’s wife, financial wellness, which is a top priority to me means a.) Having sufficient life and health insurance for me and my husband because our sons who are aged 19 and 15 are still financially dependent on us; b.) Having an emergency fund equivalent to one year’s worth of our family’s expenses; c.) Having sufficient monthly passive income so that I don’t have to worry if my husband (our breadwinner) is on vacation. Our main source of passive income is from apartment rental. We have saved up for it for many years because we did not want to take out loans from the bank to finance the construction. My husband and I wanted to avoid worries in case no renters would occupy the units immediately; d.) Having no bad debts; e.) Having a fund for our sons’ college tuition fees; f.) Having a separate date fund and fun fund that we can freely spend for our family’s bonding moments, especially when my husband is home; g.) Having a specific budget on our ‘giving fund’ so we can still share to others without feeling guilty saying ‘No’ if the budget runs out.” – Doris (seafarer’s wife, full-time mom of two)

11. “As a mid-level government retiree, it is having at least Php1 million in the bank and being able to still set aside at least Php5,000 from my monthly pension. It is being able to find an alternative business or job that would allow me to continue saving. And most of all, it’s having a mortgage-free house.” – Jane (retiree)

12. “Financial wellness is a state of one’s well-being in relation to money, where a person experiences prosperity, good health, satisfaction, and happiness with a sense of meaning or purpose for his wealth in life. He is able to manage stress and avoid worry and anxiety associated with money difficulties, having control over his finances, being free of debt and financially prepared to handle financial emergencies.” – (Pol Española, retiree, Freedom Father)

It was very interesting for me to see different perspectives on financial wellness. And this is what we should always remember. Financial wellness means different things to different people. And yet, there are very fundamental similarities in their definitions.

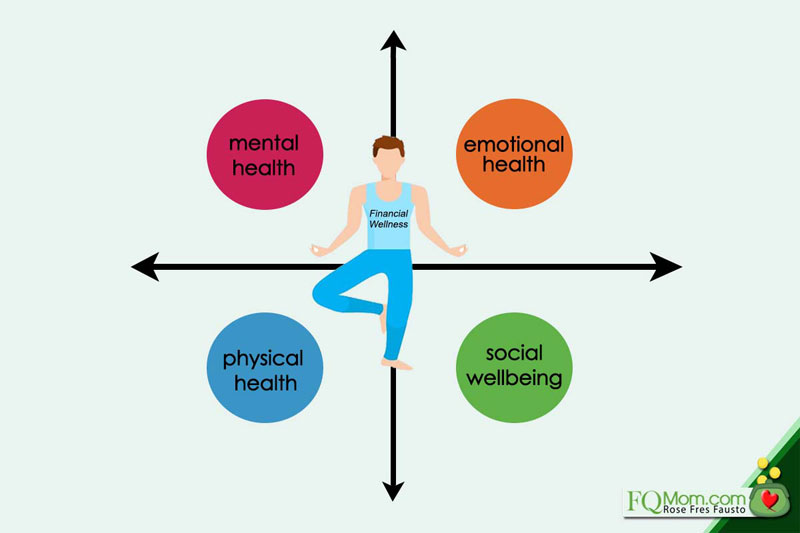

Financial wellness is the overall health of your finances. And it is not an amount of money and other assets that you can measure on a stand-alone basis. It is not “one-size-fits-all.” It’s because financial wellness intersects with each individual’s physical, mental, emotional, and social well-being.

The above is the reason why we should always start our FQ journey with a deep foundation. We go down our childhood money memory lane in order to understand our respective family money stories. It’s actually a bitter-sweet but definitely liberating exercise for our FQ Workshop participants to do this CMM (Childhood Money Memory) exercise. Even FQ Book readers give me the feedback that the exercise has a cathartic effect on them. Here’s one that I recently received, “FQ: The nth Intelligence is filled with sobering wisdom wrapped in motherly warmth. I felt like the book and I developed some sort of mutual trust, because it got really up close and personal. Chapter 4 blew my mind away! The exercise on CMM was surprisingly painful, ultimately liberating, and most of all, encouraging to start 2021 with fresh and sharper eyes!”

The CMM exercise is followed by looking into our core values. Values are not material things. They are core beliefs and philosophies that we live by. These are the principles that we are willing to work hard and sacrifice for. Some are even willing to die for their core values. Examples are Family, Spirituality, Health, Relationships, Autonomy, Love, and many more. In Gallup Strengths Coaching, we use 28 values.

The importance of knowing your core values very well is for us to be able to use them as our compass in the way you deal with money. In the 12 definitions we have above, we can see that they are defining financial wellness as being able to use money to help them live the life that they want. Because ultimately, the purpose of money in our life is to fulfill our core values. If we fail to have this alignment of how we use money and how we live our core values, we will never be truly happy, no matter how rich we become.

So, my dear reader, have you decided what financial wellness means to you? I hope this article helps you articulate it as we start another year.

Cheers to high FQ!

Announcements

1. I will be one of the speakers at the InvestaFest, an event happening from January 21 – 24, 2021. My talk will be released on January 21, 2021 at 8am. Then we will have a live Q&A on January 22, 2021 at 5pm.

2. On January 23, 2021, I will speak at the Viviamo Women Event entitled Women Being Well.

3. My son Anton and I will speak at the What’s Your Game Plan” event of AXA Philippines on January 30, 2021. Watch out for it.

4. Want to start the year by knowing your FQ Score? Take the FQ Test and map out your 2021 FQ Plan. Scan the QR code or click the link http://fqmom.com/dev-fqtest/app/#/questionnaire

5. To understand how our human wiring works in our important decisions on money and other important aspects of life, read FQ Book 2, a 2-in-1 book. After years of studying, writing, rewriting, some more writing and rewriting, I’m happy to announce that it’s finally accomplished, my new baby! To pre-order, please click link.

To know more about it, watch this short video .

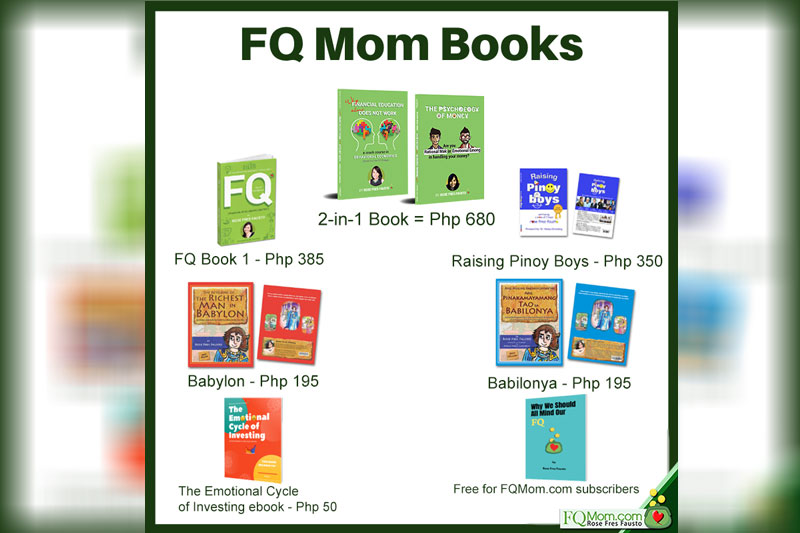

6. If you want to enhance your FQ through stories, check out FQ Mom books, available in print (with autograph) and ebook versions.