Beyond side hustling: Sam YG, Tony Toni's tips to grow your income

MANILA, Philippines — “Don’t put all your eggs in one basket.” We’ve often been told of this idiom, and it has never become truer at this time when the economy is slowly opening up after lockdown was gradually eased up since March.

The workforce and businesses were among the severely affected with physical distancing in place. Those relying on their paychecks went through uncertainty as they are dependent on their company’s performance amid the bear market, that according to Forbes lasted from March to August this year.

Small, MSMEs, and big businesses have their stories of survival. Notable, of course, was the rise of home-based F&B businesses that heavily used Instagram and Facebook in selling their heirloom recipes or trendy dishes such as sushi bake and ube pandesal.

These are all well and good but do you know there is such a thing called “passive income”? Yes, it is possible to continually earn money without breaking much sweat. All it needs is time.

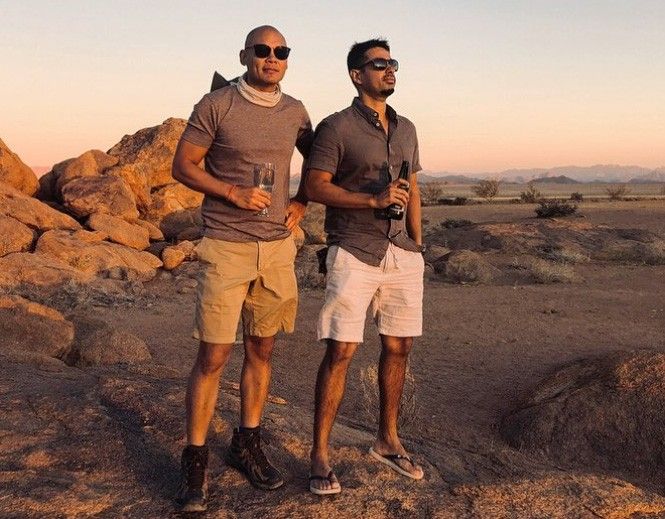

Radio personalities and “Boys Night Out” hosts Sam YG and Tony Toni attested that this has helped them have better financial disposition, even amid uncertain times.

“We’re here to tell you how regular guys like us started investing and how we grew our money slowly and surely as the years passed by,” Sam YG shared during the Bonds & Stocks Conference hosted by The Global Filipino Investor (TGFI) last weekend.

“It started in 2005 or 2006 when I was working for a multinational finance and insurance corporation. My bosses were heavily into the stock market. For a fresh grad like me, I see stock market as a heavy word. My automatic notion was ‘Grabe. Kailangan mayaman ka para makapag-invest diyan.’ It’s gambling for rich people. That was my first understanding back in college,” Sam YG confessed.

Hustling to make money

Both talked about their favorite “hustle,” which is their radio broadcasting jobs, that initially paid meager amounts. Sam YG said he earned P8,500 a month while Tony Toni was paid P3,333. This was around mid-2000s.

Sam YG also shared that aside from his misconception on the stock market, all he ever knew about saving money was from the advice of his parents who told him to put his money on time deposit.

“If you want your money to grow, you need to learn how to invest. I want to use the word ‘learn’ because that’s we want everybody to do — to learn what other investment instruments that are out there to make your money grow,” Sam YG shared.

Saving vs Investing: Which is better?

To prove that there is more value investing money than saving in a bank, he bought his first stocks in 2007 with Ayala Land which was valued then at P5. And from then on, he continued his investments and said he has not had major losses until today.

Aside from stocks, Tony Toni also invested in real estate since he said he loves traveling. He has bought properties in Palawan, as well as went into partnerships in some properties in Boracay. He admitted that some of his property investments, especially in Boracay, are badly hit by the pandemic and the onslaught of the successive typhoons that hit the country early this month.

Even if it he had losses, Tony Toni admitted it was a loss that he was prepared to take. This is an advice he can give to anyone who wants to invest – to invest in a market, product or service that one believes in or uses.

Tips for first-time investors

For those who are thinking of starting on their investments, Sam YG and Tony Toni gave tips culled from their experience.

Every investor should know his risk appetite, said Sam YG. This entails weighing the level of risk an investor is willing to take before pursuing an investment.

“I think the first thing you should consider is your risk appetite. Like, if you have a family that depends on you, you have a different risk factor. If you’re single, your risk appetite is higher because you don’t have that much people who might depend on you,” he said.

After establishing one’s risk appetite, one should also consider the length of investment. Sam YG posed this question: Are you a day trader or are you a long-term trader? This is crucial as he found over the years that he has higher gains when he decided to be a long-term trader.

“I put my money in different companies, stocks and shares. Those that I’ve not touched from the time I started years before until today, none of them registered any losses. The index of PSEi has not really gone down. Of course, there’s a pandemic, but if you compare it to 2006, all those stocks that I bought, they have not lost yet.”

Sam YG continued, “Ide-date ko ba ito ng three months lang? Ide-date ko ba ito ng girlfriend-material or ito na ba yung pang-asawa? Short term, mid-term or long-term?”

He stressed that the longer the term of which ever instrument one decides to invest in, the lower the risk will be.

Third factor should be practicing due diligence: do your own research. Tony Toni emphasized this several times throughout their session. He stressed that one must not believe in the “hype” of friends or relatives who might encourage or influence one to invest in a particular property or stock.

One must instead check on reputable sources of information because there is a wealth of it on the internet. One example is TGFI whose website (tgfiph.com) is regularly updated with news on stocks, bonds and relevant articles on how to grow one’s money.

“You really have to do your due diligence. At the end of the day, it is your money. You worked for it so you should be the one who should learn. You can’t blame your barkada or parents unless you’re paying an actual financial advisor. But at the end of the day, it’s your choice. You win with the gains, you lose with your losses,” Sam YG said.

Tony Toni's hope is for people to start early. "If you haven’t, it’s never too late."