A fun way to teach kids how to be money smart

Most parents excel when it comes to teaching their kids about safety and good manners, but with money matters few know where to start.

Raising children to be financially smart can be a challenging task for parents because most of them feel financially inept themselves. Yet, research suggests that parents’ behavior is the biggest influence passing their (good or bad) habits down to their children.

In a survey conducted by Prudence Foundation the community investment arm of Prudential in Asia among parents all across Asia on the importance of financial education for their children, 95 percent feel that it is “extremely important.”

“But they’re reluctant to teach their kids about money matters because they don’t have the right tools available,” notes Marc Fancy, executive director of Prudence Foundation, during the PRUWise webinar titled “Cha-Ching Kids at Home: Financial Literacy Basics for Filipino Families” on Zoom.

And that’s a big challenge because financial education and money management is such a boring topic. It’s really hard to get kids excited about it.

“As an investment company, we feel that financial literacy is really an important topic; not only in Asia, but around the globe,” Fancy adds. “And so we developed a financial education program for kids that’s fun and engaging.”

With the help of Cartoon Network, Pru Life UK created an animated musical show for children that teaches money-smart values for kids seven to 12 years old.

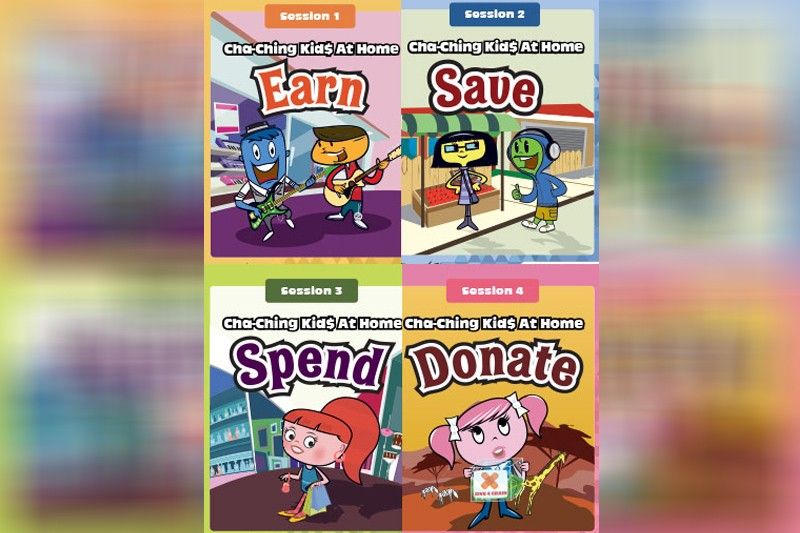

Simply titled Cha-Ching Money Smart for Kids, which airs on Cartoon Network, tackles the four core money concepts: Earn, Spend, Save and Donate. Through a series of animated music videos about a band of kids — Prudence, Zul, Justin, Bobby, Charity and Pepper — with different-money spending habits, children can learn practical money-smart skills.

“Earn, save, spend and donate” are repeated in various episodes, which allows kids to master these and use it in their everyday lives.

“We hope that these four key behaviors will provide a good foundation for children, as well as help them make better financial decisions as they get older,” enthuses Fancy.

Teach them well and early

Hosted by TV personality Tonipet Gaba and Pru Life UK’s Mary Jane Pangan, the webinar featured education and finance experts Dr. Queena Lee-Chua and Dr. Mary Joy Abaquin, who shared insights on how parents can raise money-smart children at home. Some 700 parents, teachers and children from around the country joined the virtual event.

So when is the right time to teach kids about money?

“Start as soon as they are able to count, and when they ask you to buy them toys,” Dr. Abaquin hastily replies. “Don’t buy the toy right away even if you can afford it. Show them the price tag or ask them if they need it so badly. The whole idea about talking to our children about money matters is very important.”

Time these (discussions) around dates when the kids are due to receive a reward for having good grades or behaving during their online classes so that you can also talk about saving versus spending.

Dr. Abaquin cites a US study that says, “If parents talk to their children at least once a month, it will increase their financial literacy.”

“So imagine if we do it every day. Their financial literacy rate will increase because it becomes part of how they think and behave,” she adds.

But financial lessons must be age-appropriate to resonate. Lessons should be tailored for their age, rather than just made simpler.

Dr. Abaquin, founding directress of the Multiple Intelligence International School and author, also guided parents through the concepts of financial and fiscal responsibility, saving and investing, and responsible consumerism by making smart spending choices.

“It’s also important to teach our kids to be grateful for everything that they have, rather than focus on the things that their friends or classmates have,” advises Dr. Abaquin. “If they do the latter, that’s when impulse spending happens.”

As parents, we should instill in them “to live within their means” so that they will not be burdened with too much debt later on.

“Financial freedom is a mental, emotional and educational process that all of us have to go through. As parents and teachers let us take an active part in giving our kids this lifelong gift,” Dr. Abaquin stresses.

For her part, multi-awarded Ateneo professor and author Dr. Queena Lee-Chua shared tips on introducing money concepts to kids and encouraged parents to normalize lessons about monthly bills, exchange rates or distinguishing between needs and wants when kids are older.

“Parents and teachers are the best role models,” notes Dr. Chua. “If we don’t practice what we preach, it will be absorbed by our kids.”

Cha-Ching, Dr. Chua adds, provides an avenue for parents to teach their kids essential life skills like money management in an engaging way.

“What I love about Cha-Ching is that the lessons don’t stop after watching the video. There are many activities you can do with your child after that give kids a chance to practice these essential skills,” Dr. Chua notes.

Some of the activities were featured in the “Cha-Ching Kids at Home” webinar. In “Guess the Price,” students were asked to give the estimated cost of certain school supplies. They were also asked if an item is a necessity in the “Need or Want?” game. Students were asked to give the estimated cost of school supplies in “Guess These” games based on existing Cha-Ching Kids at Home modules.

Winners received P500 gift cards and exclusive Cha-Ching comics. One lucky attendee won a brand-new tablet to aid in his/her home schooling.

When Pru Life UK conceptualized Cha-Ching, the company knew that coming up with a cartoon by Alice Wilder, the creator of Blue’s Clues, would never be enough, “so we partnered with Junior Achievement Philippines to create a curriculum,” enthuses Fancy. “And what we ended up with was an ecosystem, a platform where teachers, parents and students have access to a lot of (financial) learning tools available. Our modules are free and available online.”

* * *

Parents can view or print out the Cha-Ching Kids at Home modules online, including parent guides and daily challenges that teach their children the four basic money management concepts: Earn, Save, Spend, and Donate. Modules come with hands-on activities and music video links.

Access the modules at www.cha-ching.com.