How about cutting the financial umbilical cord of our parents?

From reader:

Dear Ma’am Rose,

Ganda po ng articles nyo about “cutting the financial umbilical cord of our children!” (link to articles 1, 2 and 3). I am pregnant with our first child at relate na relate ako - I agree that there should be a time to cut the financial umbilical cord of our children. I have friends with siblings who are still depending on their parents financially even into their adulthood. They can’t finish a course, some can’t hold a job.

By the way, I’m an OFW and as expected, nagpapadala nga pera sa pamilya sa Pilipinas. Here’s the other side of the cord - I hope you can also share your views and advice for parents naman na umaasa sa mga anak. Sana ang anak din puedeng mag “cut ng financial umbilical cord” ng parents.

Not that I do not want to help my parents pero nakakalungkot lang isipin na nakikita kong hindi sila nagbabago, parang walang progress sa situation. I feel like I am forever paying their debts, and for other tings due to their poor financial decisions. Nagpapamana na nga po sila e.

As an OFW I don’t know how to help them other than send money every month because I am also busy with work. I tried to make conversations with them to find ways to improve their financial situation pero parang hanggang usap-usap lang. I can’t get them to move.

Thanks in advance for your advice. – M.G.M. via FB PM

My reply:

Dear M.G.M.,

Thank you for your letter and I wish you a safe delivery of your first child. May your child be raised with good Filipino values mixed with the positive values of your host country. I also wish that you raise your child to have a high FQ! That way, you will be confident to cut his/her financial umbilical cord once he/she graduates from college! ![]()

I hear you loud and clear with your question, “How can children cut the financial umbilical cord of their parents?” And I have encountered this concern too many times among our OFWs and also those living here in our country.

Providing for our parents stems from filial piety, the Confucian and Filipino-acquired virtue of respect for one’s parents. It is actually a positive virtue that helps the family stay united and strong. However, anything in excess may cause problems.

In the olden days when families would stay together such that one household consisted of several generations, it was easier to carry out the financial contribution of the generation that was earning more, which probably in your case now, would be you. Back then, children usually inherited the profession and properties of their parents, so there was a natural passing on of financial burden to the more productive generation, the middle generation.

But times have changed. Children don’t inherit the professions of their parents anymore. They live outside their parents’ homes. In your case, you even live outside the country. This makes it difficult to expect you to carry the financial burden of another household because you have your own household to worry about.

Now the challenge for you is how to tell your parents that you also need to stop giving them their monthly allowance in order for you to set aside for your own retirement and for the needs of your growing family.

Families have their own culture, way of communicating and showing love and care for each other. What are yours? Bear these in mind when you talk to them about this sensitive matter.

Here are some guidelines to ponder upon.

1. How old are your parents? What is the current state of their health?

2. Are they gainfully employed? If so, how are they using their earnings? Are they setting aside for their own twilight years?

3. If they’re not employed, why? Aren’t they capable of working and earning anymore? If they still are, can you gently recommend earning options for them?

4. Your specific arrangement with your parents: When you left to work abroad, what was the agreement? Did you have any formal or informal terms and conditions with regard to your monthly contribution to them? Are they for your parents’ expenses? Or do they include other relatives and friends’ expenses? Is there an expiry to the monthly contributions?

5. Your siblings: If you are not an only child, have you discussed financial matters with your siblings, especially the ones concerning your parents? Oftentimes, there is this unfair assumption that those working abroad and earning dollars should be the ones providing for their parents. Talk about this matter carefully and healthily.

6. Your own financial situation. Have you listed down all your expenses on a regular basis? Do you already have an emergency fund? How much more are you going to spend with the arrival of your baby? Have you considered setting aside for his/her education? Are you insured such that if something happens to you, your dependent(s) will be okay? Have you started setting aside for your own retirement nest egg? Have you come up with your own Balance Sheet to see how much you have in order to have a guide on how much you need to set aside for a happy old age? Talk to your husband about your own situation.

I know it’s not easy to have these conversations, but you must have them. It’s not easy to tell your parents that you want to cut their financial umbilical cord. Some might say this is un-Filipino! We often hear people say, “Uy pamilya yan, hindi nagbibilangan” and so money issues are left the elephant in the room. But you see, not confronting the matter puts your own financial future at risk. You, who are in that “sandwich-generation,” will not have enough time to prepare for your own old age. If this goes on unchecked, you will pass on the burden to your own children in the future and perpetuate the vicious cycle of financial dependence. This has to stop.

Once you have assessed your own financials and you know how much you’d wish to set aside for your own retirement nest egg, have a heart-to-heart conversation with your family. Do things gradually if it is possible to eventually cut, or at least reduce the financial dependence of your parents on you.

Take a closer look at your parents’ financial condition. If you can, maybe you should also help them prepare their Balance Sheet. Who knows, they may have assets that can be sold or properties they can earn from. You mentioned, “Nagpapamana na nga sila!” What are these properties? Shouldn’t they be used for your parents’ expenses instead of being given away? It’s okay to give away for so long as you are not a burden to others. Do they have a house that’s already too big and too expensive for them to maintain? Maybe selling it and downsizing can provide that needed liquidity.

As mentioned in number 3, maybe they can still have an earning activity. Convince them to have one. It’s not only good for the pocket, it’s also good for the brain, soul and quality of life in general. Our life span has become longer and retiring at 60 should be re-invented. It’s possible that they will live up to their 80s or beyond, and that’s a lot of years of monthly expenses, and a lot of years of not doing anything productive if they opt not to engage in an earning activity anymore.

I wish you the best of luck in talking to your parents and other family members about this. Sometimes, it’s also good for them to hear these principles from other people. Give them articles and books that discuss this matter. The FQ Book lengthily discusses this money issue with family. (Click link to order a copy for your parents) I hope it helps.

Cheers to high family FQ! ![]()

*********************************

ANNOUNCEMENTS

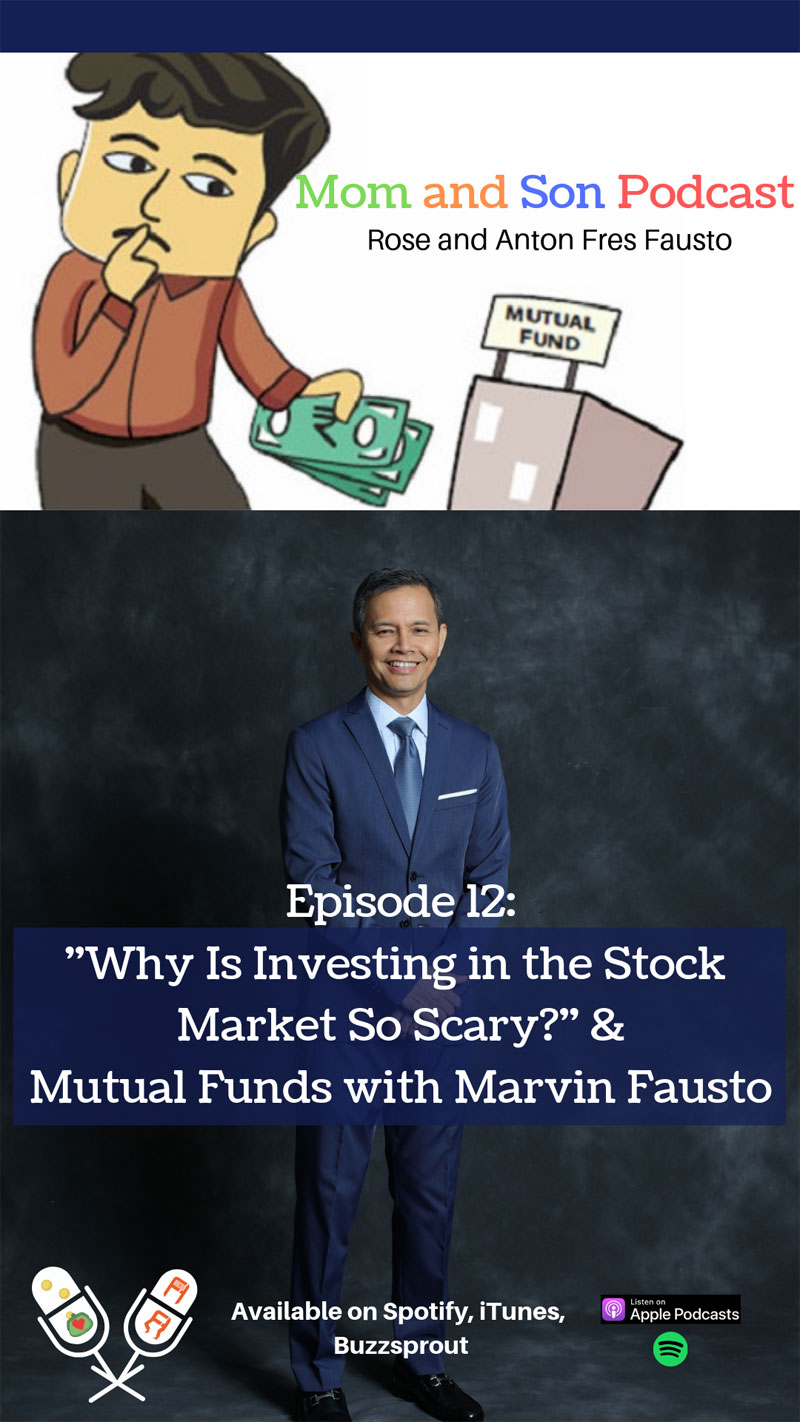

1. Why is it so scary to invest your money in the stock market? We discuss its different misconceptions, break it down and explain what the stock market really is, with our focus on mutual funds. Today’s guest is the founding President of the Fund Managers Association of the Philippines (FMAP), aka the Honey, Marvin Fausto! With 30+ years of experience in the finance industry, we briefly explain the five different kinds of mutual funds, and how everyone can easily take part and invest in their financial future. For all your questions, e-mail us at antonfausto@gmail.com.

Cartoon image – https://www.investmentpedia.org/portfolio-approach-in-mutual-fund-investment/

Spotify:

https://open.spotify.com/episode/5g26cKJTHJF2IP2ALSVmE4?si=CEfIN2uxSQ6_3Ie9S4kghg

Apple iTunes:

https://itunes.apple.com/ph/podcast/mom-and-son-podcast/id1449688689?mt=2

YouTube:

https://youtu.be/DhDtB2FQrJo

2. I’ll be having an FQ workshop for the Insurance Commission in Gender and Advancement. This is part of the InLifeSheroes project, a collaboration with Insular Life and the IFC (International Finance Corporation), a member of the World Bank group, this coming March 29, 2019 (Friday).

3. Thanks to those who already bought the FQ Book, especially to those who took the time out to send me their feedback. Your feedback is food for my soul. To those who have not gotten their copy yet, here’s a short preview of “FQ: The nth Intelligence.”

You may now purchase the book in major bookstores, or if you want autographed copies, please go to FQ Mom FB page (click SHOP), or FQMom.com (click BOOKS), or email us at FQMomm@gmail.com.

4. Want to know where your FQ stands? Take the FQ Test Challenge now! Click link: http://rebrand.ly/FQTest

Rose Fres Fausto is a speaker and author of bestselling books "Raising Pinoy Boys" and "The Retelling of The Richest Man in Babylon" (English and Filipino versions). Click this link to read samples – Books of FQ Mom. She is a behavioral economist, a certified Gallup strengths coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook & YouTube as FQ Mom, and Twitter & Instagram as the FQMom. Her latest book is "FQ: The nth Intelligence."