‘Invest only what you can afford to lose’ is a bad investment advice!

To believe the advice “invest only what you can afford to lose” is to treat investing as gambling!

I cringe whenever I hear this advice. Why? Because it is a bad advice! Imagine if Uncle Warren Buffet followed that advice. He wouldn’t have become the world’s best investor. Okay, let’s get more real. Imagine if the regular Juan and Juana would follow that advice. Both would never get to say, “I am ready to have a decent retirement.” And that is even after they have set aside savings religiously from the time they started working! Inflation would have eaten up the purchasing power of their savings leaving them feeling kawawa despite being conscientious in following the first basic law of money, “Pay yourself first.”

It should be remembered that yes, all investments have risks but to invest only the money you are willing to lose? Come on. That is like saying “do not invest!” I am not willing to lose the money I invest. I am willing to take calculated risks.

Warren Buffet’s investing principles are summarized in two rules:

Rule No. 1: Never lose money.

Rule No. 2: Never forget Rule No. 1!

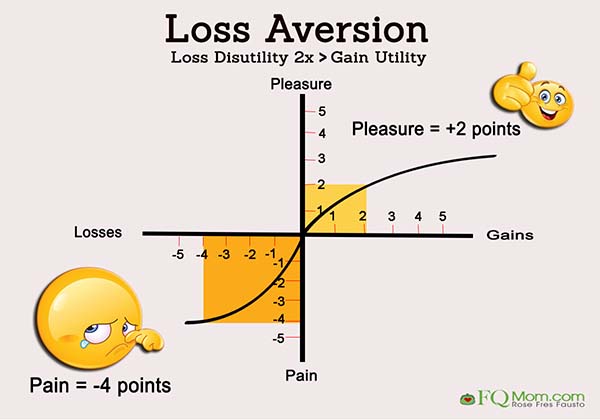

The loss aversion is very much at work here. This is the principle explained in the seminal study of Nobel Laureate Daniel Kahneman and his late friend and collegue Amos Trevsky entitled “Prospect Theory.” Simply stated, loss aversion explains that we feel the impact of a loss twice as much as the impact a gain. Click Loss aversion (The psychology of money) and Myopic loss aversion to read more about it.)

And so this is why only a miniscule less than 1 percent of Filipinos invests in the stock market, despite the fact that it is the asset class that gives the highest return in the long run.

The advice “invest only what you can afford to lose” is most likely a reaction to the prevalent occurrence of people losing money in the stock market due to misguided active trading. I’ll say it again, even if investing is (and should be) for everyone, active trading in the stock market is not for everyone. I only know of very few successful active traders, most of whom own the stock brokerage firm they trade with. And remember, traders love to talk about their wins but are quiet about their losses. ![]()

To believe the advice “invest only what you can afford to lose” is to treat investing as gambling!

Restating the wrong advice

So let’s re-state that ill advice in order to have a decent retirement. What these finance guru-guruhans probably mean is that you should always have liquid assets to fund your different needs – household expenses, school-related fees, etc. And that’s correct.

Here’s how we can mitigate our unhealthy loss aversion when it comes to investing. We have to be very clear on what is short term, what is medium term, what is long-term in our portfolio. For short term needs, just put your money in fixed income instruments like cash accounts, time deposit, money market placements. For long-term needs, invest in the stock market, preferable in equity index funds. You may also invest in a business that you understand and have the time to manage. (Remember the second basic law of money?) For medium term, have a combination of short and long term funds.

So let’s re-state that advice:

That’s right, invest only what you can afford to hold for the long-term. But remember, we all have long-term needs such as retirement. So that means that everybody should be investing for the long-term! If you haven’t started because of the confusion that this investment advice has caused you, check your portfolio now and start moving some of your low return fixed income assets to higher yielding long-term assets. And after you do, brace yourself as you will definitely experience the highs and lows in the market. Stay calm and remind yourself that you will not need this until after several years. You have your short-term funds to take care of your short-term needs.

Cheers to well-guided investing! ![]()

********************

ANNOUNCEMENT

Want to know your FQ score? Take it today. Click link to take the test. http://tinyurl.com/FQTest

Rose Fres Fausto is a speaker and author of bestselling books “Raising Pinoy Boys” and “The Retelling of The Richest Man in Babylon” (English and Filipino versions). Click this link to read samples – Books of FQ Mom Rose. She is a behavioral economist, a certified gallup strengths coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook and You Tube as FQ Mom, and Twitter & Instagram as theFQMom.