‘Don’t miss the TRAIN!’ (Use your additional take-home pay to pay yourself first!)

"If you will have a higher take home pay due to the TRAIN: Please don’t miss the TRAIN!"

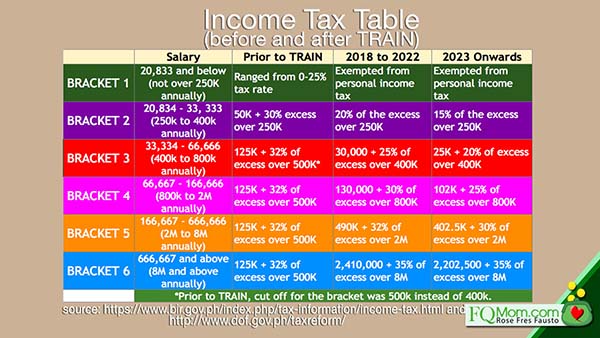

The TRAIN (Tax Reform for Acceleration and Inclusion) has been signed into law and will take effect on Jan. 1, 2018. This means that if you belong to income brackets 1 to 5, you will be enjoying a higher take home pay on the first sueldo of the year! Check where your salary belongs to using the table below.

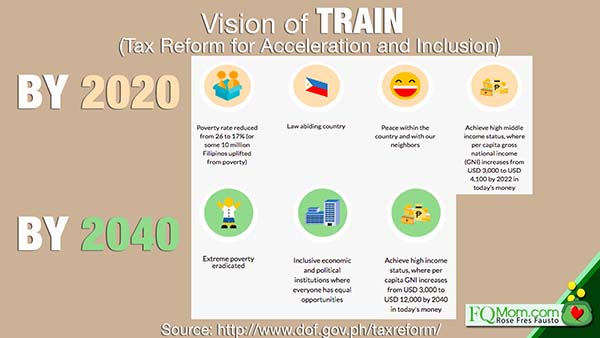

If you visit the website of the Department of Finance, they have a neat presentation of the TRAIN: http://www.dof.gov.ph/taxreform/

The six goals of the program are presented in a simple and visually appealing manner as shown below.

If you scroll down, you will see the vision of TRAIN.

Based on the above vision, by 2020 poverty rate will be reduced from 26 percent to 17 percent or some 10 million Filipinos uplifted from poverty. By 2040 extreme poverty will be eradicated.

But wait…

Eradicating poverty has been a never-ending and elusive dream for every leader, and for all of us for that matter.

We complain of low income and point to it as the reason why we are unable to set aside money for our future. With the higher take home pay brought about by the TRAIN, will those in brackets 1-5 now set aside more money for retirement?

If you want to see the effect of the TRAIN on your take home pay, click this link: https://bir-excel-

Let’s take an example. If you earn P20,000 per month, your annual tax in 2017 was P32,206.10 that was withheld from your income – P2,683.84 every month. Now with the TRAIN, guess how much you will pay in 2018?

Zero! That’s right and that’s a huge extra cash without changing jobs or working overtime.

The question is “Where will that money go?”

My plea to workers:

If you will have a higher take home pay due to the TRAIN: Please don’t miss the TRAIN! Put the tax savings (or at least half of it) in your retirement next egg, invested monthly automatically. This way you don’t have to decide every single payday and be tempted to spend it.

Think of it this way. You were paying the government that much, and now they’ve decided to give it to you, what will you do with it? Who do you want to benefit from that “windfall?” Will you pay the suppliers of various goods and services or will you pay yourself first? If you choose the former you are helping the suppliers earn more. If you choose the latter, you are ultimately helping yourself prepare for a comfortable life in the future.

Save and invest that windfall right at the start – on January 15 or 30, whenever your first sueldo this year will happen. Don’t get used to spending more due to the tax savings. If you end up eating out or shopping more or getting a higher cellphone plan, etc., you are paying yourself (your future self) last!

Take your pick, who do you really want to benefit from the TRAIN? Your suppliers or yourself?

My plea to employers:

For employers, I ask you to help your employees practice pay yourself first. Design something for them. Make saving and investing a default arrangement in their payroll account. You are not taking away their freedom to spend their money, because they do have the choice to opt-out. But just like a good parent, you are setting the environment safe and conducive so that you are able to nudge them to do the right thing. Get rid of loan sharks circling around your employees during paydays, enticing them to buy this and that gadget, offering loans at exorbitant interest rates, making your employees pawn their payroll ATM cards! Do not let these loan sharks and other temptations take the first crack at your employees’ TRAIN windfall.

Your employees are in your circle of influence and care. Their financial well being is your responsibility. Ultimately, employees with healthy financial well being make good workers which are good for your company.

If you pay yourself first…

For the P20,000 per month wage earner who will put in that entire P2,683.84 per month in a low-cost index fund, he stands to accumulate anywhere from over half a million pesos (after 10 years) to over P17 million (after 40 years for the young workers), assuming an average return of 10 percent p.a.

If you put in just half, it will be P278 thousand to P8.6 million. If the employer does a counterpart funding, it will still be the P557 thousand to P17.12 million.

Such is the power of paying yourself first. That’s a significant additional amount to one’s retirement money and it could mean not relying on other people during your old age.

This tax savings is happening in a few days, let’s make sure that the intended beneficiaries, the workers, will really be the ones who will gain from it. Let it be used to pay themselves first! This opportunity to save and invest now made available to the lower income brackets may not happen in a long time, so please don’t miss the TRAIN! ![]()

********************

ANNOUNCEMENTS

1. I hope you are all set for 2018. Watch our FQwentuhan tomorrow with my son Enrique Fausto who will share his views on how millennial employees like him can benefit from the TRAIN.

2. Catch me on ANC On The Money on Jan. 6, 2018.

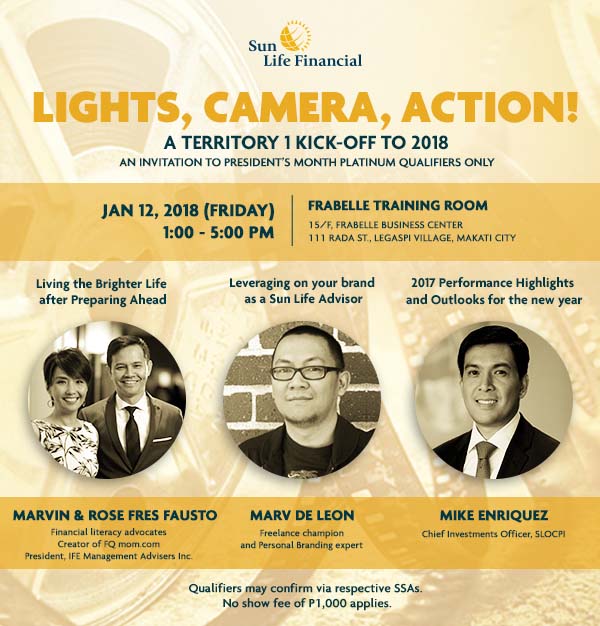

3. Marvin and I will speak about “Living a Brighter Life after Preparing Ahead” on Jan. 12, 2017 in Frabelle Business Center, Makati. Registration starts at 12:30 p.m.

4. Want to know your FQ score? Take it today. Click link to take the test. http://tinyurl.com/FQTest.

Rose Fres Fausto is a speaker and author of bestselling books Raising Pinoy Boys and The Retelling of The Richest Man in Babylon (English and Filipino versions). Click this link to read samples – Books of FQ Mom Rose. She is a behavioral economist, a certified gallup strengths coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook and You Tube as FQ Mom, and Twitter & Instagram as theFQMom.