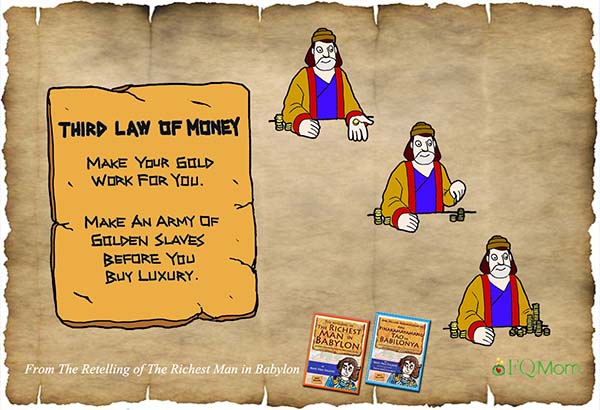

The third basic law of money

When I decided to retell Clason’s classic and came up with “The Retelling of The Richest Man in Babylon,” I simplified his many nuggets of money wisdom to Three Basic Laws of Money.

1. Pay your self first.

2. Get into a business that you understand and seek advice only from competent people.

3. Make your gold work for you. Make an army of golden slaves before you buy luxury.

I’m happy to see that the above have been picked up by a good number of people and sometimes modified to suit their respective businesses. I particularly like that of COL Financial Chairman Edward Lee’s 1) Save; 2) Invest; 3) Reinvest - easy to remember and very applicable to his talks when he teaches people how to invest in the stock market.

Today, I wish to discuss the third basic law of money. This is the law that separates those who are just able to get by from those who are able to accumulate considerable wealth.

In the story, the main character Arkhad got a scolding from his mentor Algamish when the former reported that he had been feasting on honey, fine wine, spiced cake, buying nice things using his earnings, “So you eat the ‘children’ of your savings? How can you expect them to work for you if they’re gone? You should have made your earnings earn more. You have to have an army of golden slaves before you buy luxury. This way you and your family will enjoy all these luxuries without fear of using up all your golden slaves.”

FQ Mom’s guide

Our lazy (or efficient?) brain wants to input easy to remember guidelines, and so I came up with this easy to remember rule when we can start considering indulging in luxury: Buy luxury only if you can afford to buy at least 10 pieces of it!

It’s funny when I said this during a talk with fashionistas in the audience. One said, “But Rose, all the luxuries I have, I can’t afford to buy 10 pieces of!” I just explained that when we keep on doing this, we won’t give a chance to make our investment portfolio enjoy the magic of compounding.

Now for parents who already have an army of golden slaves, the challenge is when do you allow your children to enjoy these luxuries?

Flying business class

A business class ticket costs around three times more than an economy class ticket. My first taste of flying business class was in my late 20s but that was a business trip so I didn’t shoulder the cost. For family trips, we flew economy with the boys until such time that long haul flights for our midlife bodies were getting to be a challenge. But the upgrade was just for us, the boys continue to fly economy on family trips.

This is always an interesting conversation with friends. Here you are, you can well afford to fly business class and your midlife body actually needs it. How about your children? Should you also get them business class tickets? Wouldn’t you be exposing them to luxury traveling too soon? How can they spend for their own trips when they’re so used to traveling in style since their childhood days? So do you make them travel economy, away from mommy and daddy? Or do you just forego the luxury you can afford and just endure the tight leg room, no flatbed on long haul flights that your older body will take several days to recover jet lag from?

One of the advantages of having your children early in life (in our case, 20s until early 30s) is that by the time you hit midlife and can afford to spend more on vacations, your children will be old enough to be seated away from you in the economy class, without parental worry and guilt. ![]()

How about the very…very rich?

Suppose you can easily afford to travel business, or even first class with your children, should you still make them travel economy?

Here’s an interesting story that may make you assess your own situation, should you be one of the parents who allow their children to enjoy the fine things in life too soon.

During the summit of the Philippine Shareholders’ Association of the Philippines held last August 31, a lady stood up during the Q&A to say her piece about the event’s guests of honor Jaime and Fernando Zobel de Ayala, “I remember one time while traveling with your parents, you two were very handsome young men in your twenties and you were seated at the economy class.” This elicited reaction from the audience.

Wow! The heirs to this 183-year-old conglomerate riding economy class?

Assuming you can easily afford to make your kids fly business class, how soon will you do it?

I was curious to find out more about their FQ upbringing and so in another occasion I asked Fernando, “So when did you start flying business or first class? This may sound like I’m just asking you in jest, but I’m really interested to know your answer, it will help me in my FQ archive. It’s a dilemma for parents who can afford to give it to their children but at the same time, want to instill simplicity and being frugal in their parenting.”

This was his answer, “We traveled on economy during our school years (Note: After only a couple of years at the Ateneo de Manila Grade School, Jaime and Fernando went to boarding schools in England and completed their college and masters in Harvard) and during the early years when we started working. My parents would go on business and the kids in economy. We have done the same for our kids. The only exception is when only one young child is traveling alone with us in the plane. In that case, we give the child an upgrade!”

He went on to say, “I didn’t start traveling on business until I was entitled to do so in the company and until I could afford to pay it on my own. My kids will have to do the same.”

I was so happy to receive his answer. It validated my belief that if you want to instill financial discipline in your children, delaying gratification is key. For us ordinary mortals, this is easier to do because chances are, we are still in our accumulation stage when the kids are young and so there’s not much choice about when to give them luxury. Just refer to the 10x FQ Mom guide above.

So paging wealthy parents out there. If this old rich family (and when I say old, I mean almost two centuries old) is able to delay gratification for its seventh generation heirs to their conglomerate, we don’t have any reason why we can’t. ![]()

*******************************

ANNOUNCEMENTS

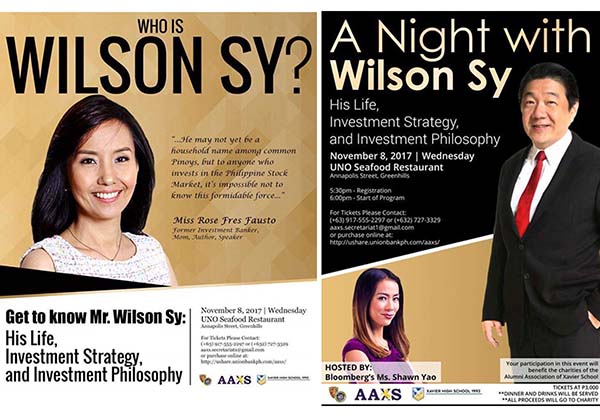

1. This is happening tonight.

2. I will be the moderator of a segment at the Blogapalooza’s annual event, this time entitled Generation D (as in Digital). This will be on Nov. 18, 2017 at the City of Dreams from 10 a.m. to 7 p.m.

3. Want to know your FQ score? Take it today. Click link to take the test. http://tinyurl.com/FQTest

Rose Fres Fausto is a speaker and author of bestselling books “Raising Pinoy Boys” and “The Retelling of The Richest Man in Babylon” (English and Filipino versions). Click this link to read samples – Books of FQ Mom Rose. She is a behavioral economist, a certified gallup strengths coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook and You Tube as FQ Mom, and Twitter & Instagram as theFQMom.