Draft constitution promises bigger revenue share for regions

MANILA, Philippines — In hundreds of hours of speeches, President Rodrigo Duterte has declared the country must overhaul the 1987 Constitution and shift to a federal system of government to address the Philippines’ widening wealth gap and empower regional governments. The Filipino people are closer to finding out if he is right.

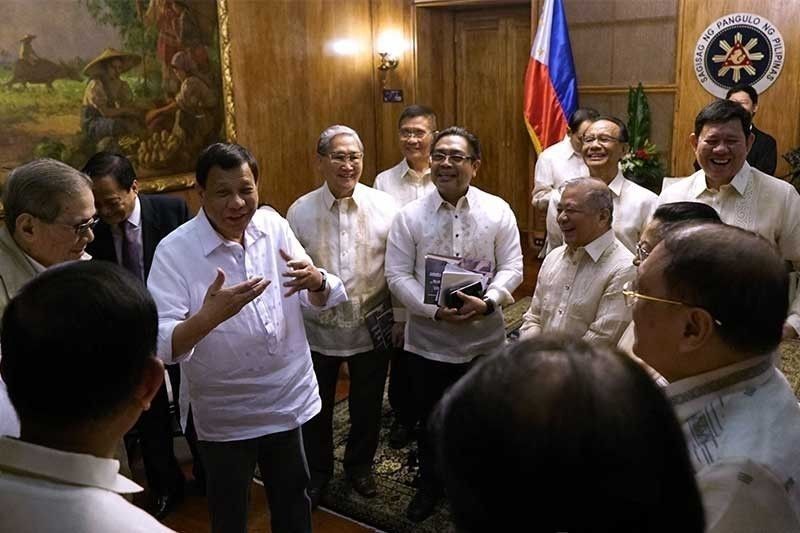

On Monday, Duterte approved the draft federal charter that was crafted by a consultative committee, which he formed to review the present constitution. He is expected to endorse the proposal to Congress.

Here’s how the con-com envisions the distribution of fiscal powers under the proposed federal government.

'Equal shares' of 50 percent

Under Article XIII of the con-com’s proposed federal constitution, the Federal Government “shall have the power to levy and collect all taxes, duties, fees, charges, and other impositions except the power to tax granted to the Federated Regions.”

Double taxation is not allowed.

The Federated Regions shall also be given a share of not less than 50 percent of all national taxes, which will be “equally divided among them and automatically released.”

Meanwhile, an “equalization fund,” which will be not less than 3 percent of the annual national budget, will be formed and “distributed based on the needs of each region.”

Federated Regions that require support to achieve “financial viability and economic sustainability” will have a bigger bite of the equalization fund, as determined by the Federal Intergovernmental Commission.

'Just share' under 1987 Constitution

According to Section 6, Article X of the 1987 Constitution, local government units shall have a “just share,” as determined by law, in the national taxes.

The country’s Local Government Code, meanwhile, spells out that LGUs shall have a 40-percent share in the "national internal revenue taxes," or the taxes collected by the Bureau of Internal Revenue.

In a landmark ruling, the Supreme Court last week effectively allowed the allocation of bigger Internal Revenue Allotments for LGUs under the national budget.

“The court interpreted the basis for the ‘just share’ of local government units under Section 6, Article X of the 1987 Constitution as being based on all national taxes and not only national internal revenue taxes, as provided in Section 284 of the Local Government Code,” the SC public information office reported.

The national taxes under the current charter include not only Bureau of Internal Revenue collections, but also Bureau of Customs tariffs as well as taxes collected by other state agencies such as the Bureau of Immigration. — Ian Nicolas Cigaral

- Latest

- Trending