Ex-finance chief lauds Duterte’s tax reforms

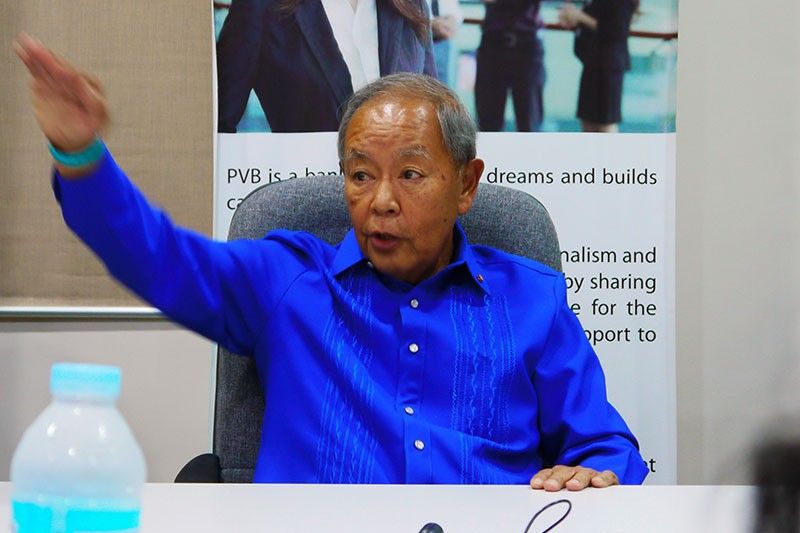

CEBU, Philippines — Amid widespread resistance from the private sector on the government’s move to re-structure the current tax incentive policies, former finance secretary Robert de Ocampo lauded Duterte’s administration in pushing reforms on tax perks.

De Ocampo led the Department of Finance during the presidency of Fidel Ramos. He said the idea of incentive reform has been proposed during his time but it failed to get approval.

De Ocampo who was in Cebu recently to grace the opening of Philippine Veterans Bank’s business center, believes that if the Duterte administration will succeed in this move, it would bring in good economic boost for the country.

“Incentives are supposedly given only to infant industries, and these industries which have enjoyed this perks for years are no longer infants. They’re not supposed to get the incentives anymore,” De Ocampo said referring to industries, who have been resisting the implementation of Trabaho Bill.

Re-structuring of incentive to industries is a right move, De Ocampo reiterated. What happens now is that the “now big” industries have been spoiled by the government.

The second package of tax reforms dubbed “Trabaho Bill” is meant to "modernize" fiscal incentives and reduce the corporate income tax rate.

The bill, dubbed as Tax Reform for Attracting Better and High-Quality Opportunities, or TRABAHO bill contains several features geared towards employment generation.

It is a substitute to TRAIN 2 of the second package of the Tax Reform for Acceleration and Inclusion.

Under the Trabaho Bill, Incentives as a lure to investors will not totally be abolished, but the government will just rationalize or streamline unnecessary "give-aways" especially to companies which are already big and earning well.

In his 4th State of the Nation Address last month, President Rodrigo Duterte appealed to Congress to pass the Trabaho bill.

The Trabaho bill aims to:

* reduce the corporate income tax rate from 30 percent to 20 percent

* broaden the tax base by removing some of the preferential or lower corporate tax rates rationalize tax incentives by making them performance-based, targeted, time-bound, and transparent. (FREEMAN)

- Latest