Premiere Horizon Alliance sued by its own director for non-payment of debt

Premiere Horizon Alliance [PHA 0.32] [link] disclosed yesterday that it had been named as a defendant in a lawsuit filed by Brandon Benito P. Leong (BBPL), a director and shareholder of PHA, alleging that Marvin C. Dela Cruz (MCDC) and his company, SquidPay Technology Inc. (SquidPay), have failed to make payments on a P100-million loan that came due in July.

The loan had a convertibility clause which allowed BBPL to elect to take payment in PHA shares, which he did.

BBPL alleges that his conversion notice was not heeded, nor were payments made by MCDC or SquidPay to pay off the debt at maturity.

A regional trial court granted BBPL’s request for a Writ of Preliminary Attachment “against the properties of [SquidPay] and Marvin C. Dela Cruz”.

PHA notes that it is listed as a defendant, but that it has not received “any summons or other documents” relating to the case.

PHA also said that the order would have “no impact on the operations and financial condition of PHA”, as it is “merely” implementing an order to freeze MCDC’s PHA shares.

MCDC purchased 55% of PHA’s shares for P925 million back in October of 2020, with the first P300 million in cash and the rest in a combination of cash and (maybe) stock in SquidPay.

MB BOTTOM-LINE

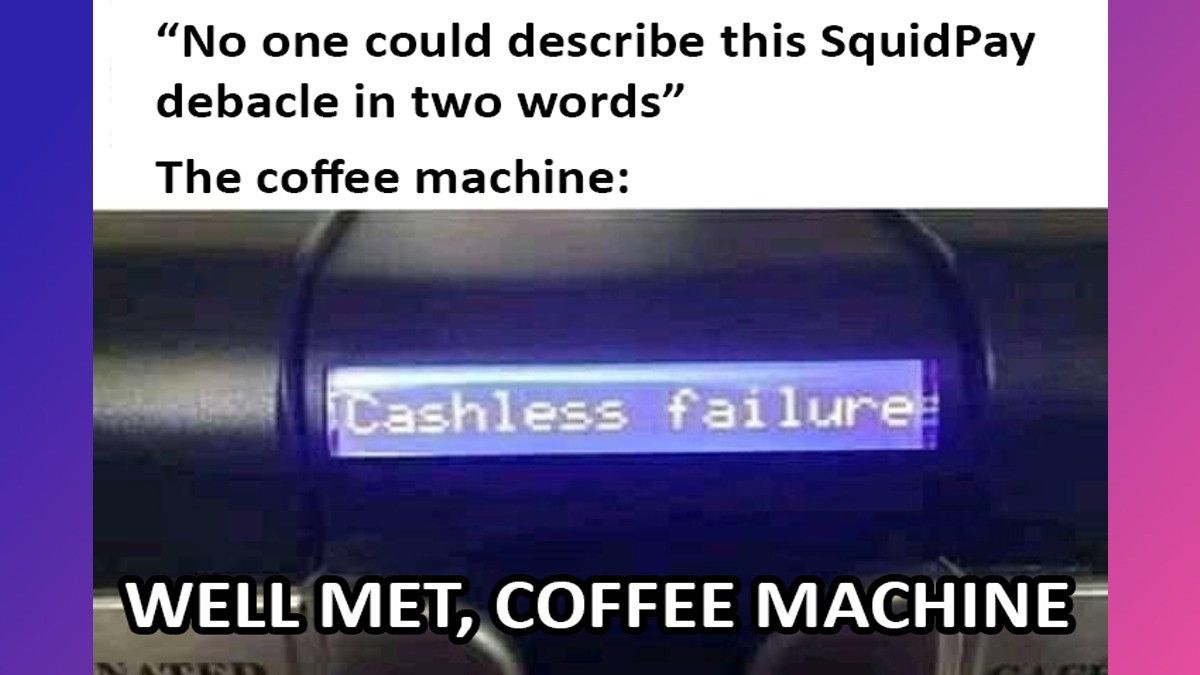

SquidNoPay, amirite!? What a mess.

It’s not clear if this P100 million convertible loan was ever disclosed by BBPL or Mr. Dela Cruz, but the timing of the loan is quite interesting.

The loan agreement was signed on December 14, 2020, when BBPL gave Mr. Dela Cruz P100 million.

Then, four days later, Mr. Dela Cruz used the funding to make the second tranche payment of P113 million on the P300 million cash down-payment he owed for his PHA shares under the October 2020 agreement.

Because the deal is a private one between BBPL and Mr. Dela Cruz, the agreement (to the best of my knowledge) wasn’t disclosed and the terms (like the conversion strike price) are not publicly available.

If we assumed Mr. Dela Cruz’s PHA acquisition price of P0.33/share to be the strike price, then BBPL’s conversion would entitle him to roughly 303 million of Mr. Dela Cruz’s 2.8 billion PHA shares, or approximately 5.3% of PHA’s outstanding shares, and reduce Mr. Dela Cruz’s ownership stake to less than 50%.

Presumably the strike price is higher, because it would have been a terrible strategic move for Mr. Dela Cruz to sign a loan deal that could result in the loss of majority ownership of PHA, in which case, there may be some impact to PHA that goes beyond simply “implementing a court order”.

But until we learn more, we won’t know how many stocks BBPL is entitled to from MCDC’s stash.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest