PAL already looking for a new $100 million loan

Lucio Tan’s airline, which went bankrupt and was only dragged from its grave by another massive injection of Lucio Tan’s money, disclosed yesterday that it is seeking a $100 million loan to add to its cash position.

Philippine Airlines [PAL suspended] said that it exited bankruptcy with $391 million in cash (what was left of Lucio Tan’s injection), but that is now attempting to negotiate the new 3-year term loan with “international lenders” to ensure a “more sustainable operation.”

PAL said that the bankruptcy proceedings allowed it to greatly reduce its fixed lease costs for the next 18 months (presumably starting from January, when the bankruptcy deals were signed) and that it was poised to “survive” the current COVID travel situation, and “thrive” when travel restrictions are fully lifted.

MB BOTTOM-LINE

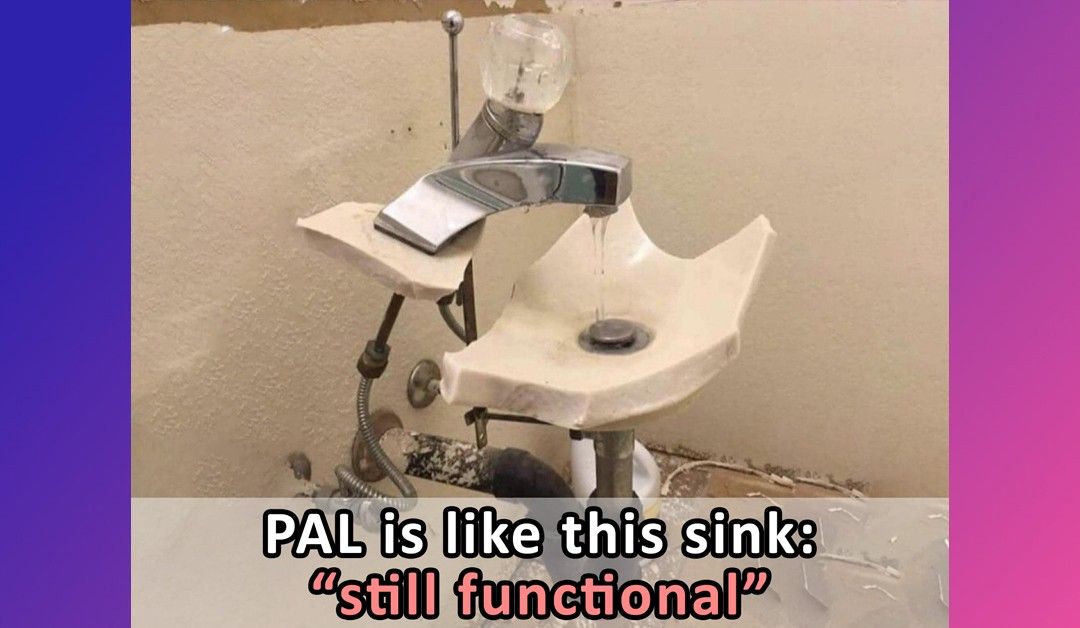

One thing is for certain: whatever PAL was when the stock was suspended more than 8 months ago is not what investors will see when (if?) it returns to active trading.

The planes will be the same, the employees will (mostly) be the same (except for all those that were let go and not recovered), but the management team was gutted and day-to-day control handed to a Lucio Tan relative, and the legal and financial foundations of the company will have completely changed.

It was smart for PAL to renegotiate lease relief (to pay “COVID market rates” instead of “peak travel market rates”), but many of those relief measures come with a time limit (mid-2023).

Despite all of the changes, though, the overall trajectory of PAL is probably the same: inefficient planes flying inefficient routes, yearning for the return of a time when Filipinos only had one option for domestic air travel.

As I said previously, if PAL does manage to stay alive, return Lucio Tan’s advances, and establish itself as a going concern with no major red flags, then Lucio Tan (and only Lucio Tan) deserves the credit.

It’s going to be really interesting to see some audited financial statements, and to watch what PAL can do for the next few quarters.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest