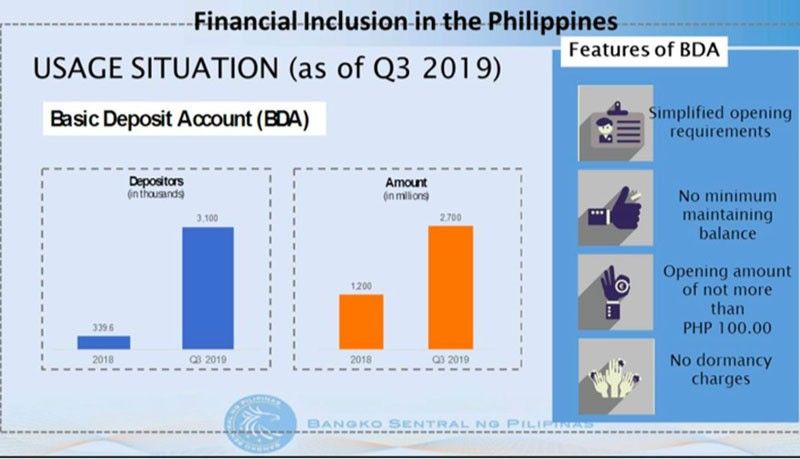

Basic deposits hit P2.7 billion with 3.1 million new accounts

MANILA, Philippines — The low cost, no frills deposit accounts have reached P2.7 billion two years after the Bangko Sentral ng Pilipinas (BSP) launched the basic deposit account framework.

BSP Governor Benjamin Diokno said the number of basic deposit accounts has reached 3.1 million as of the third quarter of 2019 or more than nine times the 339,000 in 2018.

“The increase in basic deposit accounts reflects the demand for a financial product that meets the needs and capacities of the low- income sector,” Diokno said.

Diokno reported there are now 199 banks offering basic deposit accounts from only 77 banks a year ago.

The BSP approved a new circular in February 2018 promoting account ownership among the unbanked and provide Filipinos the tool to save and transact money in a safe, convenient and affordable manner.

Minimum key features of the account include simplified know-your-customer (KYC) requirements, an opening amount of P100 or less as well as no minimum maintaining balance and dormancy charges.

“The basic deposit account addresses the very reasons most Filipinos do not have an account,” the BSP chief said.

Diokno said he intends to double the percentage of Filipino adults for formal bank account to 70 percent by the end of his term in the middle of 2023 from the current level of 34.5 percent based on the World Bank Findex 2017.

“The basic outcome indicator for financial inclusion is the level of account penetration, that is, the percentage of adults with a formal account that can be used to save money, make payments, and send or receive funds,” he said.

The BSP chief said only around four percent of municipalities remain financial unserved in the country as 95.8 percent of the total has at least one financial access points as of the third quarter from a year ago level of 93.6 percent.

Pia Bernadette Roman Tayag, managing director of the BSP’s Center for Learning and Inclusion Advocacy, said the number of retail outlets such as small shops, convenience stores, supermarkets, and pharmacies utilized as cash agents has reached over 17,000 nationwide.

According to the BSP, it also continues to create an ecosystem for digital financial inclusion characterized by wide range of players and digital platforms to facilitate the sustainable delivery of fit-for-purpose and affordable financial services.

- Latest