Amid massive buildup, Philippines banks breach P2-T capitalization mark

MANILA, Philippines — The capitalization of Philippine banks breached the P2 trillion level last year amid the capital build-up undertaken by industry players in anticipation of faster credit growth, the Bangko Sentral ng Pilipinas (BSP) said in a report.

The report on the Philippine Financial System for the second semester of 2018 showed the capitalization of the Philippine banking system settled at P2.07 trillion in end-2018, 14.2 percent higher than the end-2017 level of P1.76 trillion, due to the capital build-up in view of the ongoing Basel reforms and in anticipation of further expansion of the credit portfolio.

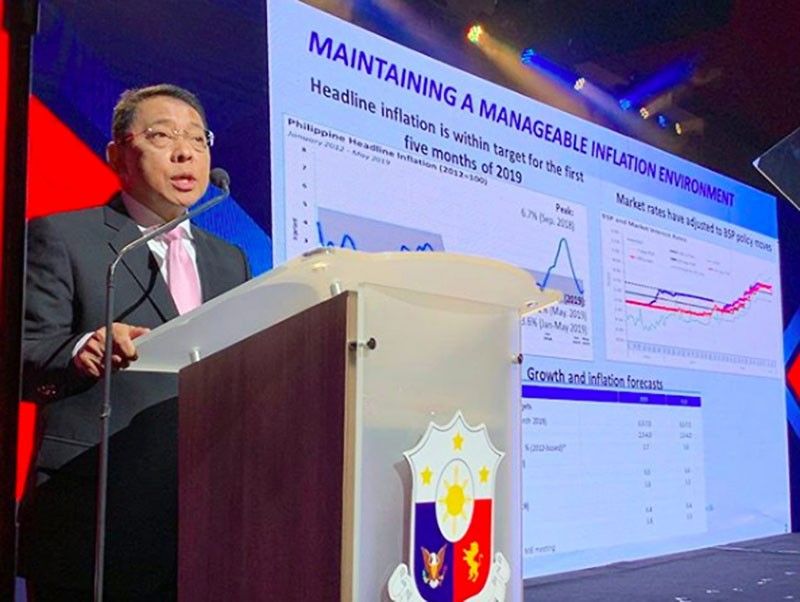

BSP Deputy Governor Diwa Guinigundo said in his presentation at the 2019 pre-SONA economic and infrastructure forum yesterday the Philippine banking system remains strong, while financial intermediation continues to promote greater economic activity.

“Now even in crisis, the banking system is strong,” Guinigundo said.

The BSP said the capital adequacy ratio (CAR) of big banks or universal and commercial banks under the Basel III framework on solo and consolidated bases slightly improved to 14.8 percent and 15.4 percent, respectively, from 14.4 percent and 15 percent a year ago.

“These capital ratios are well-above the minimum thresholds set by the BSP and the Bank for International Settlement of 10 percent and eight percent, respectively,” it added.

For mid-sized banks, the BSP said thrift banks (TBs) reported a dip in CAR to 16 percent last year from 16.5 percent in 2017 due to the expansion of the industry’s loan portfolio at a faster rate than their capital.

By contrast, small banks or rural and cooperative banks reported higher CAR at 19.6 percent in 2018 from 18.9 percent in 2017 due to the higher allocation to less risky assets in view of the stiff competition in the loan market.

The BSP said banks actively managed the maturity of their funding sources with increased bond issuances. As a result, the banking system’s bonds payable, all issued by big banks jumped by 150.4 percent to P270.1 billion last year.

“The rise in issuance of debt securities partly stretched the average maturity of the banks’ obligations, helped diversify their funding sources and allowed banks to match the need for long-term funding to build the necessary infrastructure required for a more sustained economic growth,” the central bank said.

It added the fund raising activities are in compliance with the Basel III Net Stable Funding Ratio standard that requires a stable funding profile for banks in relation to their assets and off-balance sheet activities.

“Importantly, the increase in banks’ debt issuance supports the BSP’s initiative to develop the domestic capital markets and is guided by the BSP’s relaxation of rules for the issuance of bonds and commercial papers,” it said.

- Latest