Philippine global ranking in financial inclusion slips 1 notch — EIU

MANILA, Philippines — The Economist Intelligence (EIU) said the Philippines has one of the most conducive environments globally for financial inclusion despite a drop in its ranking this year.

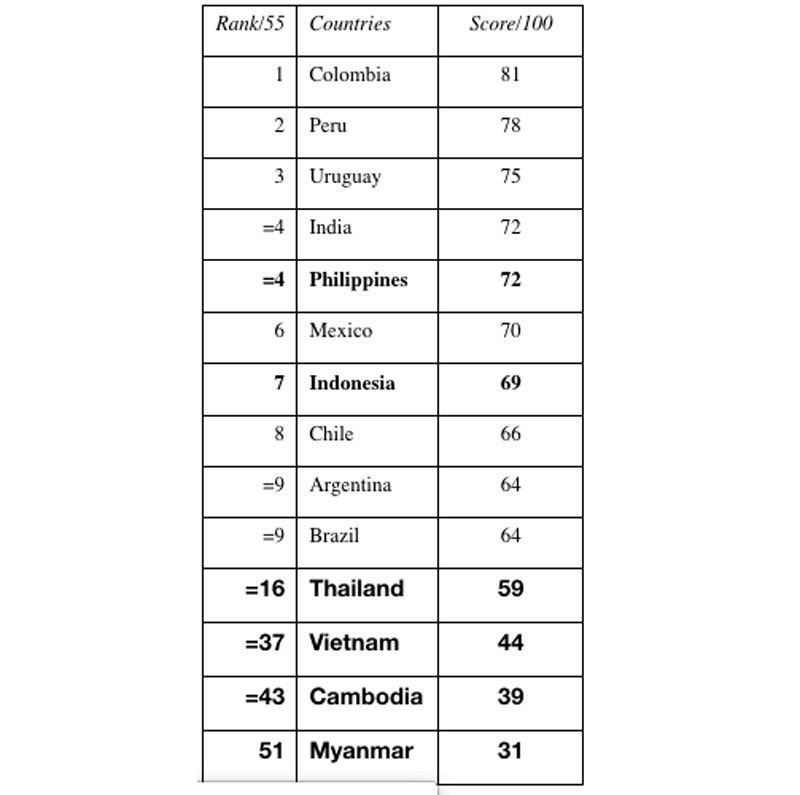

Based on the 2018 Global Microscope, the Philippines ranked fourth with a score of 72, together with India, due to a high degree of government coordination as financial inclusion is one of the priority areas of the Bangko Sentral ng Pilipinas (BSP).

The ranking of both the Philippines and India slipped one notch from third spot in the 2016 Global Microscope as Uruguay jumped to third place with a score of 75 this year from 11th place in 2016.

Columbia still topped the list with a score of 81, followed by Peru with 78.

Aside from a financial inclusion plan, the EIU said the Philippines has strategies supported by high-level working groups.

The think tank added institutions from banks and non-bank financial institutions to e-money issuers and cross-border payments providers in the Philippines, Peru, and Uruguay could reach their clients with restrictions that are proportionate to the risk of the services they provide.

EIU said it sees differentiated capital requirements or overly restrictive licensing requirements and fees, among others in the Philippines, Peru, and Uruguay.

E-money is making inroads, becoming more accessible as a wider variety of providers are able to enter the market.

EIU said most countries in the 2018 Microscope have made efforts to facilitate new digital providers and generally had few market entry restrictions.

“This positive operating environment globally, along with client demand, is helping e-money to become a leading digital financial product,” it said.

However, there is no legal recognition of e-money in Chile, Guatemala and Vietnam, while 16 countries have opted for bank-led digital transformations.

The research suggests that competition and innovation can make e-money more accessible, especially if a wide range of institutions can become e-money issuers.

“Access to inclusive insurance products is facilitated by specific regulatory frameworks in Peru, India, and the Philippines where low-income populations have access to life, health, and other insurance products,” the EIU said.

In the Philippines, and other countries, both licensed financial institutions and mobile money providers are allowed to have agents, helping the commercial viability of agent models by ensuring they are more active.

Furthermore, the Philippines provides supervisors with similar specialized training, while Peru offers a 14-week training course for regulators that focuses on risk management and supervision specific to microfinance and financial inclusion.

- Latest