Peak inflation

While headline US inflation accelerated to 9.1 percent in June, the highest since November 1981, the path of commodity prices suggests a possible turning point in inflation. From copper to wheat to oil, commodity prices have experienced a very severe drawdown indicating that inflation may have already peaked or will peak over the next few months.

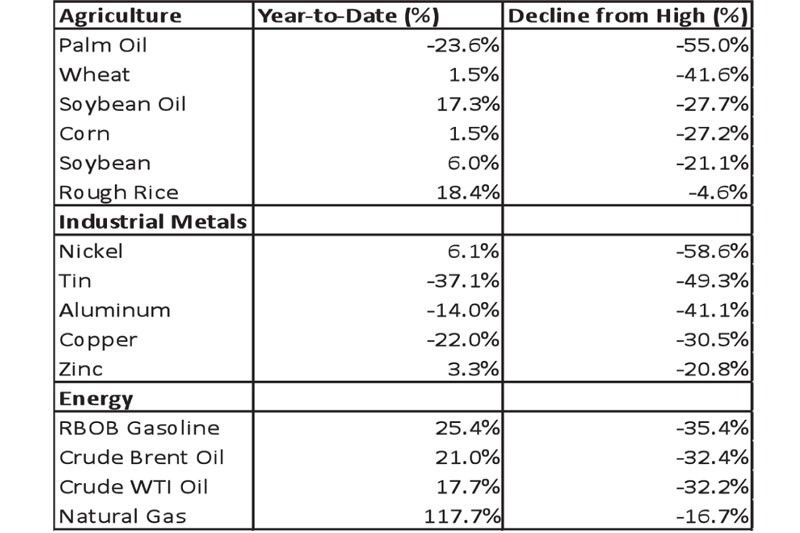

Dr. Copper signals slowdown

Copper has tumbled as much as 31 percent from its peak last March, signaling an economic slowdown. Copper is often used to predict the global economy’s health, hence the name Dr. Copper. Other cyclical industrial commodities such as nickel and aluminum have tumbled 59 percent and 41 percent, respectively.

Agri commodities back to pre-Ukraine war levels

Agricultural commodities, which surged following Russia’s invasion of Ukraine, have plummeted back to pre-invasion levels. Wheat prices have lost as much as 42 percent from March’s high. Corn, soybean, and soybean oil have lost 27 percent, 21 percent, and 28 percent, respectively. Even Malaysia’s month-long palm oil ban did little to stop prices from plummeting by 50 percent.

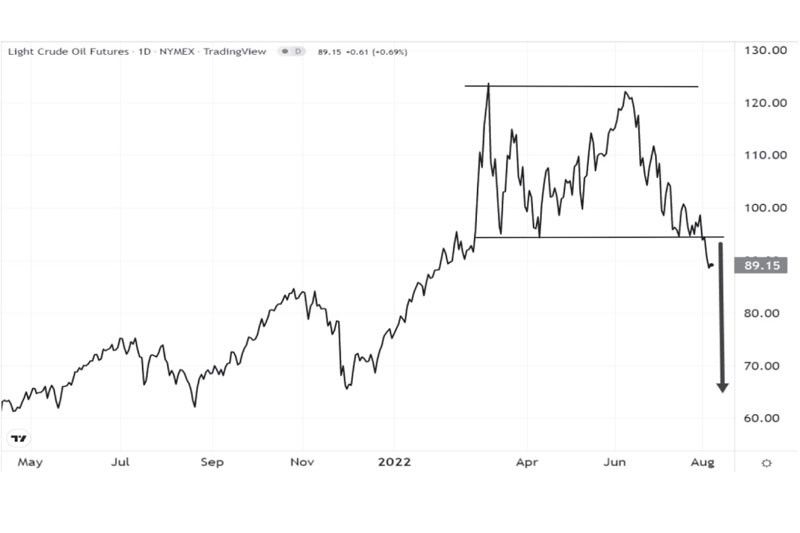

Crude oil succumbs to recession concerns

Despite tight supply due to sanctions on Russian oil, crude oil prices finally succumbed to the growing concerns of a slowing global economy. US oil prices fell below $90 per barrel for the first time since February, as US oil inventories unexpectedly rose by 4.5 million barrels. WTI crude and Brent crude are down 32 percent from their recent highs, while gasoline prices have fallen 35 percent. Only natural gas remains elevated after Russia curtailed its gas flows to Europe.

Based on technical analysis, the break below $90 indicates a possible move towards the next support at the $65 to $70 range or the level where it was trading back in December of 2021.

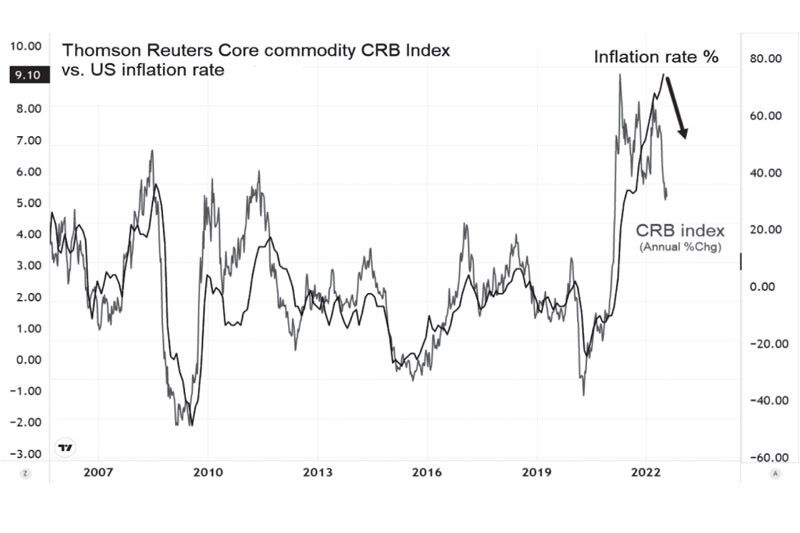

Commodities to drag headline inflation lower

Since commodities are both primary and intermediate inputs in manufacturing, their costs eventually affect final goods prices. Hence, the chart below shows that the path of commodity prices is often a good predictor of turning points in inflation. Given the declining annual percentage change in the CRB index, there is a high probability that inflation will be substantially lower in six months to a year.

BSP sees July CPI peak

BSP Governor Felipe Medalla was reported as saying that Philippine inflation may have peaked in July at 6.4 percent. He also said that average inflation for next year has “better than 50/50 chance” to decelerate below the four percent upper-end of the BSP’s target. “BSP stands ready to employ all the necessary policy actions to bring inflation toward a target-consistent path over the medium term,” Medalla added.

The Taiwan risk

The upside risk to inflation is the brewing tensions in Taiwan following US House Speaker Nancy Pelosi’s visit. China responded by stepping up its military activity around Taiwan, suspending fruits and fish imports from Taiwan, and halting sand exports. China also cut off military and climate talks with the US.

The risk of unintended accidents and sanctions getting out of hand is worrisome. Taiwan is the world’s top producer and supplier of semiconductor chips. Any turmoil against Taiwan as retaliation to Pelosi’s visit could result in a catastrophic global chip shortage that disrupts the supply chain across industries worldwide.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending