Bear arrives

On June 13, the S&P closed at 3,749.63 or down 21.3 percent, signaling that the bear market had arrived. It fell to an intraday low of 3,636.87 on June 17 before bouncing back with a vengeance. US stocks rallied, and the yields on US debt fell as concerns that the Fed’s aggressive rate hikes may cause a recession. It was a “bad news is good news” week on Wall Street as investors look forward to a less hawkish Fed in 2023. The market also welcomed positive comments by Fed hawk Bullard who stated that he believed most of the Fed tightening is now priced in. The benchmark S&P 500 index gained 6.45 percent for the week, erasing the previous week’s loss of 5.79 percent and lifting itself from bear market territory.

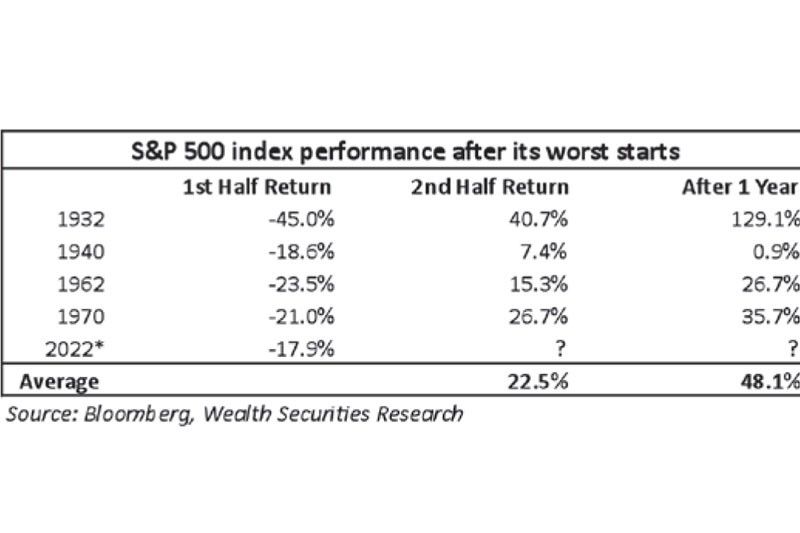

Worst start since 1970

Before the strong rally last week, the first half of 2022 was shaping up as one of the worst starts for the S&P 500 index in recent memory. At its intraday low last June 17, the S&P 500 was down as much as 23.7 percent. Rising inflation due to energy shortages and supply-chain bottlenecks was the primary concern at the start of the year. This was exacerbated by Russia’s invasion of Ukraine and the COVID-lockdowns in China. Then the Fed began aggressively raising rates and reducing its balance sheet.

Rising recession risks

The market has since transitioned from worrying that the Fed will be behind the curve to worrying that the Fed will go too far and cause a recession. Several leading global investment banks have raised the odds of a recession occurring near term after the Fed increased rates by 75 basis points, its largest hike since 1994. Citigroup, Deutsche Bank, and Morgan Stanley expect a 50 percent chance of a recession as rates rise. Goldman Sachs sees a 30 percent chance of a downturn in the US over the next 12 months. Meanwhile, Bank of America puts the odds of a recession within 12 months at 40 percent.

One sign of rising recession risk is the rotation from cyclical stocks (e.g., energy, materials, homebuilders, and industrial) to growth stocks as the narrative transitioned “from inflation to recession” and “from Fed hikes to growth cuts.”

Glass half-full

What happens when the S&P 500 index experiences its worst start? History has shown that it tends to bounce with above-average forward returns after hitting highly oversold levels. During the five worst starts in the S&P 500, the return in the second half of the year averaged 22.5 percent. The recovery after one year averaged 48.1 percent. The view is that these sizeable declines bring the S&P 500 closer to its ultimate bottom and are seen as a “glass half-full” event.

Market rallies from oversold levels

Given the oversold conditions, the depressed sentiment, and the magnitude and speed of the current bear market decline, the market deserves a relief rally at the least. Note that the S&P 500 has now rebounded 7.6 percent from the intraday low of 3,636.87, while the Nasdaq Composite has rallied nearly 10 percent from its bottom of 10,565.14.

Where is the S&P 500 index heading?

Scenario 1 – In a recent interview with Sohn Conference Foundation, billionaire hedge fund manager Stanley Druckenmiller mentioned that there has never been a time when the economy did not fall into recession when inflation hits above 4.5 percent. If a recession becomes deep or is accompanied by a financial crisis, just like in 2008, the decline will be deeper, and the bear market can drag on.

Scenario 2 – On the other hand, if there is no recession or the downturn is shallow, the market may already be in a bottoming out process. Note that there are already indications that energy and commodity prices may have topped, and inflation may be peaking. The announcement of big rate hikes by the Fed and other global central banks has brought down oil, commodity prices, and interest rates. In addition, the cost of semiconductors, shipping, and fertilizer have come down. The SPDR Energy Sector ETF (XLE) has fallen 23 percent and is technically in a bear market.

China is leading the global markets

China, in the meantime, is providing a $5 trillion monetary stimulus on its economy and has toned down its rhetoric on regulatory reforms. There are also talks of removal or reduction of tariffs to bring down inflation. This would be bullish for both countries. Chinese stocks have been leading the global markets. As shown below, the Shanghai Stock Exchange Composite Index (SSEC) has increased since May, diverging from the S&P 500, which made a new low in June.

PSEi bounces off major support

In the Philippine setting, the stock market was spooked by the unexpected big drop in the peso when the depreciated from 52.50 to 55. As a result, the PSEI fell from around 6,800 in early June to an intraday low of 6,054. However, it rose 2.5 percent last Friday after bouncing off major support at about 6,050.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net

To learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending