Stocks slide on inflation, Ukraine concerns

Global stocks nosedived last week after a hotter-than-expected US inflation was reported. US CPI surged to a fresh four-decade high, hitting 7.5 percent last month. As a result, the US two-year Treasury yield soared 20 basis points to 1.5 percent, the highest since January 2020. Meanwhile, the 10-year yield jumped above two percent for the first time since 2019.

Fears of a Russian attack on Ukraine further dampened risk sentiment after President Joe Biden urged US citizens to leave Ukraine immediately after NATO warned of Russian live-fire drills in Belarus. As a result, the Dow Jones Industrial Average dropped 500 points last Friday. The S&P 500 declined 1.9 percent, while the tech-heavy Nasdaq Composite fell 2.78 percent.

1% rate hike by July

Fed’s James Bullard called for more aggressive rate hikes following the strong CPI print. Bullard said he was open to a 50-basis point hike in March and a total of 100 basis points by July following the upside surprise and broad-based inflation rise. Notably, the cost of food, electricity, and shelter were the largest contributors to inflation. These are sensitive categories that are more important to the US consumer.

Fears of Russian attack on Ukraine

With two hours left on Friday’s trading, US National Security advisor Jake Sullivan warned of a Russian escalation at the Ukraine border. The news sent WTI crude prices soaring 4.25 percent last Friday. WTI crude rose for the eight consecutive week to close at $93.83 per barrel, bringing the year-to-date increase to 25 percent.

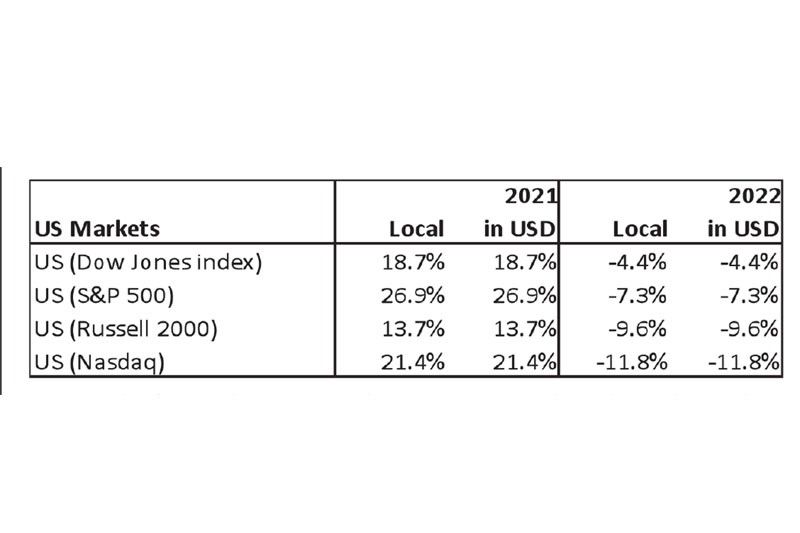

Worst start since 2008

Soaring inflation and a more hawkish Fed have dragged down stock indices in the US and developed markets this year. The Nasdaq Composite performed the worst as investors shied away from growth stocks. In January, the Nasdaq was down as much as 16 percent for its worst start of the year since 2008. As of Friday, the Nasdaq is down 11.8 percent year-to-date.

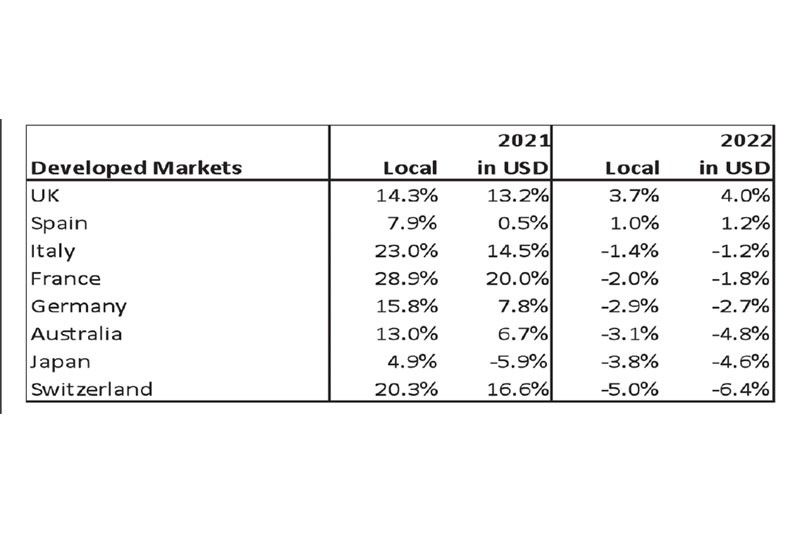

Aside from the UK and Spain, most developed market indices are also down. Switzerland, Japan, and Australia are the three worst performers year-to-date.

Bright spots in EM

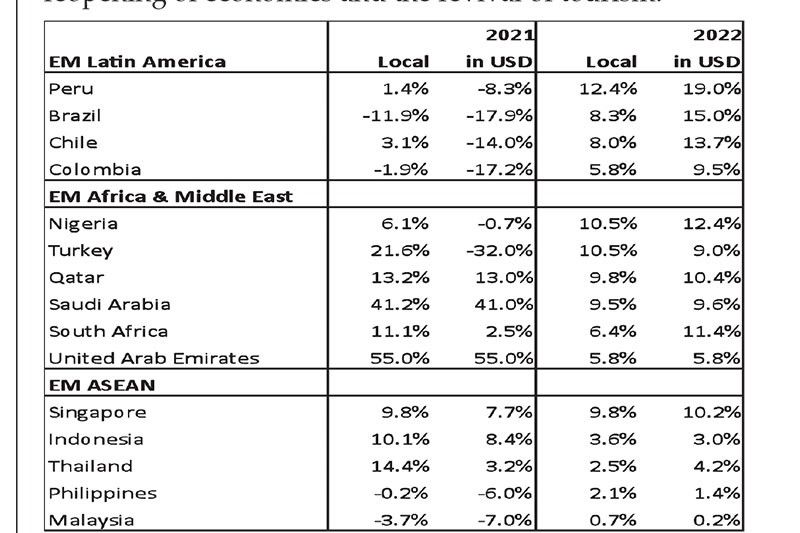

While developed markets have been struggling this year, some emerging market regions have diverged and rebounded. EM Latin America is the top regional performer. Brazil, Chile, and Peru have benefited from rising prices of industrial metals, agricultural products, and energy products. This has lifted commodity stocks like Vale and Petrobras.

EM Africa and the Middle East also performed well this year, led by Qatar, South Africa and Saudi Arabia. Rising oil prices and heavy demand for industrial and precious metals have boosted energy and mining stocks in the region.

EM ASEAN, which has high exposure to financials, industrials, and services, remains stable amidst this global stock market correction. The region benefits from the reopening of economies and the revival of tourism.

Resilient PSE Index

The PSE index (+2.1 percent YTD) has been relatively resilient this year and has diverged from the weakness in the US and developed markets. However, expect volatility to remain heightened amid the prospects of aggressive Fed hikes and the escalating Russia-Ukraine conflict.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit http://www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending