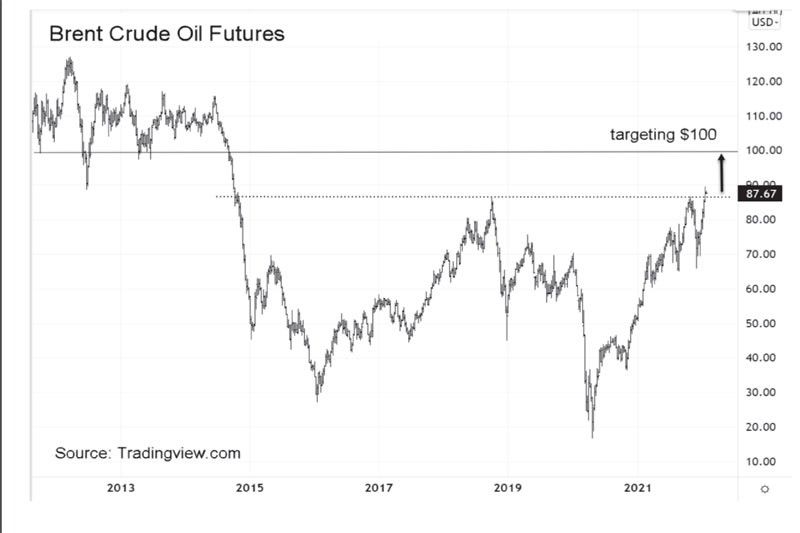

Oil going to $100?

Crude oil reversed the sharp decline last December to register its highest level since 2014 as supplies remain tight amid surging global demand. In addition, rising geopolitical risks given the current Russia-Ukraine dynamic, an attack on an Abu Dhabi facility, and an explosion of a pipeline from Iraq sent Brent oil futures as high as $89.50 per barrel. Goldman Sachs and Morgan Stanley have raised their oil forecast to $100 per barrel this year, citing the growing supply and demand imbalance. JP Morgan projects $125 per barrel and possibly a spike to $150 if US and Russia tensions escalate over Ukraine.

Reversing the December sell-off

Crude oil has rallied 33 percent from its December lows, fully reversing the sell-off caused by the release of 50 million barrels from the US Strategic Petroleum Reserves (SPR). Except for China, which has maintained a zero-COVID policy, the impact of Omicron on oil demand has been muted.

Oil demand to surpass pre-pandemic levels

The IEA forecasts that oil demand will surpass pre-pandemic levels in 2022. Total oil demand is expected to reach 99.7 million barrels per day this year, around 200,000 barrels a day more than 2019 levels. Demand for gasoline and diesel from motorists and the recovery of jet fuel comprises the bulk of the global demand growth.

Gas-to-oil switch

Low stock levels, tight Russian pipeline supply, and volatile LNG prices have prompted a switch from natural gas to oil. European natural gas inventories have dropped below 50 percent. This is the earliest the half-empty mark was hit, beating the previous record by seven days. As a result, many industries and households in Europe are likely to rely on local diesel generators just as they did in the past when power cuts occurred in previous winters.

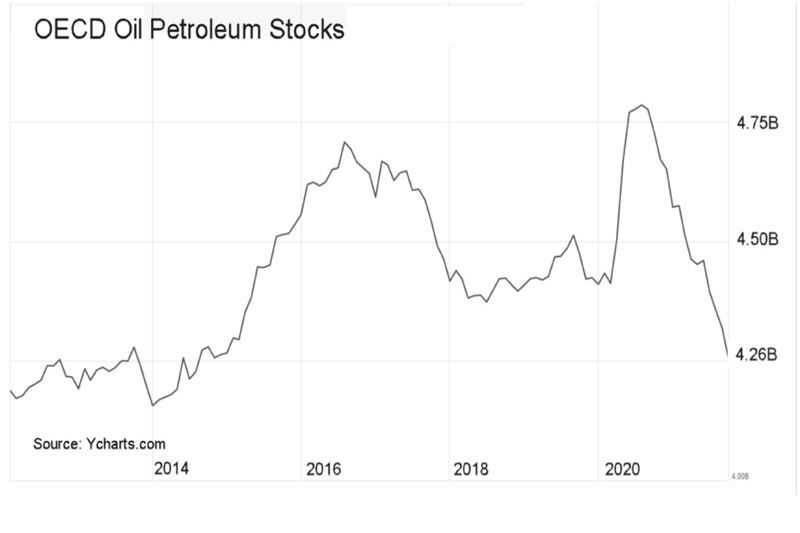

Oil inventories at a 7-year low

In November, oil inventories in the OECD countries (which include the US, UK, Japan, and Europe’s major economies) were down by 354 million barrels from the previous year, hitting a seven-year low. OECD oil inventories last reached such a low level in the 1st quarter of 2015.

OPEC+ fails to deliver

The Organization of Petroleum Exporting Countries and its partners failed to deliver on their promise of boosting output by 400,000 barrels per day. Last month, OPEC+ increased production by only 250,000 barrels per day. A lack of investments in the past years amid a global shift to cleaner fuels has led to crude supply shortages.

US shale producers stay disciplined

Meanwhile, US shale producers focused on returning capital to shareholders after years of burning cash. Note that a lot of the current US crude production growth is coming via the rapid depletion of drilled-but-uncompleted (DUCs) wells that accumulated in 2019. DUCs peaked near 9,000 wells in mid-2020 and are now down 50 percent.

Rising geopolitical risks

Geopolitical risks are rising given the Russia-Ukraine conflict and the potential derailment of Iran nuclear talks. The tension in the Middle East increased following an attack by Yemeni rebels on UAE’s oil facilities. In addition, an explosion of a pipeline that carries oil from Iraq to world markets added to already tight supply conditions. Russia, Iran, UAE, and Iraq are among the top 10 largest oil producers.

Harnessing renewable energy supplies

The Philippines is vulnerable and susceptible to higher oil prices. In the short-term, we should prepare for the effects of tighter supplies and elevated oil prices. Longer-term, we should continue harnessing and increasing our renewable energy sources, such as geothermal, hydro, wind, biomass, and solar.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending