Omicron volatility

It has only been two weeks since the discovery of the new COVID variant Omicron jolted the financial markets. After the initial shock from Omicron, the market recovered from its initial fears. The S&P 500 surged to 4,712.02 to close at a record high for the 67th time this year. The Dow rose four percent for the week to register its best weekly performance since March. The S&P 500 and the Nasdaq Composite added 3.8 percent and 3.6 percent, respectively, the best since February for both indices.

Inflation hits 39-year high

US inflation rose to 6.8 percent in November, the highest recorded in 39 years. Food, energy, and shelter accounted for much of the gains. Excluding food and energy prices, core-CPI was up 4.9 percent, the sharpest pick-up since 1991. However, the inflation reading came in modestly below some whisper numbers, anticipating much higher inflation. This led to a recovery in the stock markets. Bond-king Jeffrey Gundalch of DoubleLine Capital said in a call this week that he feared inflation could top seven percent.

Markets in a roller-coaster

Global stock markets sold off sharply on Nov. 26 (Black Friday), when initial news filtered about a new and more contagious COVID variant coming out of South Africa. The Dow, S&P 500, and Nasdaq lost more than two percent that day as investors hit the panic button. The Dow dropped 905 points, while the S&P 500 slid 106 points, suffering their worst day since October 2020. Europe’s Stoxx 50 index was down 5.3 percent, the Nikkei lower by 2.5 percent. The PSEi declined 1.2 percent on that day but fell 4.5 percent the next two days for a three-day drop of 5.7 percent. This resulted in significantly higher volatility as investors assessed the health and economic implications of the new variant.

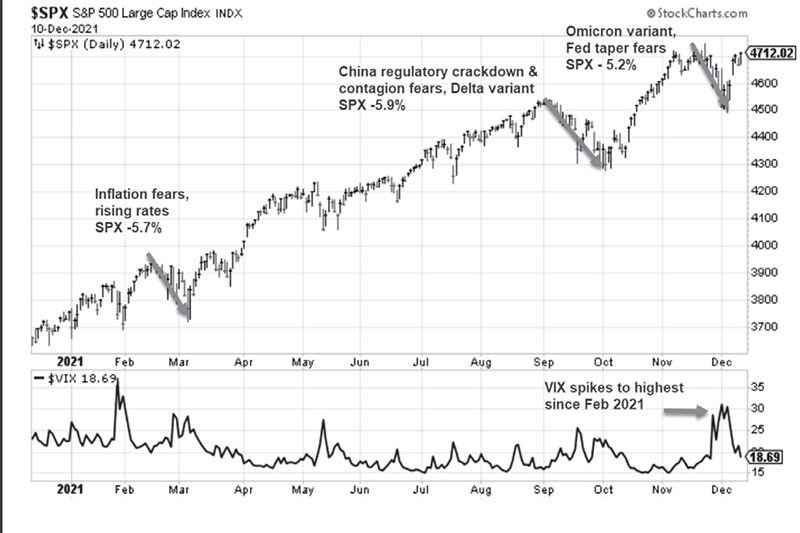

S&P recovers from 5% pullback

The S&P 500 pulled back 5.2 percent from the high on Nov. 22 to the low on Dec. 3. This is the third pullback this year that is greater than five percent. Previously, the S&P 500 fell 5.7 percent in February and March due to fears of inflation and rising rates. It also corrected 5.9 percent in September and October on China’s regulatory crackdown and contagion fears, and the COVID Delta variant. The Volatility Index (aka “VIX”) shot to its highest level since January. But after a tumultuous week of trading, the S&P 500 bottomed out after early reports showed that Omicron was a “more transmissible,” but “possibly milder” virus than Delta. In fact, S&P 500 closed at a new all-time high, erasing all its losses from Omicron.

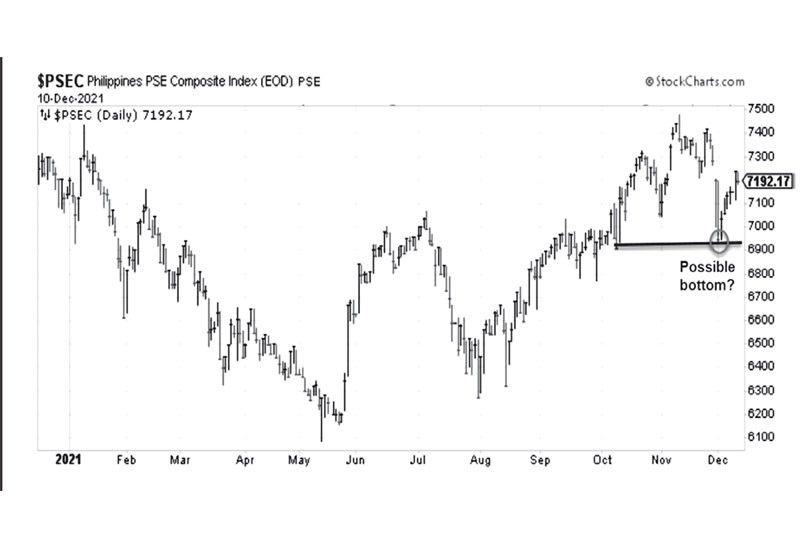

PSEi may have found its Omicron bottom

The PSE Index managed to erase most of its losses from Omicron, ending the week higher by 1.94 percent. It closed at 7,192 last Friday. After the initial shock, which sent the PSEi down to 6,928, it has found its footing, recovering 264 pts or 3.8 percent. According to the DOH, the NCR is now at “minimal risk” for COVID, averaging only 106 new cases from Dec. 3 to 9. Last Friday, only 379 new cases were reported for the entire country, the third-lowest number of additional COVID cases for the year. Also, on that day, half of the hospitals in the Philippines reported zero new COVID cases.

The resilience of markets

Last month, we wrote how the US stock indices managed to close at new all-time highs despite the prevalence of various risks. The market was able to weather the surge in COVID Delta cases, high commodity prices, rising inflation, a global energy crunch, China’s regulatory crackdown, and supply-chain bottlenecks (see Climbing a wall of worry, Nov. 15). This time around, the stock market remains resilient despite the Omicron volatility and a more hawkish Fed chairman Jerome Powell. The stock market doesn’t like uncertainty and the unknown. But in time, it generally adjusts to various shocks and crises and has often found basis to recover.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending